Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.Prepare an adjusted trial balance as of January 31, 2021. 4. Prepare a multiple-step income statement for the period ended January 31, 2021. 5. Prepare

3.Prepare an adjusted trial balance as of January 31, 2021.

4. Prepare a multiple-step income statement for the period ended January 31, 2021.

5. Prepare a classified balance sheet as of January 31, 2021.

* Need help on questions 3,4, and 5.

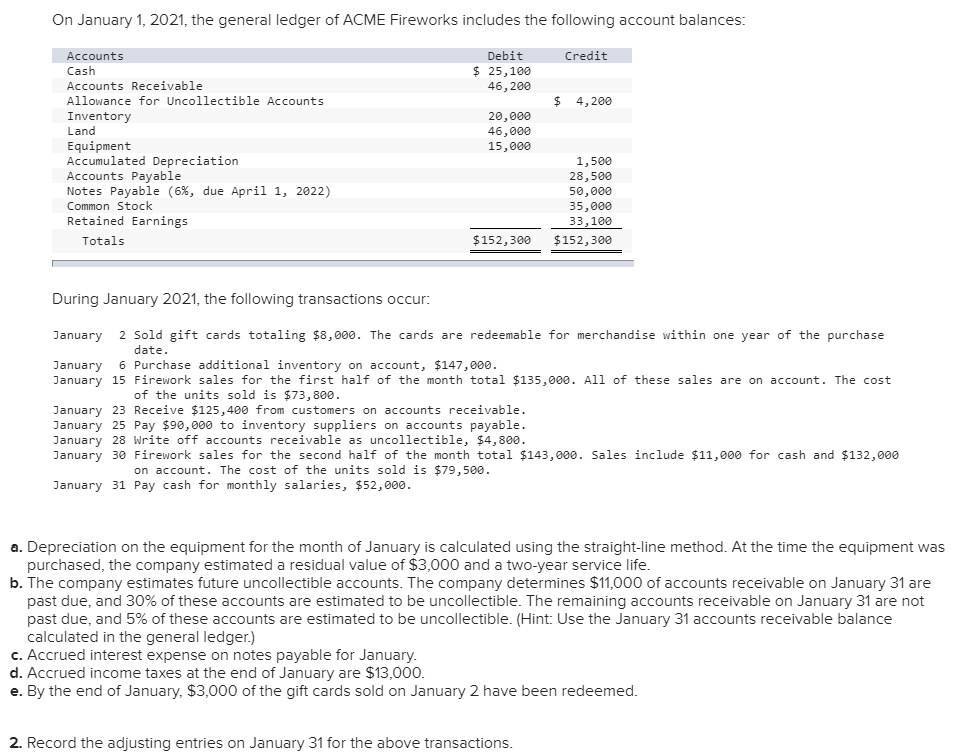

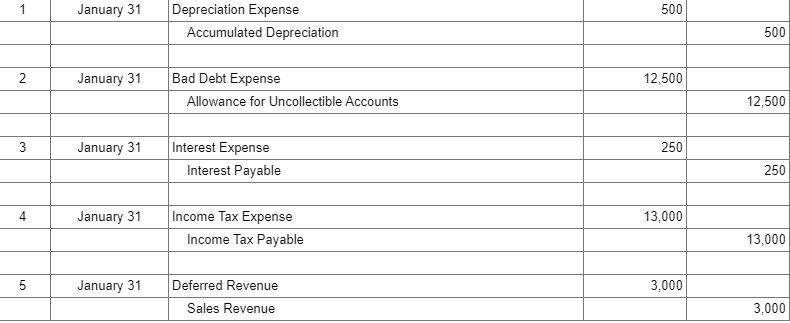

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Accounts Debit Credit Cash 25,100 Accounts Receivable Allowance for Uncollectible Accounts 46, 200 4,200 Inventory Land 20,000 46,000 15,000 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, 2022) Common Stock 1,500 28,500 50,000 35,000 33,100 Retained Earnings $152,300 $152,300 Totals During January 2021, the following transactions occur: 2 Sold gift cards totaling $8,000. The cards are redeemable for merchandise within one year of the purchase January date 6 Purchase additional inventory on account, $147,000. January January 15 Firework sales for the first half of the month total $135,000. All of these sales are on account. The cost of the units sold is $73, 800 January 23 Receive $125,400 from customers on accounts receivable January 25 Pay $90,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $4,800 January 30 Firework sales for the second half of the month total $143,000. Sales include $11,000 for cash and $132,000 on account. The cost of the units sold is $79,500 January 31 Pay cash for month ly salaries, $52,000. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $3,000 and a two-year service life. b. The company estimates future uncollectible accounts. The company determines $11,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Accrued interest expense on notes payable for January. d. Accrued income taxes at the end of January are $13,000 e. By the end of January, $3,000 of the gift cards sold on January 2 have been redeemed. 2. Record the adjusting entries on January 31 for the above transactions. Depreciation Expense January 31 1 500 Accumulated Depreciation 500 January 31 Bad Debt Expense 2 12,500 Allowance for Uncollectible Accounts 12,500 Interest Expense January 31 3 250 Interest Payable 250 Income Tax Expense January 31 13,000 4 Income Tax Payable 13,000 Deferred Revenue January 31 3,000 Sales Revenue 3,000 LOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started