Question

3-year ratio trend analysis for the following company: Home Depot 1-year ratio analysis of the following company: Lowes You will need to complete all the

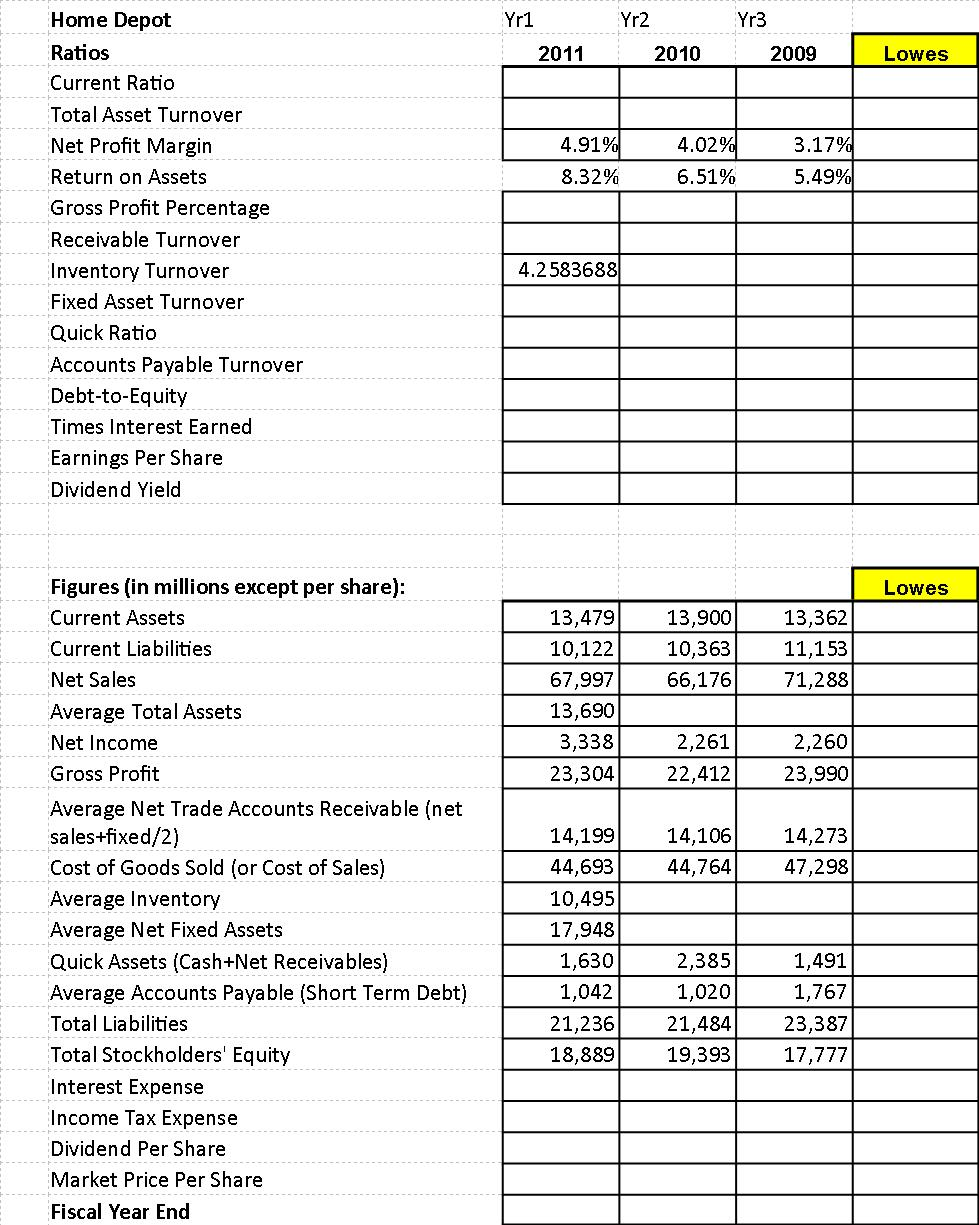

3-year ratio trend analysis for the following company: Home Depot 1-year ratio analysis of the following company: Lowes You will need to complete all the ratios covered in the course and discuss how each ratio is trending and compared against the competitor. Ratios to complete: Profitability Ratios Gross Profit Percentage Net Profit Margin Return on Assets Return on Equity Earnings Per Share Dividend Yield Asset Utilization Ratios Receivable Turnover Average Collection Period Inventory Turnover Fixed Asset Turnover Total Asset Turnover Liquidity Ratio Current Ratio Debt Utilization Ratios Accounts Payable Turnover Financial Leverage Debt-to-Equity Times Interest Earned So far, I have come up some of it, but I feel like I am doing everything wrong and I'm getting really frustrated and I don't want to do the Lowe's one if it's going to be wrong anyways.

Here is the websites to find the information:

Home Depot: http://investing.businessweek.com/research/stocks/financials/ratios.asp?ticker=HD

Lowes: http://investing.businessweek.com/research/stocks/financials/financials.asp?ticker=LOW

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started