Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. A portfolio manager entered a swap with a dealer. The swap's notional principal is $100 million, payments are to be made semi-annually, and the

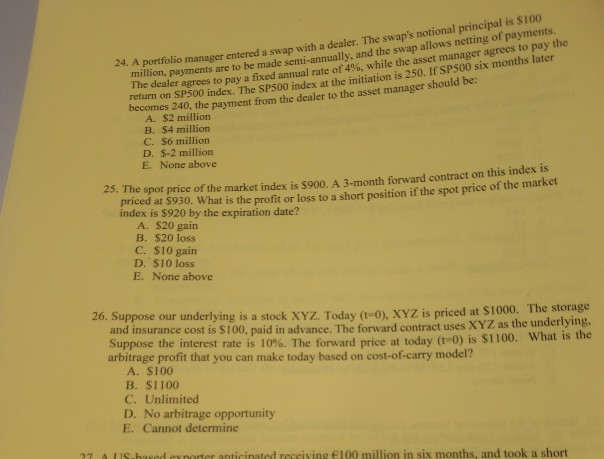

4. A portfolio manager entered a swap with a dealer. The swap's notional principal is $100 million, payments are to be made semi-annually, and the swap allows netting of payments. The dealer agrees to pay a fixed annual rate of 4%, while the asset manager agrees to pay the return on SP500 index. The SP500 index at the initiation is 250. If SP500 six months later becomes 240, the payment from the dealer to the asset manager should be: om the desk at the initiation the asset manageing of payment on is 250. If SP500 s agrees to pay the A. $2 million B. S4 million C. S6 million D. S-2 million E. None above entract on this index is 25. The spot price of the market index is $900. A 3-month forward contract on this index priced at $930. What is the profit or lose to a short position if the spot price of the market index is $920 by the expiration date? A. $20 gain B. $20 loss C. $10 gain D. SIO loss E. None above 26. Suppose our underlying is a stock XYZ. Today (t=0), XYZ is priced at $1000. The storage and insurance cost is $100 paid in advance. The forward contract uses XYZ as the underlying Suppose the interest rate is 10%. The forward price at today (t-0) is $1100. What is the arbitrage profit that you can make today based on cost-of-carry model? A. S100 B. $1100 C. Unlimited D. No arbitrage opportunity E. Cannot determine 77 A LIS.huseynorter anticinated receiving 100 million in six months, and took a short

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started