Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 A trial balance is extracted on lance is extracted on 31 December 2015 and the total does not re is a shortage of RM

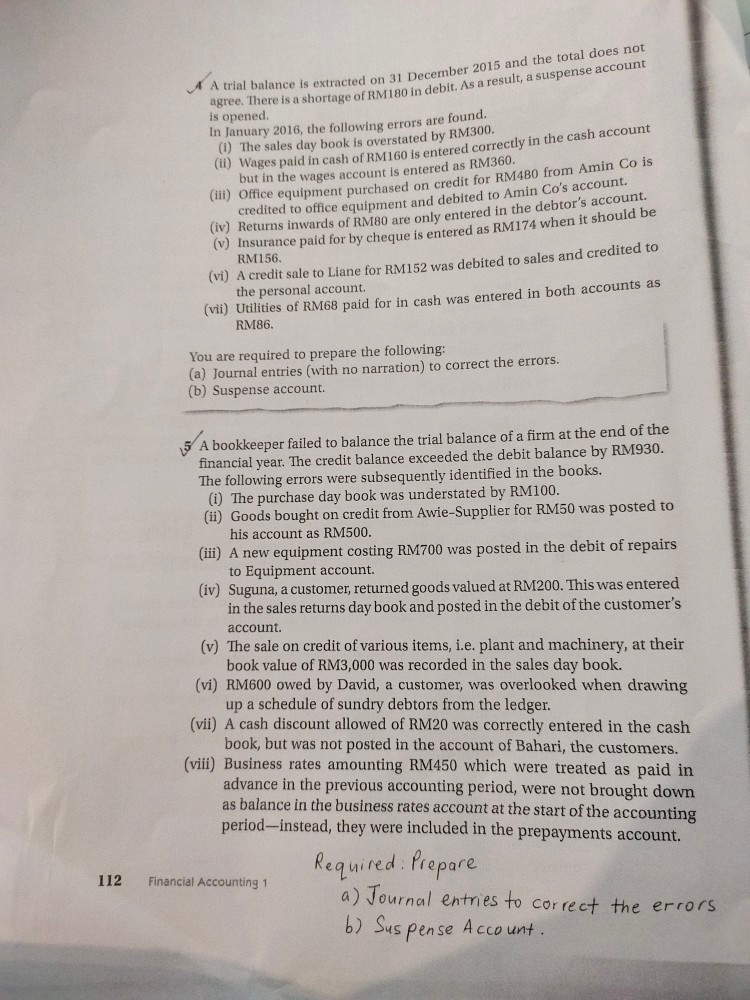

4 A trial balance is extracted on lance is extracted on 31 December 2015 and the total does not re is a shortage of RM 180 in debit. As a result, a suspense account is opened. In January 2016, the following errors are found. (1) The sales day book is overstated by RM300. Wages paid in cash of RM160 is entered correctly in the cash account but in the wages account is entered as RM360. Office equipment purchased on credit for RM480 from Amin CO is credited to office equipment and debited to Amin Co's account. (IV) Returns inwards of RM80 are only entered in the debtor's account. (V) Insurance paid for by cheque is entered as RM174 when it should be RM156. (vi) A credit sale to Liane for RM152 was debited to sales and credited to the personal account. (vii) Utilities of RM68 paid for in cash was entered in both accounts as RM86. You are required to prepare the following: (a) Journal entries (with no narration) to correct the errors. (b) Suspense account. 5 A bookkeeper failed to balance the trial balance of a firm at the end of the financial year. The credit balance exceeded the debit balance by RM930. The following errors were subsequently identified in the books. (1) The purchase day book was understated by RM100. (ii) Goods bought on credit from Awie-Supplier for RM50 was posted to his account as RM500. (iii) A new equipment costing RM700 was posted in the debit of repairs to Equipment account. (iv) Suguna, a customer, returned goods valued at RM200. This was entered in the sales returns day book and posted in the debit of the customer's account (v) The sale on credit of various items, i.e. plant and machinery, at their book value of RM3,000 was recorded in the sales day book. (vi) RM600 owed by David, a customer, was overlooked when drawing up a schedule of sundry debtors from the ledger. (vii) A cash discount allowed of RM20 was correctly entered in the cash book, but was not posted in the account of Bahari, the customers. (viii) Business rates amounting RM450 which were treated as paid in advance in the previous accounting period, were not brought down as balance in the business rates account at the start of the accounting period-instead, they were included in the prepayments account. Required. Prepare Financial Accounting 1 a) Journal entries to correct the errors b) Suspense Account. 112

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started