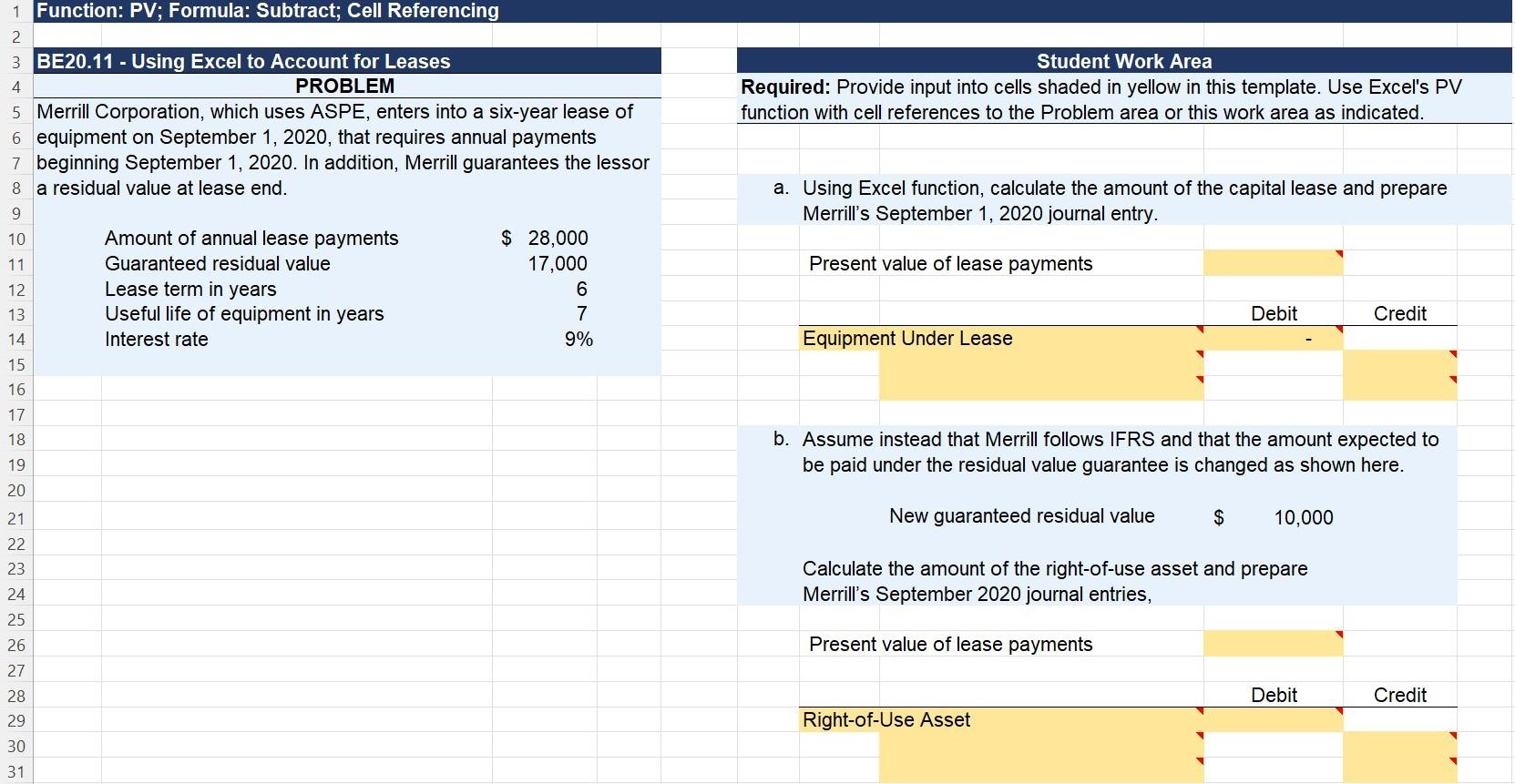

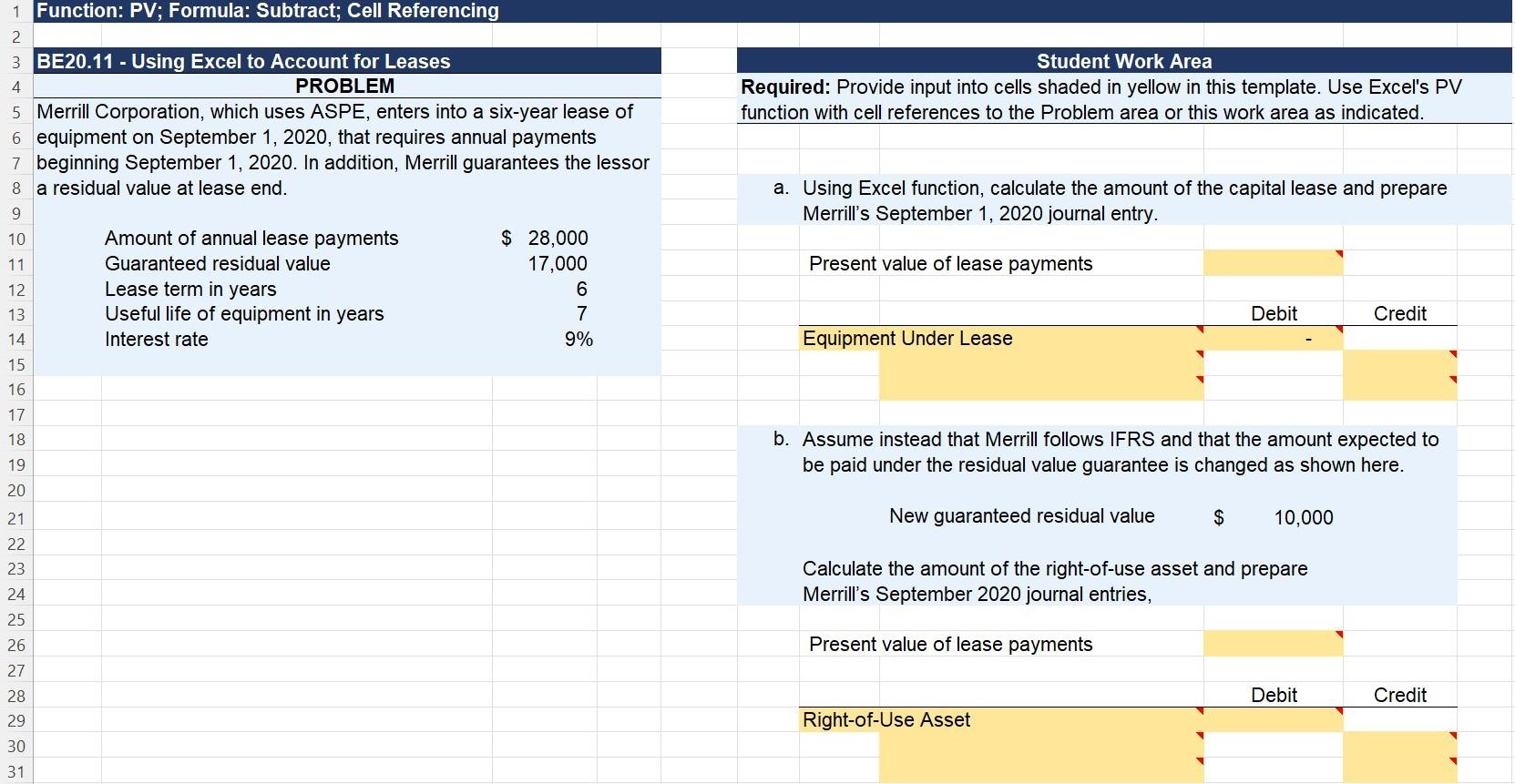

4 1 Function: PV; Formula: Subtract; Cell Referencing 2. 3 BE20.11 - Using Excel to Account for Leases PROBLEM 5 Merrill Corporation, which uses ASPE, enters into a six-year lease of 6 equipment on September 1, 2020, that requires annual payments 7 beginning September 1, 2020. In addition, Merrill guarantees the lessor 8 a residual value at lease end. Student Work Area Required: Provide input into cells shaded in yellow in this template. Use Excel's PV function with cell references to the Problem area or this work area as indicated. a. Using Excel function, calculate the amount of the capital lease and prepare Merrill's September 1, 2020 journal entry. 9 10 11 Present value of lease payments 12 13 14 Amount of annual lease payments Guaranteed residual value Lease term in years Useful life of equipment in years Interest rate $ 28,000 17,000 6 7 9% Debit Credit Equipment Under Lease 15 16 17 18 b. Assume instead that Merrill follows IFRS and that the amount expected to be paid under the residual value guarantee is changed as shown here. 19 20 21 New guaranteed residual value $ $ 10,000 22 23 Calculate the amount of the right-of-use asset and prepare Merrill's September 2020 journal entries, 24 25 26 Present value of lease payments 27 Debit Credit 28 29 30 Right-of-Use Asset 31 4 1 Function: PV; Formula: Subtract; Cell Referencing 2. 3 BE20.11 - Using Excel to Account for Leases PROBLEM 5 Merrill Corporation, which uses ASPE, enters into a six-year lease of 6 equipment on September 1, 2020, that requires annual payments 7 beginning September 1, 2020. In addition, Merrill guarantees the lessor 8 a residual value at lease end. Student Work Area Required: Provide input into cells shaded in yellow in this template. Use Excel's PV function with cell references to the Problem area or this work area as indicated. a. Using Excel function, calculate the amount of the capital lease and prepare Merrill's September 1, 2020 journal entry. 9 10 11 Present value of lease payments 12 13 14 Amount of annual lease payments Guaranteed residual value Lease term in years Useful life of equipment in years Interest rate $ 28,000 17,000 6 7 9% Debit Credit Equipment Under Lease 15 16 17 18 b. Assume instead that Merrill follows IFRS and that the amount expected to be paid under the residual value guarantee is changed as shown here. 19 20 21 New guaranteed residual value $ $ 10,000 22 23 Calculate the amount of the right-of-use asset and prepare Merrill's September 2020 journal entries, 24 25 26 Present value of lease payments 27 Debit Credit 28 29 30 Right-of-Use Asset 31