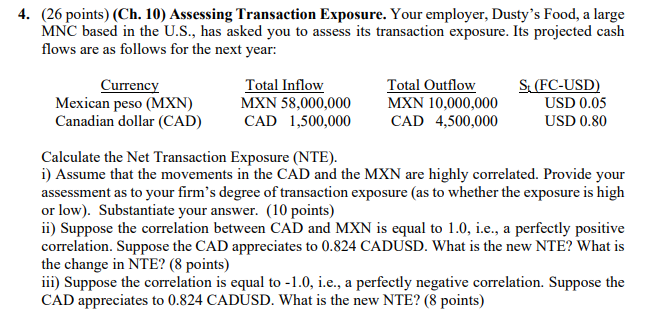

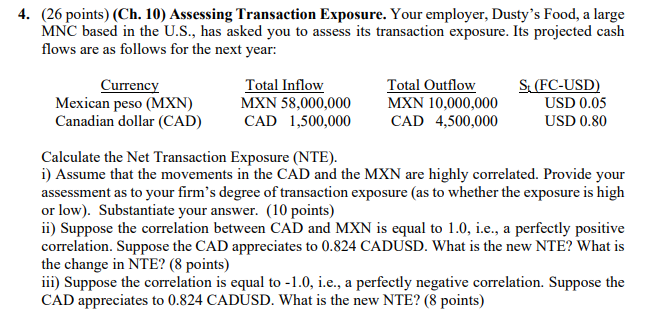

4. (26 points) (Ch. 10) Assessing Transaction Exposure. Your employer, Dusty's Food, a large MNC based in the U.S., has asked you to assess its transaction exposure. Its projected cash flows are as follows for the next year: Currency Mexican peso (MXN) Canadian dollar (CAD) Total Inflow MXN 58,000,000 CAD 1,500,000 Total Outflow MXN 10,000,000 CAD 4,500,000 S (FC-USD) USD 0.05 USD 0.80 Calculate the Net Transaction Exposure (NTE). i) Assume that the movements in the CAD and the MXN are highly correlated. Provide your assessment as to your firm's degree of transaction exposure (as to whether the exposure is high or low). Substantiate your answer. (10 points) ii) Suppose the correlation between CAD and MXN is equal to 1.0, i.e., a perfectly positive correlation. Suppose the CAD appreciates to 0.824 CADUSD. What is the new NTE? What is the change in NTE? (8 points) iii) Suppose the correlation is equal to -1.0, i.e., a perfectly negative correlation. Suppose the CAD appreciates to 0.824 CADUSD. What is the new NTE? (8 points) 4. (26 points) (Ch. 10) Assessing Transaction Exposure. Your employer, Dusty's Food, a large MNC based in the U.S., has asked you to assess its transaction exposure. Its projected cash flows are as follows for the next year: Currency Mexican peso (MXN) Canadian dollar (CAD) Total Inflow MXN 58,000,000 CAD 1,500,000 Total Outflow MXN 10,000,000 CAD 4,500,000 S (FC-USD) USD 0.05 USD 0.80 Calculate the Net Transaction Exposure (NTE). i) Assume that the movements in the CAD and the MXN are highly correlated. Provide your assessment as to your firm's degree of transaction exposure (as to whether the exposure is high or low). Substantiate your answer. (10 points) ii) Suppose the correlation between CAD and MXN is equal to 1.0, i.e., a perfectly positive correlation. Suppose the CAD appreciates to 0.824 CADUSD. What is the new NTE? What is the change in NTE? (8 points) iii) Suppose the correlation is equal to -1.0, i.e., a perfectly negative correlation. Suppose the CAD appreciates to 0.824 CADUSD. What is the new NTE? (8 points)