Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 - 4 I Activity - Based Costing The Gruen Toy Company makes a variety of dolls at its operation in Munich. Its manufacturing process

I ActivityBased Costing

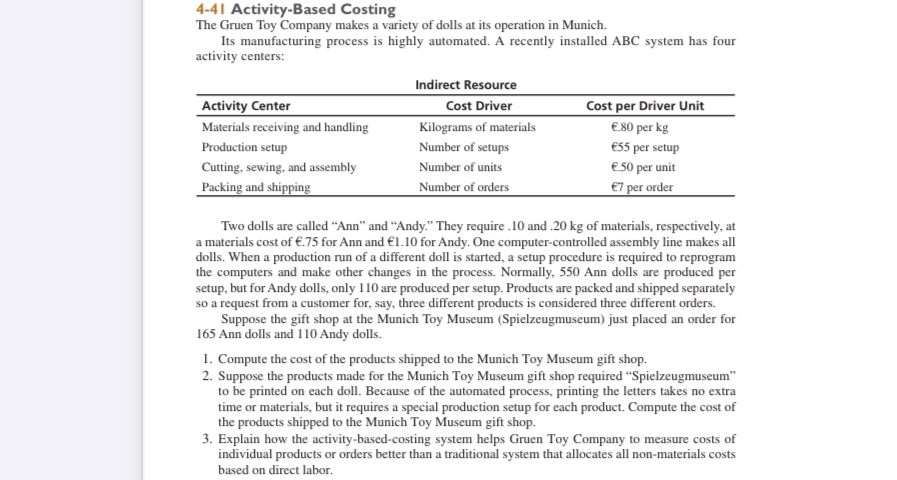

The Gruen Toy Company makes a variety of dolls at its operation in Munich.

Its manufacturing process is highly automated. A recently installed ABC system has four activity centers:

Indirect Resource

tableActivity Center,Cost Driver,Cost per Driver UnitMaterials receiving and handling,Kilograms of materials, per kgProduction setup,Number of setups, per setupCutting sewing, and assembly,Number of units, per unitPacking and shipping,Number of orders, per order

Two dolls are called "Ann" and "Andy." They require and of materials, respectively, at a materials cost of for Ann and for Andy. One computercontrolled assembly line makes all dolls. When a production run of a different doll is started, a setup procedure is required to reprogram the computers and make other changes in the process. Normally, Ann dolls are produced per setup, but for Andy dolls, only are produced per setup. Products are packed and shipped separately so a request from a customer for, say, three different products is considered three different orders.

Suppose the gift shop at the Munich Toy Museum Spielzeugmuseum just placed an order for Ann dolls and Andy dolls.

Compute the cost of the products shipped to the Munich Toy Museum gift shop.

Suppose the products made for the Munich Toy Museum gift shop required "Spielzeugmuseum" to be printed on each doll. Because of the automated process, printing the letters takes no extra time or materials, but it requires a special production setup for each product. Compute the cost of the products shipped to the Munich Toy Museum gift shop.

Explain how the activitybasedcosting system helps Gruen Toy Company to measure costs of individual products or orders better than a traditional system that allocates all nonmaterials costs based on direct labor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started