Answered step by step

Verified Expert Solution

Question

1 Approved Answer

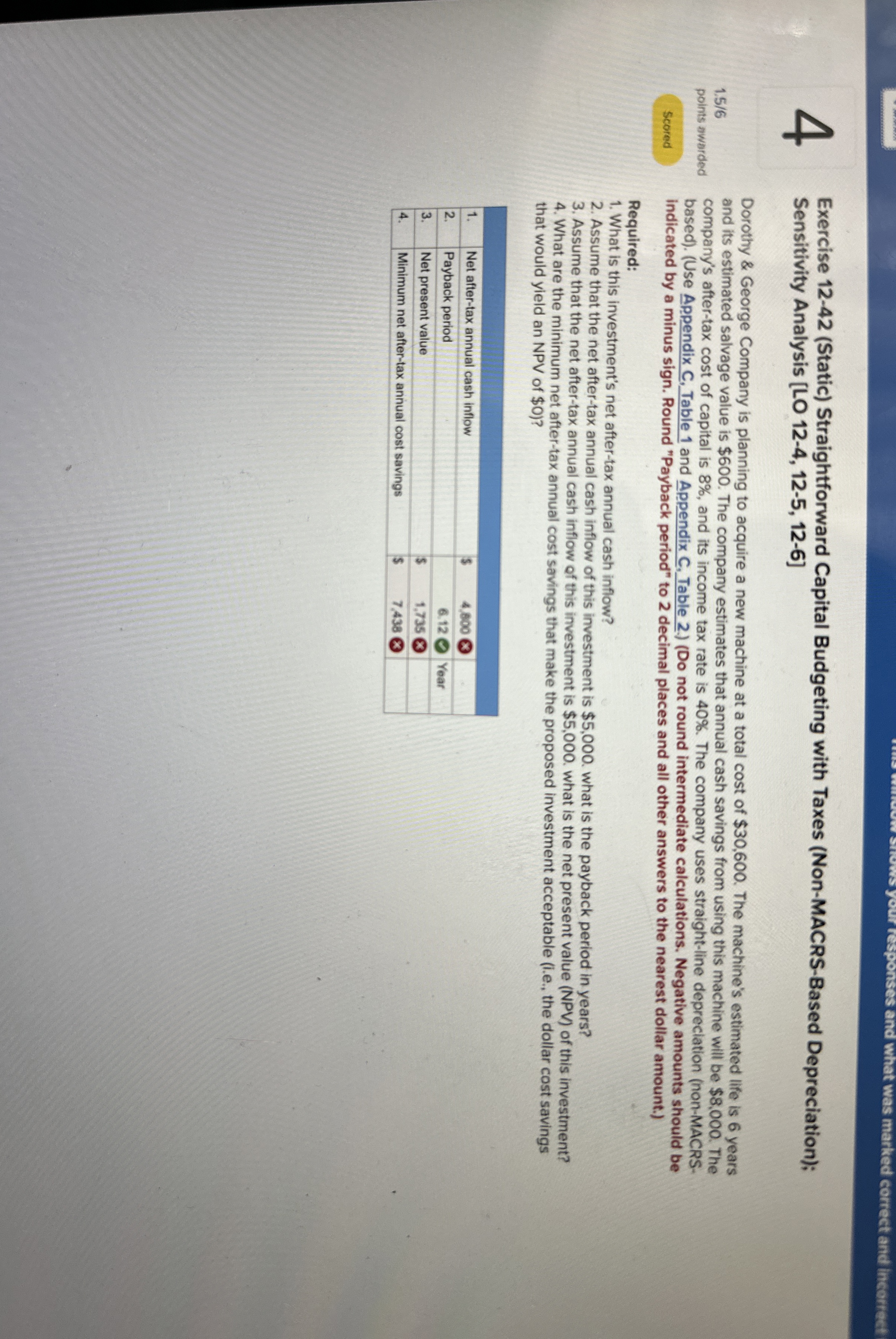

4 1 . 5 6 points awarded Scored Exercise 1 2 - 4 2 ( Static ) Straightforward Capital Budgeting with Taxes ( Non -

points awarded

Scored

Exercise Static Straightforward Capital Budgeting with Taxes NonMACRSBased Depreciation; Sensitivity Analysis LO

Dorothy & George Company is planning to acquire a new machine at a total cost of $ The machine's estimated life is years and its estimated salvage value is $ The company estimates that annual cash savings from using this machine will be $ The company's aftertax cost of capital is and its income tax rate is The company uses straightline depreciation nonMACRSbasedUse Appendix C Table and Appendix C Table Do not round intermediate calculations. Negative amounts should be indicated by a minus sign. Round "Payback period" to decimal places and all other answers to the nearest dollar amount.

Required:

What is this investment's net aftertax annual cash inflow?

Assume that the net aftertax annual cash inflow of this investment is $ what is the payback period in years?

Assume that the net aftertax annual cash inflow of this investment is $ what is the net present value NPV of this investment?

What are the minimum net aftertax annual cost savings that make the proposed investment acceptable ie the dollar cost savings that would yield an NPV of $

tableNet aftertax annual cash inflow,$Payback period,,YearNet present value,$Minimum net aftertax annual cost savings,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started