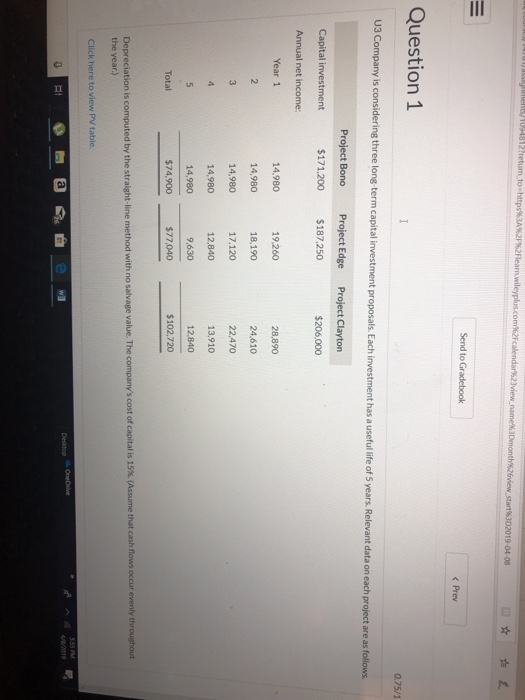

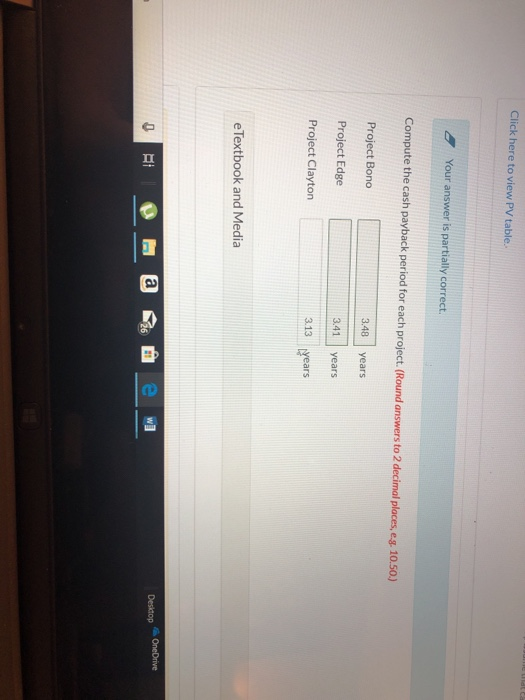

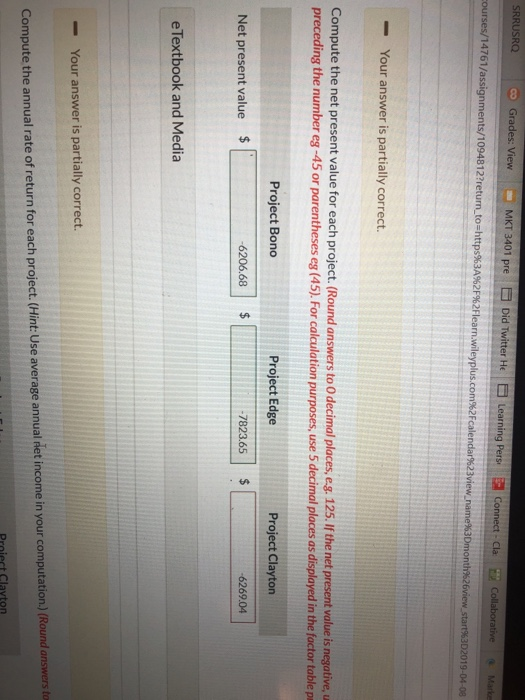

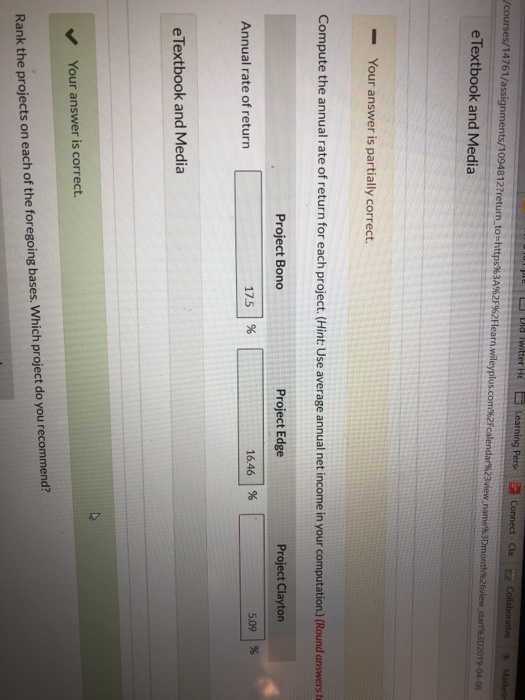

3view Send to Gradebook Prev Question 1 0.75/1 U3 Company is considering three long term capital investment proposals. Each inves tment has a useful life of 5 years. Relevant data on each project are as follows Project Bono Project Edge Project Clayton Capital investment Annual net income: Year 1 $171,200 $187.250 $206,000 14,980 19.260 18,190 17,120 12,840 9,630 $77.040 28,890 24,610 22,470 13,910 12.840 $102,720 14,980 14,980 14,980 $74,900 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%, (Assume that cash flows occur the year.) evenly throughout Click here to view PV table. SKRUSRO Grades: View -MKT 3401 pre Did Twitter He Learning Pers, Connect . Cla t2 Collaborative Marke ourses/14761/assign 10948 1 2 ?return to https%3A%2F%2F learn v leyplus.com%2F calenda1%23view name%3Dmonth%26 ew start%3D2019-04-08 Your answer is partially correct. Compute the net present value for each project. (Round answers to O decimal places, eg 125. If the net present value is negative preceding the number eg-45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table p Project Bono Project Edge Project Clayton $ 6206.68 $ 7823.65 $ -6269.04 Net present value eTextbook and Media -Your answer is partially correct. Compute the annual rate of return for each project.(Hint: Use average annual det income in your computation.) (Round answers to Proiect Clavtor 1094812?r eTextbook and Media -Your answer is partially correct. Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers te Project Bono Project Edge Project Clayton Annual rate of return 125 | 96 16.46 | % 509 | 96 eTextbook and Media Your answer is correct Rank the projects on each of the foregoing bases. Which project do you recommend? 3view Send to Gradebook Prev Question 1 0.75/1 U3 Company is considering three long term capital investment proposals. Each inves tment has a useful life of 5 years. Relevant data on each project are as follows Project Bono Project Edge Project Clayton Capital investment Annual net income: Year 1 $171,200 $187.250 $206,000 14,980 19.260 18,190 17,120 12,840 9,630 $77.040 28,890 24,610 22,470 13,910 12.840 $102,720 14,980 14,980 14,980 $74,900 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%, (Assume that cash flows occur the year.) evenly throughout Click here to view PV table. SKRUSRO Grades: View -MKT 3401 pre Did Twitter He Learning Pers, Connect . Cla t2 Collaborative Marke ourses/14761/assign 10948 1 2 ?return to https%3A%2F%2F learn v leyplus.com%2F calenda1%23view name%3Dmonth%26 ew start%3D2019-04-08 Your answer is partially correct. Compute the net present value for each project. (Round answers to O decimal places, eg 125. If the net present value is negative preceding the number eg-45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table p Project Bono Project Edge Project Clayton $ 6206.68 $ 7823.65 $ -6269.04 Net present value eTextbook and Media -Your answer is partially correct. Compute the annual rate of return for each project.(Hint: Use average annual det income in your computation.) (Round answers to Proiect Clavtor 1094812?r eTextbook and Media -Your answer is partially correct. Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers te Project Bono Project Edge Project Clayton Annual rate of return 125 | 96 16.46 | % 509 | 96 eTextbook and Media Your answer is correct Rank the projects on each of the foregoing bases. Which project do you recommend