Question

3)calculate the NPV and IRR of this investment project. Opportunity cost of the capital is 6%. Based on your answers, would you initiate this project?

3)calculate the NPV and IRR of this investment project. Opportunity cost of the capital is 6%. Based on your answers, would you initiate this project?

3)calculate the NPV and IRR of this investment project. Opportunity cost of the capital is 6%. Based on your answers, would you initiate this project?

4)Find economic and accounting break even sales for this project. Explain why economic accounting sales is greater.

5) inflation is expected to be 4% a year and both revenue and costs (including fixed costs) are expected to grow at rate of inflation. Also, the opportunity cost of the capital also increases at the rate of inflation. Show both how the inflation affects NPV and explain why it changes.

6) two years ago, the company spent $2 million to build a new access road to the warehouse. And the rental revenue(after-tax) from the warehouse is $100,000 per year. Once the project is initiated, this rental revenue will be lost. After considering this, would you initiate this project? Provide new NPV numbers based on incremental cash flow.

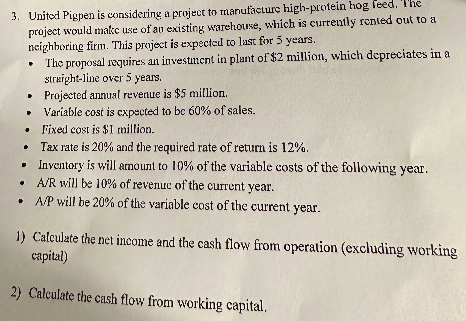

3. Unitod Pigpen is considering a project to manutacture high-plotein hog feed. The project would makc use of au existiny, warehouse, which is curtently ronted out to a neighborine firm. This project is expected to last for 5 years. - The proposal rouires an investment in plant of $2 million, which depreciates in a str\&ight-line over 5 years. - Projected annual revenue is $5 million. - Variable cost is cxpocted to be 60% of sales. - Fixed cost is Si million. - Tax rate is 20% and the required rate of return is 12%. - Inventory is will amount to 10% of the variable costs of the following year. - A/R will be 10% of revenue ot the current year. - A/ will be 20% of the variable cost of the current year. 1) Calculate the net income and the cash flow from operation (excluding Working (atpital) 2) Calculate the cash flow from working capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started