Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The interest on a $16,000,10 percent, 45 -day note receivable, dated September 15 , is a. $350.00 b. $16,850.63 c. $366.16 d. $200.00 The maturity

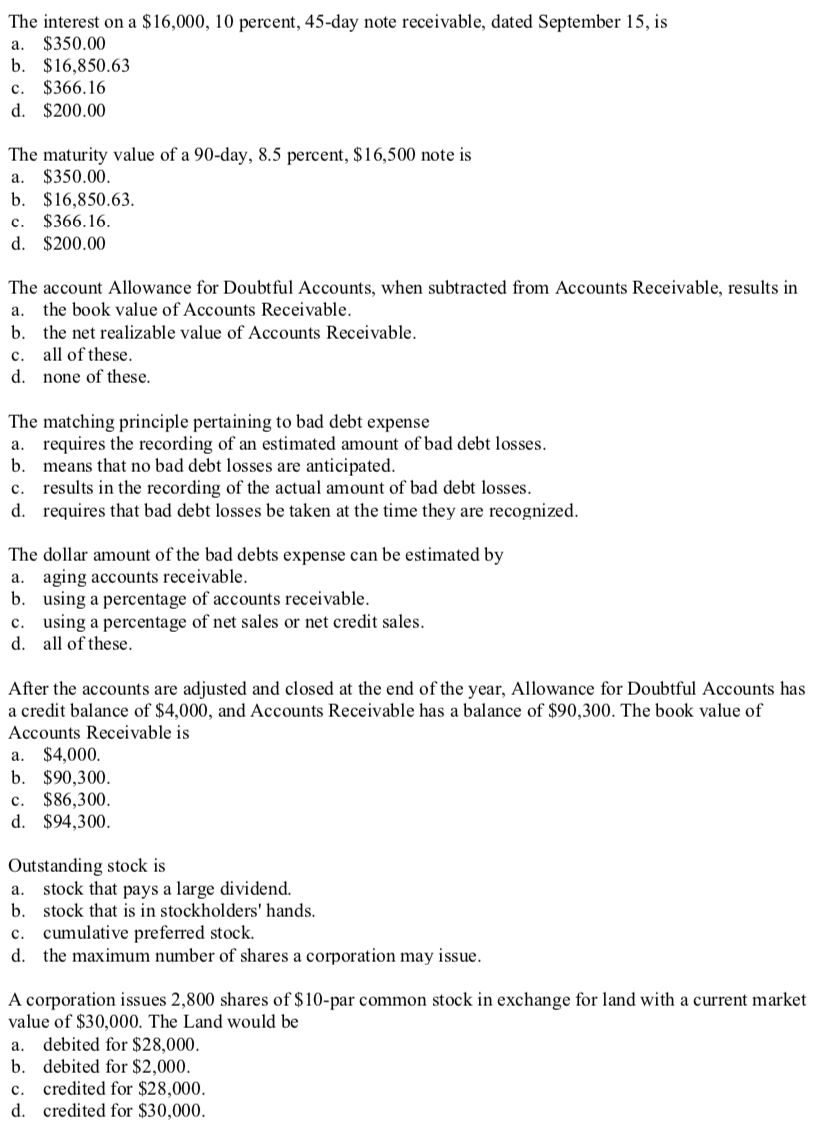

The interest on a $16,000,10 percent, 45 -day note receivable, dated September 15 , is a. $350.00 b. $16,850.63 c. $366.16 d. $200.00 The maturity value of a 90 -day, 8.5 percent, $16,500 note is a. $350.00. b. $16,850.63. c. $366.16. d. $200.00 The account Allowance for Doubtful Accounts, when subtracted from Accounts Receivable, results in a. the book value of Accounts Receivable. b. the net realizable value of Accounts Receivable. c. all of these. d. none of these. The matching principle pertaining to bad debt expense a. requires the recording of an estimated amount of bad debt losses. b. means that no bad debt losses are anticipated. c. results in the recording of the actual amount of bad debt losses. d. requires that bad debt losses be taken at the time they are recognized. The dollar amount of the bad debts expense can be estimated by a. aging accounts receivable. b. using a percentage of accounts receivable. c. using a percentage of net sales or net credit sales. d. all of these. After the accounts are adjusted and closed at the end of the year, Allowance for Doubtful Accounts has a credit balance of $4,000, and Accounts Receivable has a balance of $90,300. The book value of Accounts Receivable is a. $4,000. b. $90,300. c. $86,300. d. $94,300. Outstanding stock is a. stock that pays a large dividend. b. stock that is in stockholders' hands. c. cumulative preferred stock. d. the maximum number of shares a corporation may issue. A corporation issues 2,800 shares of $10-par common stock in exchange for land with a current market value of $30,000. The Land would be a. debited for $28,000. b. debited for $2,000. c. credited for $28,000. d. credited for $30,000

The interest on a $16,000,10 percent, 45 -day note receivable, dated September 15 , is a. $350.00 b. $16,850.63 c. $366.16 d. $200.00 The maturity value of a 90 -day, 8.5 percent, $16,500 note is a. $350.00. b. $16,850.63. c. $366.16. d. $200.00 The account Allowance for Doubtful Accounts, when subtracted from Accounts Receivable, results in a. the book value of Accounts Receivable. b. the net realizable value of Accounts Receivable. c. all of these. d. none of these. The matching principle pertaining to bad debt expense a. requires the recording of an estimated amount of bad debt losses. b. means that no bad debt losses are anticipated. c. results in the recording of the actual amount of bad debt losses. d. requires that bad debt losses be taken at the time they are recognized. The dollar amount of the bad debts expense can be estimated by a. aging accounts receivable. b. using a percentage of accounts receivable. c. using a percentage of net sales or net credit sales. d. all of these. After the accounts are adjusted and closed at the end of the year, Allowance for Doubtful Accounts has a credit balance of $4,000, and Accounts Receivable has a balance of $90,300. The book value of Accounts Receivable is a. $4,000. b. $90,300. c. $86,300. d. $94,300. Outstanding stock is a. stock that pays a large dividend. b. stock that is in stockholders' hands. c. cumulative preferred stock. d. the maximum number of shares a corporation may issue. A corporation issues 2,800 shares of $10-par common stock in exchange for land with a current market value of $30,000. The Land would be a. debited for $28,000. b. debited for $2,000. c. credited for $28,000. d. credited for $30,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started