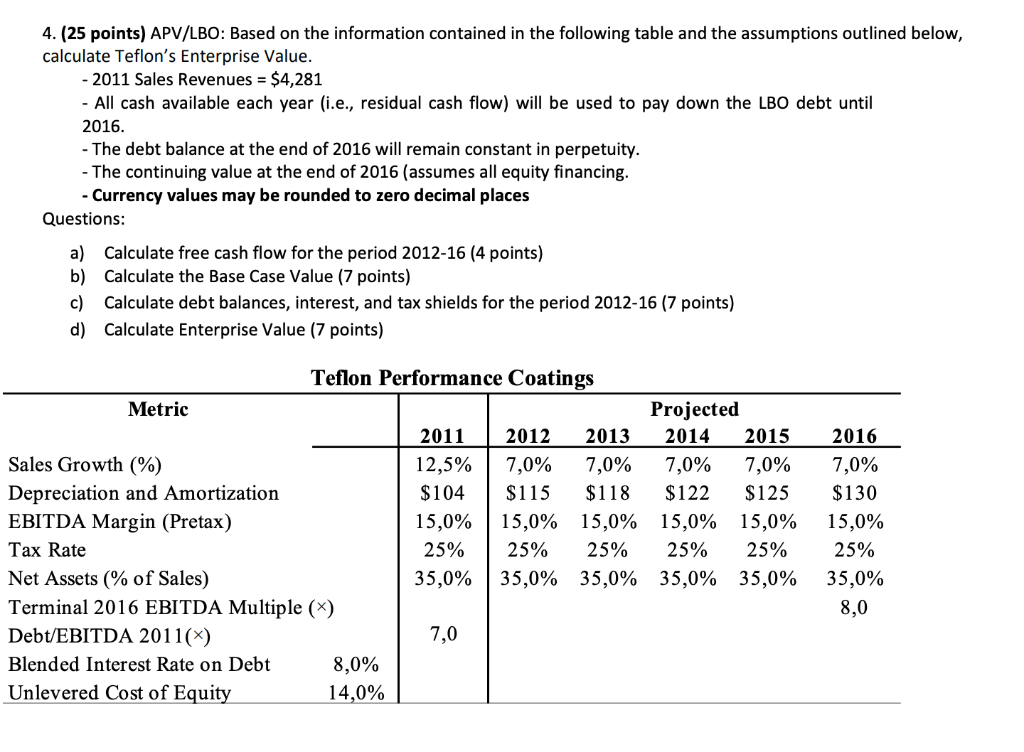

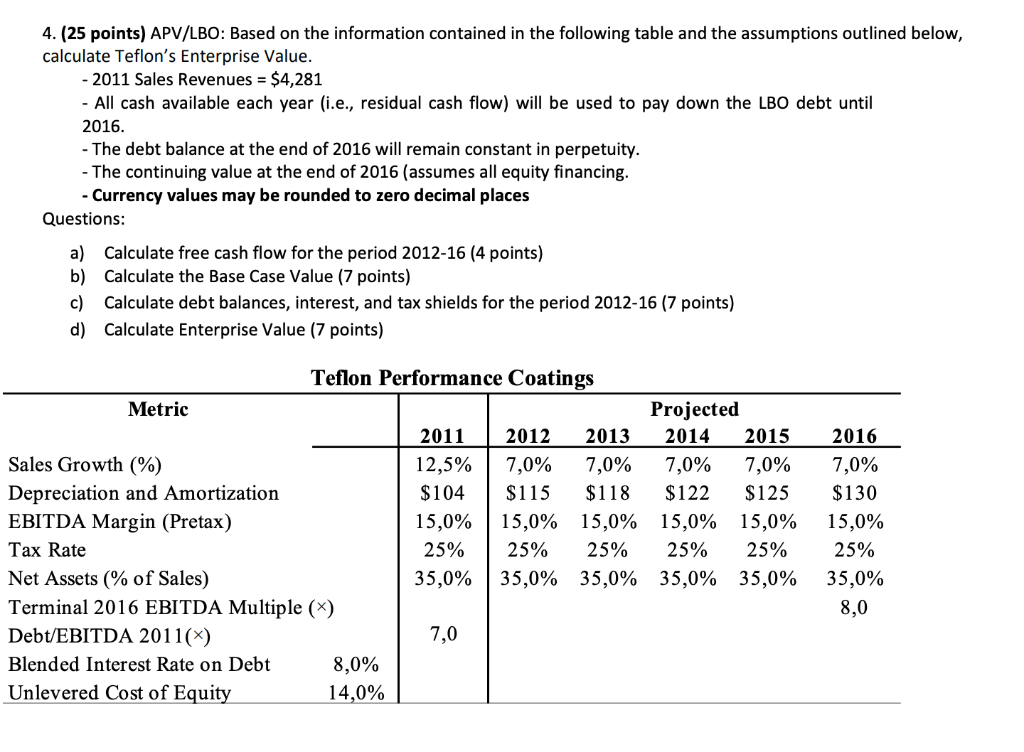

4. (25 points) APV/LBO: Based on the information contained in the following table and the assumptions outlined below, calculate Teflon's Enterprise Value. - 2011 Sales Revenues = $4,281 - All cash available each year (i.e., residual cash flow) will be used to pay down the LBO debt until 2016. - The debt balance at the end of 2016 will remain constant in perpetuity. - The continuing value at the end of 2016 (assumes all equity financing. - Currency values may be rounded to zero decimal places Questions: a) Calculate free cash flow for the period 2012-16 (4 points) b) Calculate the Base Case Value (7 points) c) Calculate debt balances, interest, and tax shields for the period 2012-16 (7 points) d) Calculate Enterprise Value (7 points) Teflon Performance Coatings Metric Projected 2011 2012 2013 2014 2015 Sales Growth (%) 12,5% 7,0% 7,0% 7,0% 7,0% Depreciation and Amortization $104 $115 $118 $122 $125 EBITDA Margin (Pretax) 15,0% 15,0% 15,0% 15,0% 15,0% Tax Rate 25% 25% 25% 25% 25% Net Assets (% of Sales) 35,0% 35,0% 35,0% 35,0% 35,0% Terminal 2016 EBITDA Multiple (X) Debt/EBITDA 2011(x) 7,0 Blended Interest Rate on Debt 8,0% Unlevered Cost of Equity 14,0% 2016 7,0% $130 15,0% 25% 35,0% 8,0 4. (25 points) APV/LBO: Based on the information contained in the following table and the assumptions outlined below, calculate Teflon's Enterprise Value. - 2011 Sales Revenues = $4,281 - All cash available each year (i.e., residual cash flow) will be used to pay down the LBO debt until 2016. - The debt balance at the end of 2016 will remain constant in perpetuity. - The continuing value at the end of 2016 (assumes all equity financing. - Currency values may be rounded to zero decimal places Questions: a) Calculate free cash flow for the period 2012-16 (4 points) b) Calculate the Base Case Value (7 points) c) Calculate debt balances, interest, and tax shields for the period 2012-16 (7 points) d) Calculate Enterprise Value (7 points) Teflon Performance Coatings Metric Projected 2011 2012 2013 2014 2015 Sales Growth (%) 12,5% 7,0% 7,0% 7,0% 7,0% Depreciation and Amortization $104 $115 $118 $122 $125 EBITDA Margin (Pretax) 15,0% 15,0% 15,0% 15,0% 15,0% Tax Rate 25% 25% 25% 25% 25% Net Assets (% of Sales) 35,0% 35,0% 35,0% 35,0% 35,0% Terminal 2016 EBITDA Multiple (X) Debt/EBITDA 2011(x) 7,0 Blended Interest Rate on Debt 8,0% Unlevered Cost of Equity 14,0% 2016 7,0% $130 15,0% 25% 35,0% 8,0