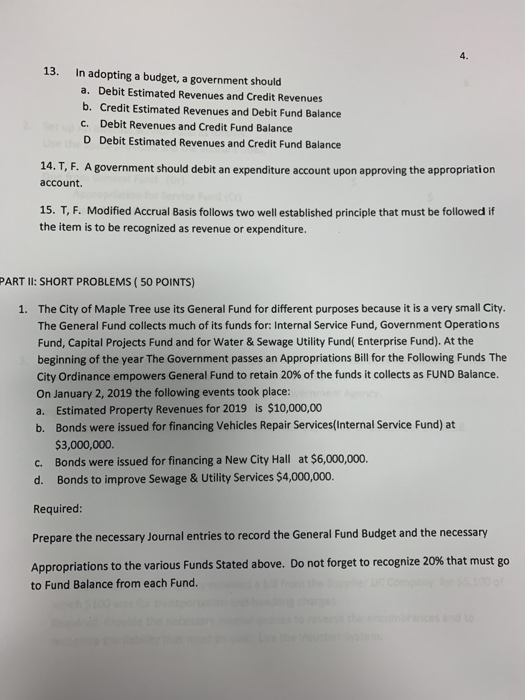

4. 13. In adopting a budget, a government should a. Debit Estimated Revenues and Credit Revenues b. Credit Estimated Revenues and Debit Fund Balance c. Debit Revenues and Credit Fund Balance D Debit Estimated Revenues and Credit Fund Balance 14. T, F. A government should debit an expenditure account upon approving the appropriation account. 15. T, F. Modified Accrual Basis follows two well established principle that must be followed if the item is to be recognized as revenue or expenditure. PART II: SHORT PROBLEMS ( 50 POINTS) 1. The City of Maple Tree use its General Fund for different purposes because it is a very small City The General Fund collects much of its funds for: Internal Service Fund, Government Operations Fund, Capital Projects Fund and for Water & Sewage Utility Fund( Enterprise Fund). At the beginning of the year The Government passes an Appropriations Bill for the Following Funds The City Ordinance empowers General Fund to retain 20% of the funds it collects as FUND Balance. On January 2, 2019 the following events took place: a. Estimated Property Revenues for 2019 is $10,000,00 b. Bonds were issued for financing Vehicles Repair Services(Internal Service Fund) at $3,000,000 c. Bonds were issued for financing a New City Hall at $6,000,000. Bonds to improve Sewage & Utility Services $4,000,000. d. Required Prepare the necessary Journal entries to record the General Fund Budget and the necessary Appropriations to the various Funds Stated above. Do not forget to recognize 20% that must go to Fund Balance from each Fund. 4. 13. In adopting a budget, a government should a. Debit Estimated Revenues and Credit Revenues b. Credit Estimated Revenues and Debit Fund Balance c. Debit Revenues and Credit Fund Balance D Debit Estimated Revenues and Credit Fund Balance 14. T, F. A government should debit an expenditure account upon approving the appropriation account. 15. T, F. Modified Accrual Basis follows two well established principle that must be followed if the item is to be recognized as revenue or expenditure. PART II: SHORT PROBLEMS ( 50 POINTS) 1. The City of Maple Tree use its General Fund for different purposes because it is a very small City The General Fund collects much of its funds for: Internal Service Fund, Government Operations Fund, Capital Projects Fund and for Water & Sewage Utility Fund( Enterprise Fund). At the beginning of the year The Government passes an Appropriations Bill for the Following Funds The City Ordinance empowers General Fund to retain 20% of the funds it collects as FUND Balance. On January 2, 2019 the following events took place: a. Estimated Property Revenues for 2019 is $10,000,00 b. Bonds were issued for financing Vehicles Repair Services(Internal Service Fund) at $3,000,000 c. Bonds were issued for financing a New City Hall at $6,000,000. Bonds to improve Sewage & Utility Services $4,000,000. d. Required Prepare the necessary Journal entries to record the General Fund Budget and the necessary Appropriations to the various Funds Stated above. Do not forget to recognize 20% that must go to Fund Balance from each Fund