Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (18 points) Mike Wheeler has been learning about data and regressions in science club. He has the following estimates of betas for 5 portfolios.

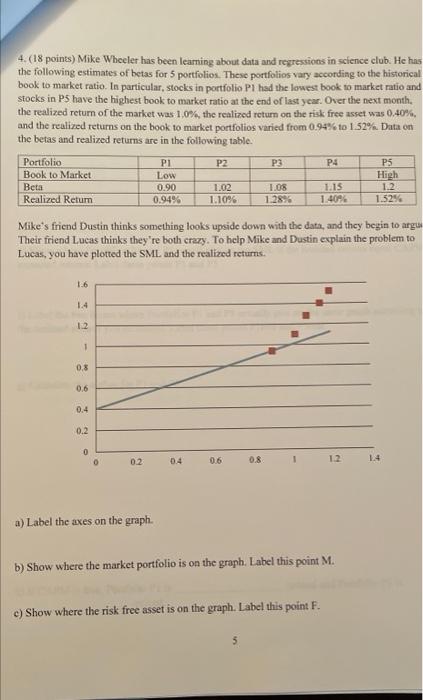

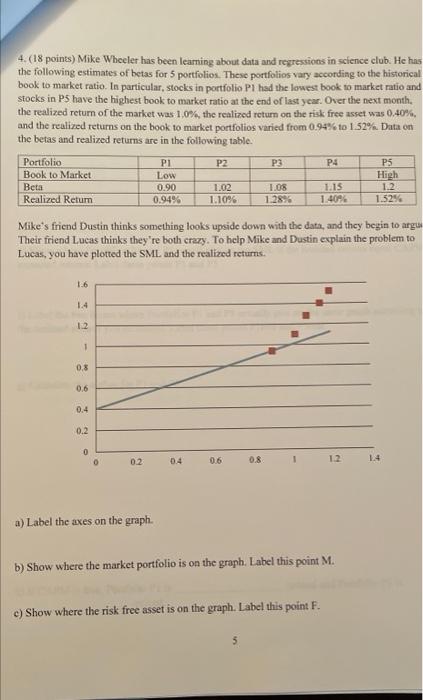

4. (18 points) Mike Wheeler has been learning about data and regressions in science club. He has the following estimates of betas for 5 portfolios. These portfolios vary according to the historical book to market ratio. In particular, stocks in portfolio PI had the lowest book to market ratio and stocks in PS have the highest book to market ratio at the end of last year. Over the next month. the realized retum of the market was 10%, the realized return on the risk free asset was 0,40% and the realized teturns on the book to market portfolios varied from 0.94% to 1.52%. Data on the betas and realized returns are in the following table. Portfolio PS Book to Market High Beta 1.02 1.08 1.2 Realized Retum 1.10% 1.28% 1.5296 P2 P3 P4 PI Low 0.90 0.94% 1.IS 1.4084 Mike's friend Dustin thinks something looks upside down with the data and they begin to argu Their friend Lucas thinks they're both crazy. To help Mike and Dustin explain the problem to Lucas, you have plotted the SML and the realized returns. 1.6 1.4 12 1 0.8 0.6 0.4 0.2 0 02 0.4 0.6 0.8 1 1.2 1.4 a) Label the axes on the graph. b) Show where the market portfolio is on the graph. Label this point M. e) Show where the risk free asset is on the graph. Label this point F. Calculate the CAPM expected return for Portfolios Pl and Ps. e Show where folios Pland Ps would plore the SML if the realized returwequal CAPM expected return. Label these points Pland IS. Label the two boxes where Portfolios P1 and PS actually plot on the same graph according to the realized returns you estimated Label these points real and Preal Calculate the alphas for Pt und PS h) CAPM is true, Portfolio Plis -priced -priced and Portfolio P5 is

4. (18 points) Mike Wheeler has been learning about data and regressions in science club. He has the following estimates of betas for 5 portfolios. These portfolios vary according to the historical book to market ratio. In particular, stocks in portfolio PI had the lowest book to market ratio and stocks in PS have the highest book to market ratio at the end of last year. Over the next month. the realized retum of the market was 10%, the realized return on the risk free asset was 0,40% and the realized teturns on the book to market portfolios varied from 0.94% to 1.52%. Data on the betas and realized returns are in the following table. Portfolio PS Book to Market High Beta 1.02 1.08 1.2 Realized Retum 1.10% 1.28% 1.5296 P2 P3 P4 PI Low 0.90 0.94% 1.IS 1.4084 Mike's friend Dustin thinks something looks upside down with the data and they begin to argu Their friend Lucas thinks they're both crazy. To help Mike and Dustin explain the problem to Lucas, you have plotted the SML and the realized returns. 1.6 1.4 12 1 0.8 0.6 0.4 0.2 0 02 0.4 0.6 0.8 1 1.2 1.4 a) Label the axes on the graph. b) Show where the market portfolio is on the graph. Label this point M. e) Show where the risk free asset is on the graph. Label this point F. Calculate the CAPM expected return for Portfolios Pl and Ps. e Show where folios Pland Ps would plore the SML if the realized returwequal CAPM expected return. Label these points Pland IS. Label the two boxes where Portfolios P1 and PS actually plot on the same graph according to the realized returns you estimated Label these points real and Preal Calculate the alphas for Pt und PS h) CAPM is true, Portfolio Plis -priced -priced and Portfolio P5 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started