Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. AASB 128 requires that where an investor company does significantly influence an investee: A. the investee company must revalue its assets to fair value

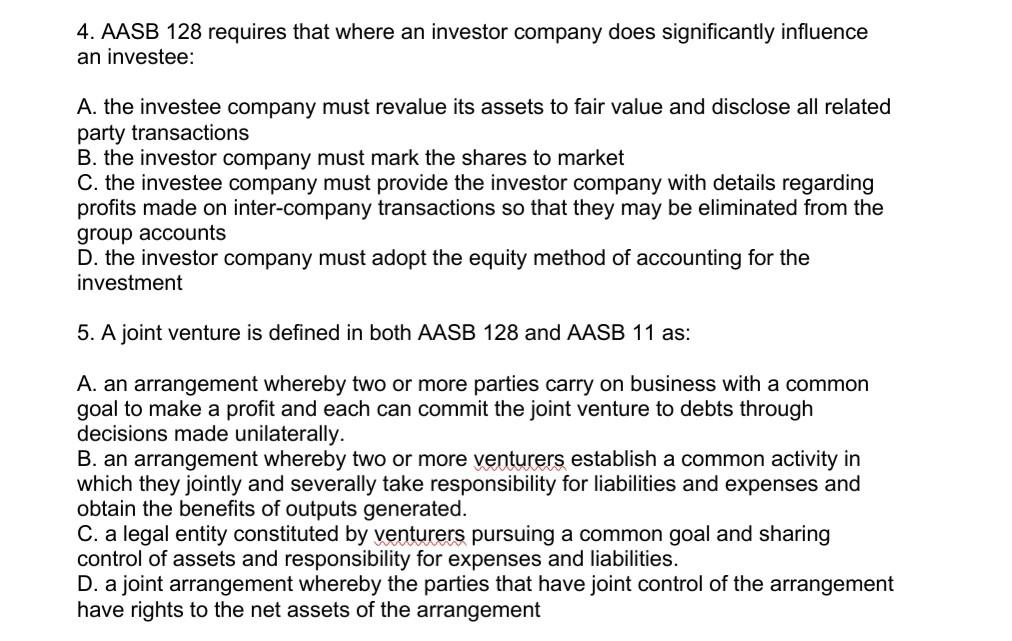

4. AASB 128 requires that where an investor company does significantly influence an investee: A. the investee company must revalue its assets to fair value and disclose all related party transactions B. the investor company must mark the shares to market C. the investee company must provide the investor company with details regarding profits made on inter-company transactions so that they may be eliminated from the group accounts D. the investor company must adopt the equity method of accounting for the investment 5. A joint venture is defined in both AASB 128 and AASB 11 as: A. an arrangement whereby two or more parties carry on business with a common goal to make a profit and each can commit the joint venture to debts through decisions made unilaterally. B. an arrangement whereby two or more venturers establish a common activity in which they jointly and severally take responsibility for liabilities and expenses and obtain the benefits of outputs generated. C. a legal entity constituted by venturers pursuing a common goal and sharing control of assets and responsibility for expenses and liabilities. D. a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started