Answered step by step

Verified Expert Solution

Question

1 Approved Answer

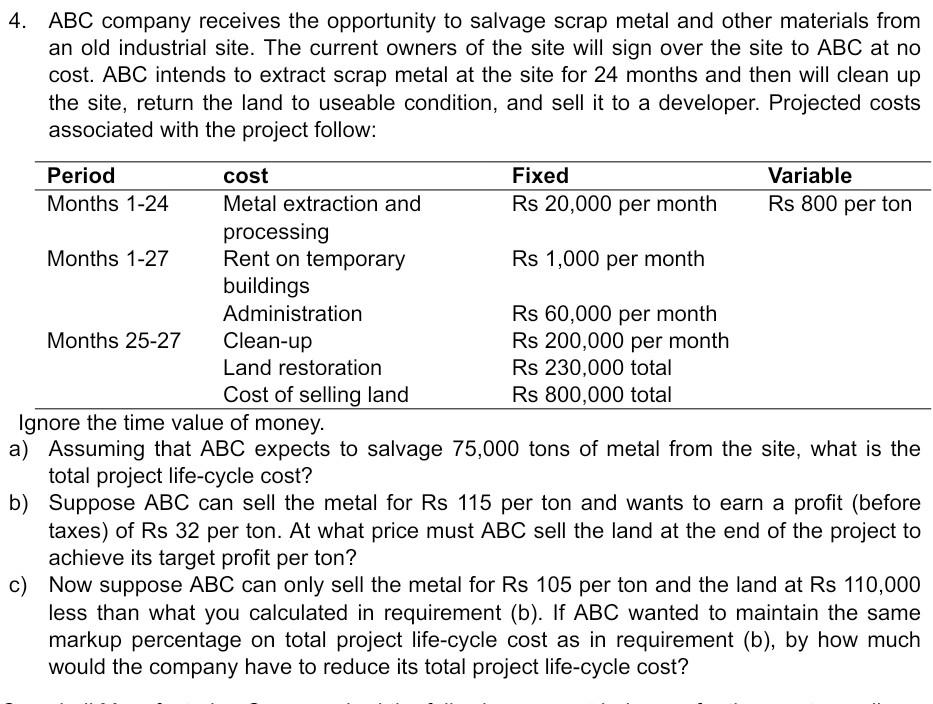

4. ABC company receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will

4. ABC company receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to ABC at no cost. ABC intends to extract scrap metal at the site for 24 months and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow: Period cost Fixed Variable Months 1-24 Metal extraction and Rs 20,000 per month Rs 800 per ton processing Months 1-27 Rent on temporary Rs 1,000 per month buildings Administration Rs 60,000 per month Months 25-27 Clean-up Rs 200,000 per month Land restoration Rs 230,000 total Cost of selling land Rs 800,000 total Ignore the time value of money. a) Assuming that ABC expects to salvage 75,000 tons of metal from the site, what is the total project life-cycle cost? b) Suppose ABC can sell the metal for Rs 115 per ton and wants to earn a profit (before taxes) of Rs 32 per ton. At what price must ABC sell the land at the end of the project to achieve its target profit per ton? c) Now suppose ABC can only sell the metal for Rs 105 per ton and the land at Rs 110,000 less than what you calculated in requirement (b). If ABC wanted to maintain the same markup percentage on total project life-cycle cost as in requirement (b), by how much would the company have to reduce its total project life-cycle cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started