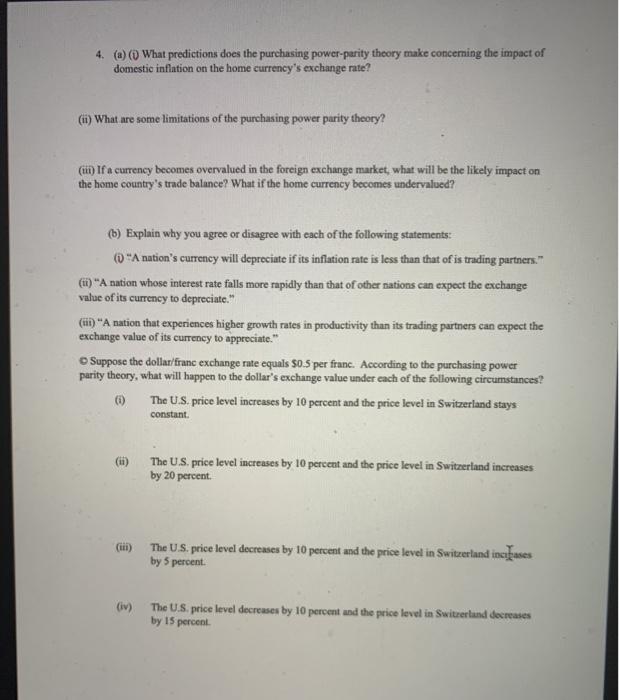

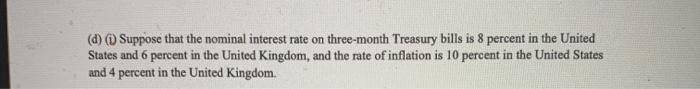

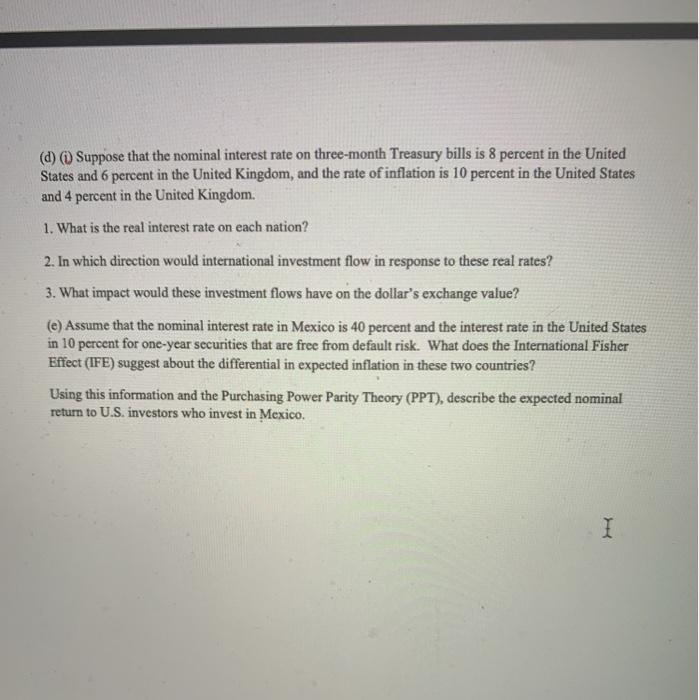

4. (a) (What predictions does the purchasing power-parity theory make concerning the impact of domestic inflation on the home currency's exchange rate? (m) What are some limitations of the purchasing power parity theory? () If a currency becomes overvalued in the foreign exchange market, what will be the likely impact on the home country's trade balance? What if the home currency becomes undervalued? (b) Explain why you agree or disagree with each of the following statements: "A nation's currency will depreciate if its inflation rate is less than that of is trading partners." C) "A nation whose interest rate falls more rapidly than that of other nations can expect the exchange value of its currency to depreciate." (1) "A nation that experiences higher growth rates in productivity than its trading partners can expect the exchange value of its currency to appreciate." Suppose the dollar/franc exchange rate equals 80.5 per franc. According to the purchasing power parity theory, what will happen to the dollar's exchange value under each of the following circumstances? (1) The U.S. price level increases by 10 percent and the price level in Switzerland stays constant (ii) The U.S. price level increases by 10 percent and the price level in Switzerland increases by 20 percent The U.S. price level decreases by 10 percent and the price level in Switzerland incases by 5 percent (iv) The U.S. price level decreases by 10 percent and the price level in Switzerland decreases by 15 percent (d) Suppose that the nominal interest rate on three-month Treasury bills is 8 percent in the United States and 6 percent in the United Kingdom, and the rate of inflation is 10 percent in the United States and 4 percent in the United Kingdom. (d) Suppose that the nominal interest rate on three-month Treasury bills is 8 percent in the United States and 6 percent in the United Kingdom, and the rate of inflation is 10 percent in the United States and 4 percent in the United Kingdom. 1. What is the real interest rate on each nation? 2. In which direction would international investment flow in response to these real rates? 3. What impact would these investment flows have on the dollar's exchange value? (e) Assume that the nominal interest rate in Mexico is 40 percent and the interest rate in the United States in 10 percent for one-year securities that are free from default risk. What does the International Fisher Effect (IFE) suggest about the differential in expected inflation in these two countries? Using this information and the Purchasing Power Parity Theory (PPT), describe the expected nominal return to U.S. investors who invest in Mexico