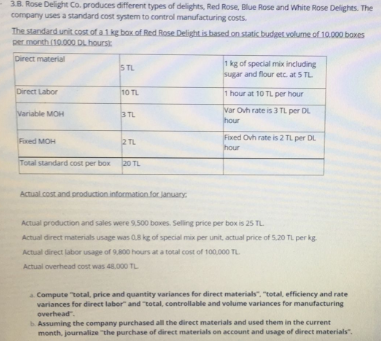

3.B. Rose Delight Co. produces different types of delights, Red Rose, Blue Rose and White Rose Delights. The company uses a standard cost system to control manufacturing costs. The standard unit cost of a 1 kg box of Red Rose Delight is based on static budget volume of 10.000 boxes per month (10.000 DL hours Direct material 5 TL 1 kg of special mix including sugar and flour etc. at 5 TL Direct Labor 10 TL 1 hour at 10 TL per hour Var Ohrate is 3TL per DL hour Variable MOH 3 TL Foxed MOH 2 TL Fixed Ovh rate is 2 TL per DL hour Total standard cost per box 20 TL Actual.cost and production information for January Actual production and sales were 9.500 boxes. Selling price per box is 25 TL Actual direct materials usage was 0.8 kg of special mix per unit, actual price of 5.20 TL per kg Actual direct labor usage of 9.800 hours at a total cost of 100.000 TL Actual overhead cost was 48.000 TL Compute "Total price and quantity variances for direct materials","total efficiency and rate variances for direct labor" and "total, controllable and volume variances for manufacturing overhead". b. Assuming the company purchased all the direct materials and used them in the current month, journalize the purchase of direct materials on account and usage of direct materials 3.B. Rose Delight Co. produces different types of delights, Red Rose, Blue Rose and White Rose Delights. The company uses a standard cost system to control manufacturing costs. The standard unit cost of a 1 kg box of Red Rose Delight is based on static budget volume of 10.000 boxes per month (10.000 DL hours Direct material 5 TL 1 kg of special mix including sugar and flour etc. at 5 TL Direct Labor 10 TL 1 hour at 10 TL per hour Var Ohrate is 3TL per DL hour Variable MOH 3 TL Foxed MOH 2 TL Fixed Ovh rate is 2 TL per DL hour Total standard cost per box 20 TL Actual.cost and production information for January Actual production and sales were 9.500 boxes. Selling price per box is 25 TL Actual direct materials usage was 0.8 kg of special mix per unit, actual price of 5.20 TL per kg Actual direct labor usage of 9.800 hours at a total cost of 100.000 TL Actual overhead cost was 48.000 TL Compute "Total price and quantity variances for direct materials","total efficiency and rate variances for direct labor" and "total, controllable and volume variances for manufacturing overhead". b. Assuming the company purchased all the direct materials and used them in the current month, journalize the purchase of direct materials on account and usage of direct materials