Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3b. Max Inc purchased a trimmer for $ 91,000 and sold the tree trimmer after four years of service. if MACRS ( 5 years MACRS)

3b.

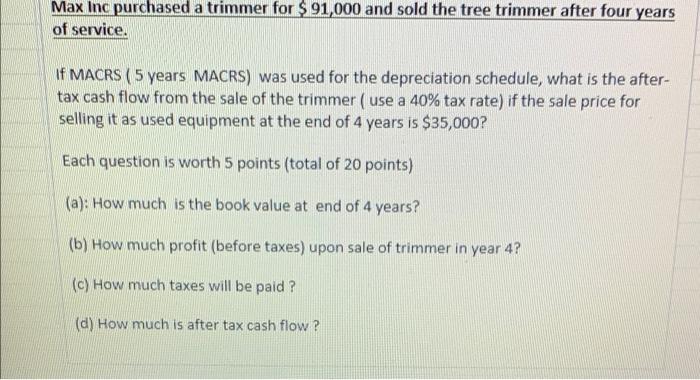

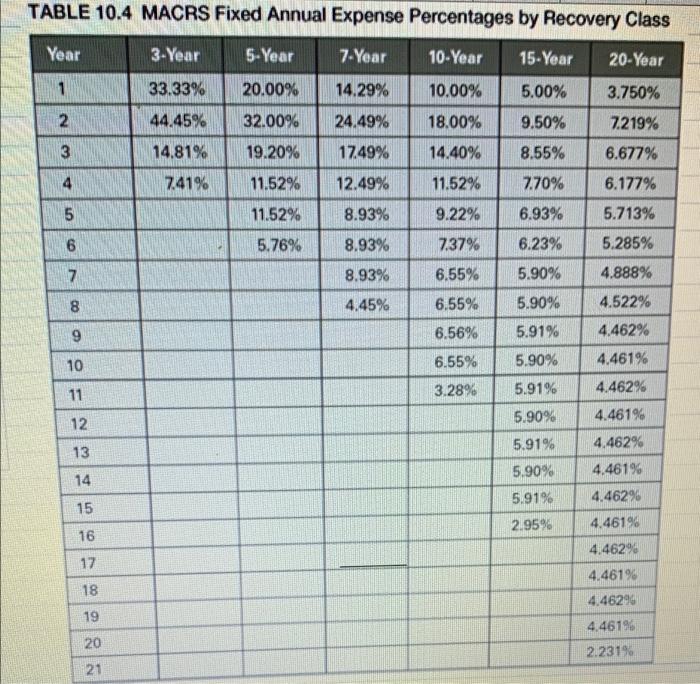

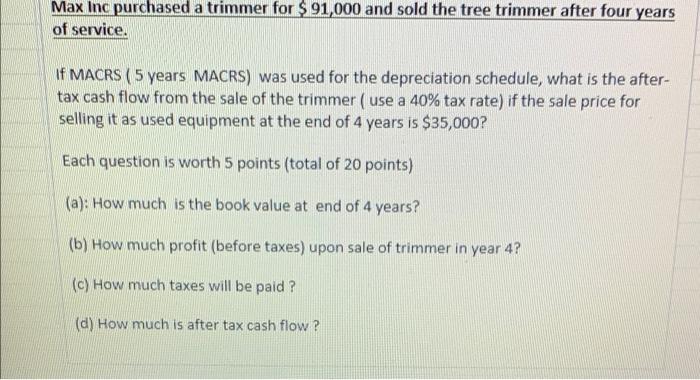

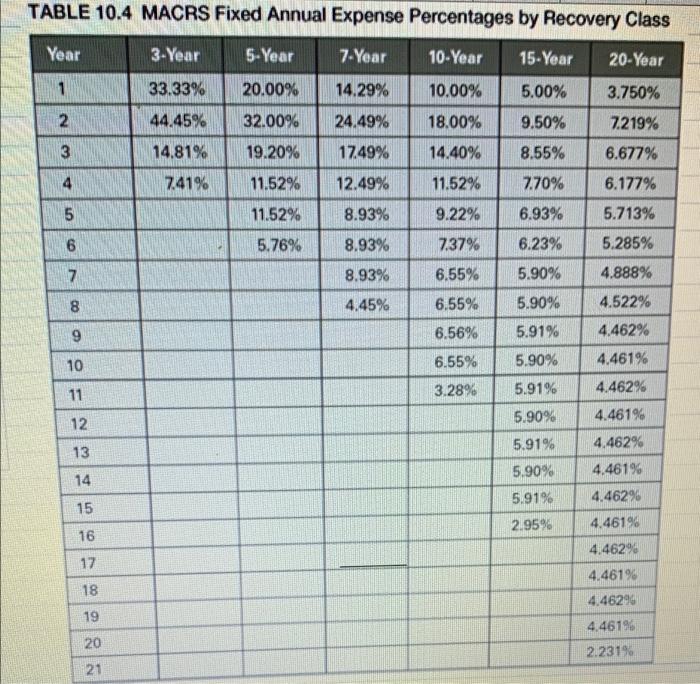

Max Inc purchased a trimmer for $ 91,000 and sold the tree trimmer after four years of service. if MACRS ( 5 years MACRS) was used for the depreciation schedule, what is the after- tax cash flow from the sale of the trimmer (use a 40% tax rate) if the sale price for selling it as used equipment at the end of 4 years is $35,000? Each question is worth 5 points (total of 20 points) (a): How much is the book value at end of 4 years? (b) How much profit (before taxes) upon sale of trimmer in year 4? (c) How much taxes will be paid? (d) How much is after tax cash flow? TABLE 10.4 MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year 5-Year 7. Year 10-Year 15-Year 20-Year 1 33.33% 20.00% 14.29% 5.00% 3.750% 10.00% 18.00% 2 44.45% 32.00% 24.49% 9.50% 7.219% 6.677% 14,81% 19.20% 17.49% 14.40% 3 4 8.55% 7.70% 4 7.41% 11.52% 12.49% 11.52% 6.177% 5 11.52% 8.93% 9.22% 6.93% 5.713% 6 5.76% 8.93% 7.37% 6.23% 5.285% 7 8.93% 6.55% 5.90% 4.888% 00 4.45% 6.55% 5.90% 4.522% 9 6.56% 5.91% 4.462% 10 6.55% 5.90% 4.461% 11 3.28% 5.91% 4.462% 4.461% 12 5.90% 5.91% 4,462% 13 5,90% 14 4.461% 4.46290 5.91% 15 2.95% 4.46199 16 4.46296 17 4.46196 18 4,46290 19 4.4619 20 2.2319 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started