Answered step by step

Verified Expert Solution

Question

1 Approved Answer

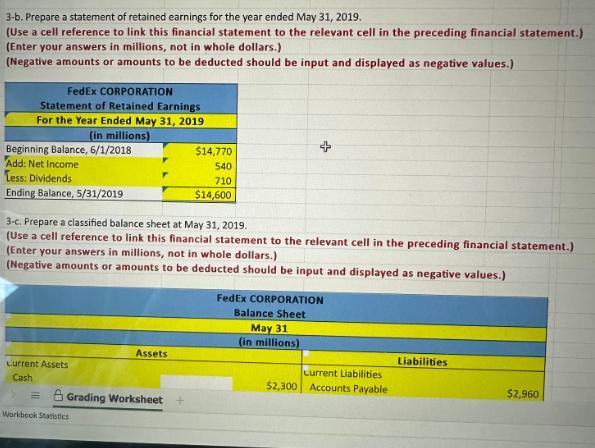

3-b. Prepare a statement of retained earnings for the year ended May 31, 2019. (Use a cell reference to link this financial statement to

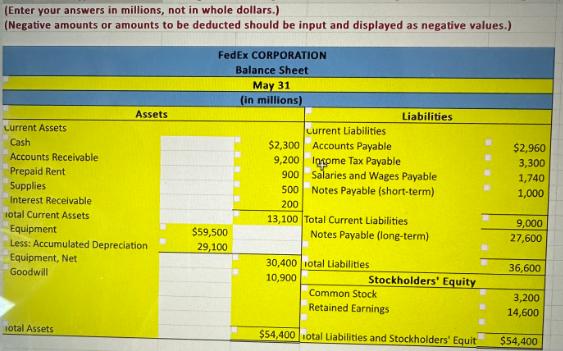

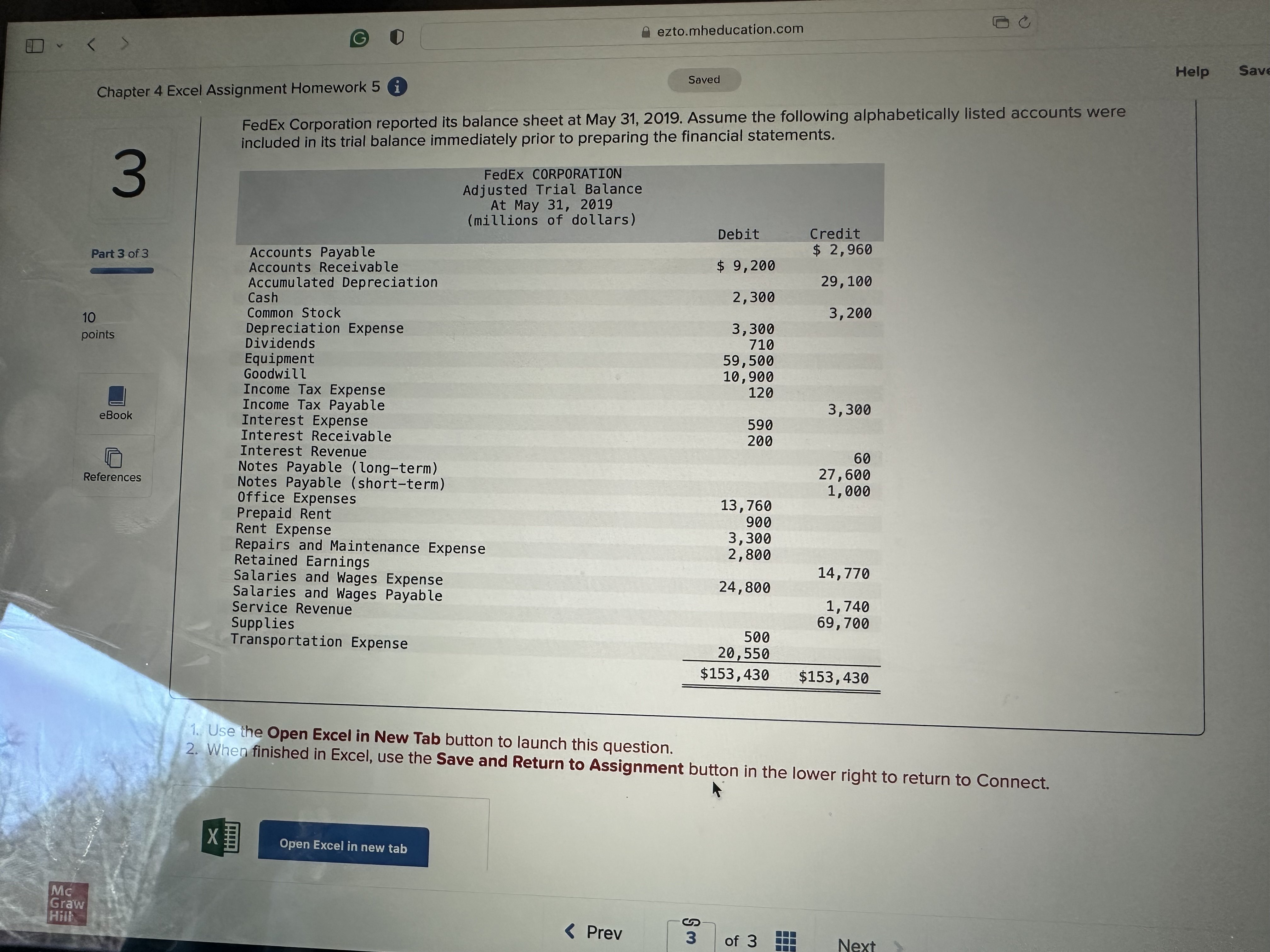

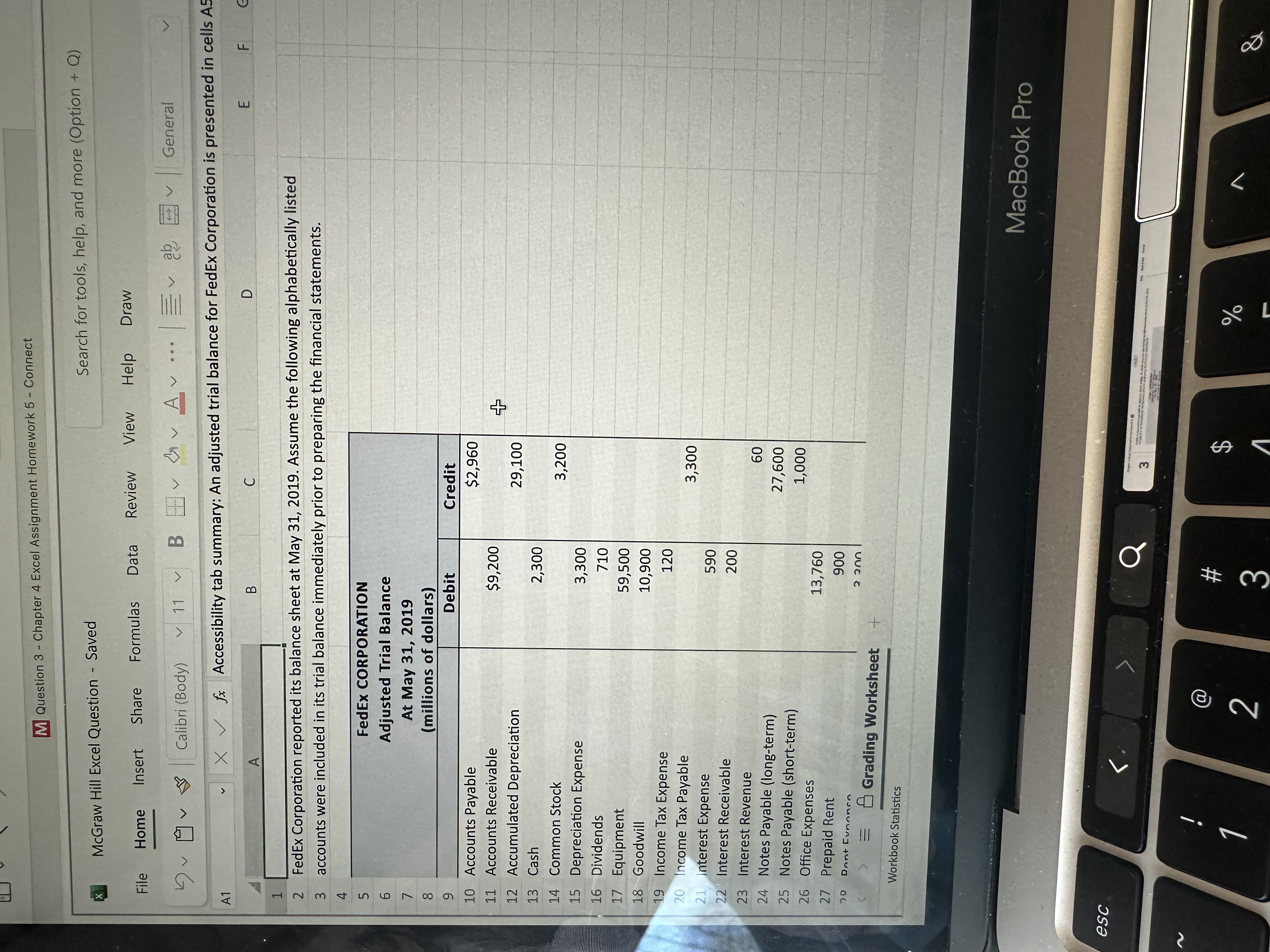

3-b. Prepare a statement of retained earnings for the year ended May 31, 2019. (Use a cell reference to link this financial statement to the relevant cell in the preceding financial statement.) (Enter your answers in millions, not in whole dollars.) (Negative amounts or amounts to be deducted should be input and displayed as negative values.) FedEx CORPORATION Statement of Retained Earnings For the Year Ended May 31, 2019 (in millions) Beginning Balance, 6/1/2018 Add: Net Income Less: Dividends Ending Balance, 5/31/2019 $14,770 540 710 $14,600 3-c. Prepare a classified balance sheet at May 31, 2019. (Use a cell reference to link this financial statement to the relevant cell in the preceding financial statement.) (Enter your answers in millions, not in whole dollars.) (Negative amounts or amounts to be deducted should be input and displayed as negative values.) FedEx CORPORATION Balance Sheet May 31 (in millions) Assets Current Assets Cash =Grading Worksheet Workbook Statistics Liabilities Current Liabilities $2,300 Accounts Payable $2,960 (Enter your answers in millions, not in whole dollars.) (Negative amounts or amounts to be deducted should be input and displayed as negative values.) FedEx CORPORATION Balance Sheet May 31 (in millions) Assets Liabilities Lurrent Assets Current Liabilities Cash $2,300 Accounts Payable $2,960 Accounts Receivable 9,200 Insome Tax Payable 3,300 Prepaid Rent 900 Salaries and Wages Payable 1,740 Supplies 500 Notes Payable (short-term) 1,000 Interest Receivable 200 iotal Current Assets 13,100 Total Current Liabilities Equipment $59,500 Notes Payable (long-term) 9,000 27,600 Less: Accumulated Depreciation 29,100 Equipment, Net 30,400 otal Liabilities: 36,600 Goodwill 10,900 Stockholders' Equity Common Stock Retained Earnings 3,200 14,600 otal Assets $54,400 otal Liabilities and Stockholders' Equit $54,400 < ezto.mheducation.com Chapter 4 Excel Assignment Homework 5 3 1 Saved FedEx Corporation reported its balance sheet at May 31, 2019. Assume the following alphabetically listed accounts were included in its trial balance immediately prior to preparing the financial statements. FedEx CORPORATION Adjusted Trial Balance At May 31, 2019 (millions of dollars) Debit Credit Part 3 of 3 10 points eBook Accounts Payable Accounts Receivable Cash Common Stock Depreciation Expense Dividends Equipment Goodwill Income Tax Expense Income Tax Payable Interest Expense Interest Receivable Interest Revenue $ 2,960 $ 9,200 Accumulated Depreciation 29,100 2,300 3,200 3,300 710 59,500 10,900 120 3,300 590 200 60 Notes Payable (long-term) References Notes Payable (short-term) 27,600 1,000 Office Expenses 13,760 Prepaid Rent 900 Rent Expense 3,300 Repairs and Maintenance Expense Retained Earnings 2,800 Salaries and Wages Expense 14,770 Salaries and Wages Payable 24,800 Service Revenue 1,740 Supplies 69,700 Transportation Expense 500 20,550 $153,430 $153,430 Mc Graw Hill 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. Open Excel in new tab S < Prev 3 of 3 Next Help Save X Search for tools, help, and more (Option + Q) M Question 3 - Chapter 4 Excel Assignment Homework 5 - Connect McGraw Hill Excel Question - Saved File Home Insert Share Formulas Data Review View Help Draw < Calibri (Body) V 11 B V V A A1 General Xfx Accessibility tab summary: An adjusted trial balance for FedEx Corporation is presented in cells A5 A B C D E F G 1 2 3 FedEx Corporation reported its balance sheet at May 31, 2019. Assume the following alphabetically listed accounts were included in its trial balance immediately prior to preparing the financial statements. 4 5 6 FedEx CORPORATION Adjusted Trial Balance 7 At May 31, 2019 8 (millions of dollars) 9 Debit Credit 10 Accounts Payable $2,960 11 Accounts Receivable $9,200 + 12 Accumulated Depreciation 29,100 13 Cash 2,300 14 Common Stock 3,200 15 Depreciation Expense 3,300 16 Dividends 710 17 Equipment 59,500 18 Goodwill 10,900 19 Income Tax Expense 120 20 Income Tax Payable 3,300 21 Interest Expense 590 22 Interest Receivable 200 23 Interest Revenue 24 Notes Payable (long-term) 25 Notes Payable (short-term) 60 27,600 1,000 26 Office Expenses 27 Prepaid Rent 13,760 900 Dont Evnonco 2.200 === Grading Worksheet + Workbook Statistics MacBook Pro Just Yours M10 3473 97 esc 2 ! < @ 2 # 3 3 $ olo L D A1 X McGraw Hill Excel Question - Saved Search for tools, help, and more (Option + Q) File Home Insert Share Formulas Data Review View Help Draw Calibri (Body) 11 V B A v .. ab General V Xfx Accessibility tab summary: An adjusted trial balance for FedEx Corporation is presented in cells A5 A 49 Service Revenue 50 Interest Revenue B C $69,700 60 51 52 Total Revenues 69,760 53 Expenses 54 Depreciation Expense 3,300 55 Income Tax Expense 120 56 Interest Expense 590 57 Office Expense 13,760 58 Rent Expense 3,300 Repairs and Maintenance 59 Expense 2,800 60 Salaries and Wages Expense 24,800 61 Transportation Expense 20,550 62 63 Total Expenses 69,220 64 Net Income $540 65 + D E F G 66 3-b. Prepare a statement of retained earnings for the year ended May 31, 2019. 67 (Use a cell reference to link this financial statement to the relevant cell in the preceding financial statement.) 62 (Enter your answers in millions, not in whole dollars.) 69 (Negative amounts or amounts to be deducted should be input and displayed as negative values.) 70 71 72 73 74 FedEx CORPORATION Statement of Retained Earnings For the Year Ended May 31, 2019 (in millions) 75 Beginning Balance, 6/1/2018 $14,770 == Grading Worksheet + Workbook Statistics C & Search for tools, help, and more (Option + Q) X McGraw Hill Excel Question Saved - File Home Insert Share Formulas Data Review View Help Draw A v Calibri (Body) 11 BA.. A1 38 Required: ab General E F G Xfx Accessibility tab summary: An adjusted trial balance for FedEx Corporation is presented in cells A5 t A B C D 39 3-a. Prepare an income statement for the year ended May 31, 2019. 40 (Use a cell reference to link this financial statement to the relevant cell in the preceding financial statement.) 41 (Enter your answers in millions, not in whole dollars.) 42 (All answers should be input and displayed as positive values.) 43 FedEx CORPORATION Income Statement 44 45 46 47 (in millions) 48 Revenues 49 Service Revenue 50 Interest Revenue $69,700 60 51 52 Total Revenues 69,760 53 Expenses 54 Depreciation Expense 3,300 55 55 Income Tax Expense 120 56 Interest Expense 590 57 Office Expense 13,760 58 Rent Expense 3,300 Repairs and Maintenance 59 Expense 2,800 60 Salaries and Wages Expense 24,800 61 Transportation Expense 20,550 62 63 Total Expenses 69,220 == Grading Worksheet + Workbook Statistics A1 McGraw Hill Excel Question - Saved Search for tools, help, and more (Option + Q) File Home Insert Share Formulas Data Review View Help Draw Calibri (Body) 11 V B vv Av... b ab General Xfx Accessibility tab summary: An adjusted trial balance for FedEx Corporation is presented in cells A5 t 20 A MCOMIC Taxayadic 21 Interest Expense 22 Interest Receivable 23 Interest Revenue B C 590 200 24 Notes Payable (long-term) 25 Notes Payable (short-term) 60 27,600 1,000 26 Office Expenses 13,760 27 Prepaid Rent 900 28 Rent Expense 3,300 29 Repairs and Maintenance Expense 2,800 30 Retained Earnings 14,770 31 Salaries and Wages Expense 24,800 + 32 Salaries and Wages Payable 33 Service Revenue 1,740 69,700 34 Supplies 35 Transportation Expense 36 37 38 Required: 500 20,550 $153,430 $153,430 D E F G 39 3-a. Prepare an income statement for the year ended May 31, 2019. 40 (Use a cell reference to link this financial statement to the relevant cell in the preceding financial statement.) 41 (Enter your answers in millions, not in whole dollars.) 42 (All answers should be input and displayed as positive values.) 43 44 45 46 47 === Workbook Statistics FedEx CORPORATION Income Statement (in millions) Grading Worksheet + > &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started