Answered step by step

Verified Expert Solution

Question

1 Approved Answer

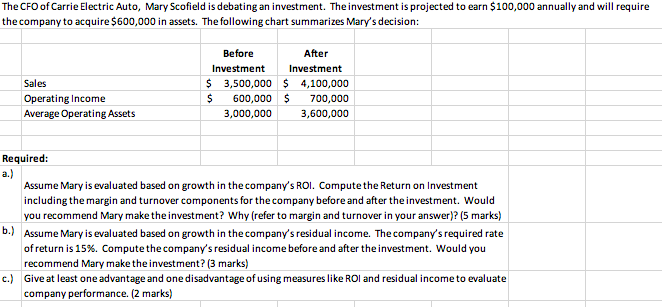

Thanks in advance! The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will

Thanks in advance!

The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Mary's decision: Sales Operating Income Average Operating Assets Before After Investment Investment $ 3,500,000 $4,100,000 $ 600,000 $ 700,000 3,000,000 3,600,000 Required: a.) Assume Mary is evaluated based on growth in the company's ROI. Compute the Return on Investment including the margin and turnover components for the company before and after the investment. Would you recommend Mary make the investment? Why (refer to margin and turnover in your answer)? (5 marks) b.) Assume Mary is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. Would you recommend Mary make the investment? (3 marks) c.) Give at least one advantage and one disadvantage of using measures like ROI and residual income to evaluate company performance. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started