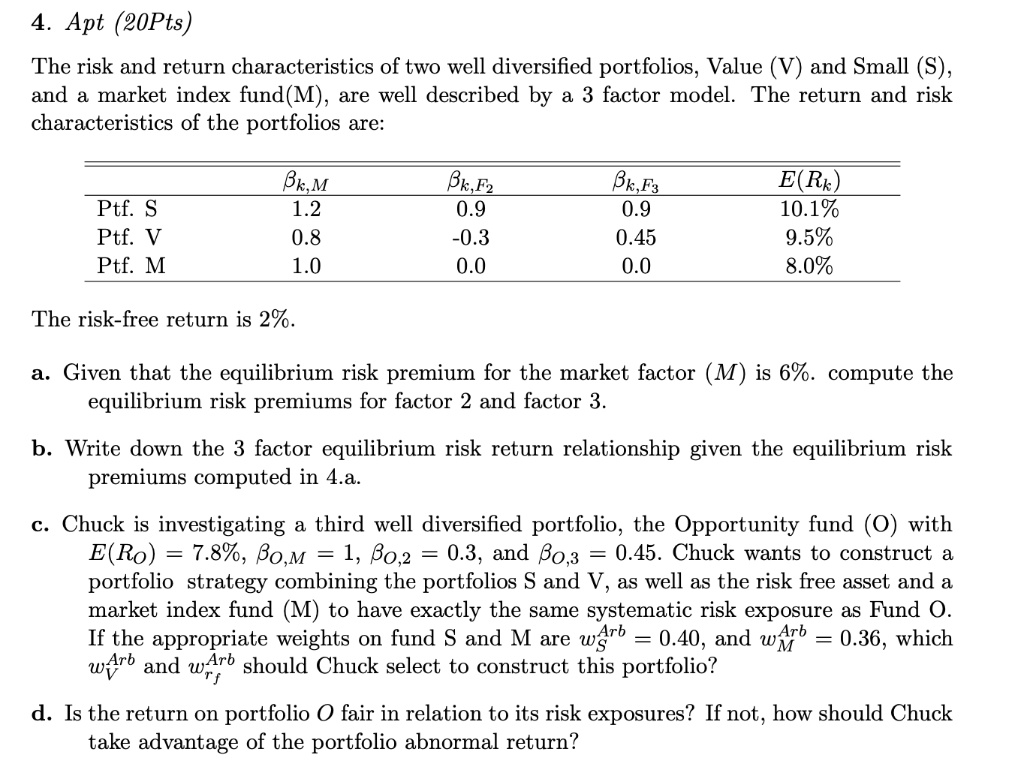

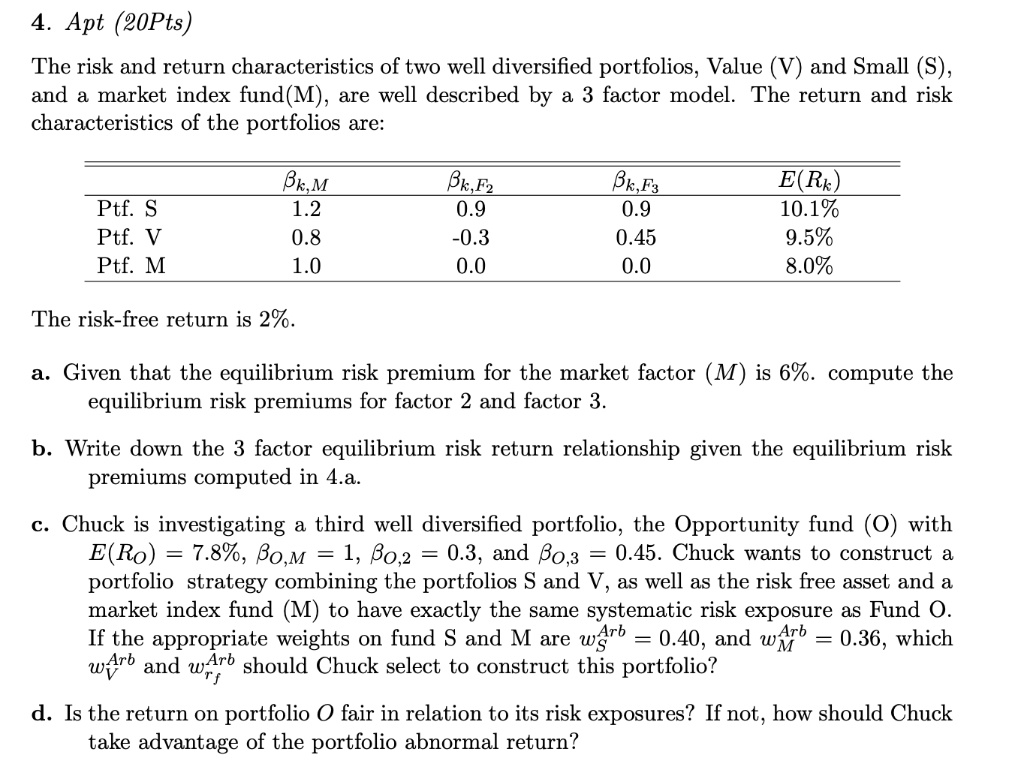

4. Apt (20Pts) The risk and return characteristics of two well diversified portfolios, Value (V) and Small (S), and a market index fund(M), are well described by a 3 factor model. The return and risk characteristics of the portfolios are: Ptf. S Ptf. V Ptf. M BkM 1.2 0.8 1.0 Bk,F2 0.9 -0.3 0.0 Bk,F3 0.9 0.45 0.0 E(RK) 10.1% 9.5% 8.0% The risk-free return is 2%. a. Given that the equilibrium risk premium for the market factor (M) is 6%. compute the equilibrium risk premiums for factor 2 and factor 3. b. Write down the 3 factor equilibrium risk return relationship given the equilibrium risk premiums computed in 4.a. = = c. Chuck is investigating a third well diversified portfolio, the Opportunity fund (0) with E(Ro) = 7.8%, Bo,m = 1, 30,2 = 0.3, and 30,3 = 0.45. Chuck wants to construct a portfolio strategy combining the portfolios S and V, as well as the risk free asset and a market index fund (M) to have exactly the same systematic risk exposure as Fund O. If the appropriate weights on fund S and M are wArb 0.40, and waru 0.36, which wArb and warb should Chuck select to construct this portfolio? d. Is the return on portfolio O fair in relation to its risk exposures? If not, how should Chuck take advantage of the portfolio abnormal return? = = 4. Apt (20Pts) The risk and return characteristics of two well diversified portfolios, Value (V) and Small (S), and a market index fund(M), are well described by a 3 factor model. The return and risk characteristics of the portfolios are: Ptf. S Ptf. V Ptf. M BkM 1.2 0.8 1.0 Bk,F2 0.9 -0.3 0.0 Bk,F3 0.9 0.45 0.0 E(RK) 10.1% 9.5% 8.0% The risk-free return is 2%. a. Given that the equilibrium risk premium for the market factor (M) is 6%. compute the equilibrium risk premiums for factor 2 and factor 3. b. Write down the 3 factor equilibrium risk return relationship given the equilibrium risk premiums computed in 4.a. = = c. Chuck is investigating a third well diversified portfolio, the Opportunity fund (0) with E(Ro) = 7.8%, Bo,m = 1, 30,2 = 0.3, and 30,3 = 0.45. Chuck wants to construct a portfolio strategy combining the portfolios S and V, as well as the risk free asset and a market index fund (M) to have exactly the same systematic risk exposure as Fund O. If the appropriate weights on fund S and M are wArb 0.40, and waru 0.36, which wArb and warb should Chuck select to construct this portfolio? d. Is the return on portfolio O fair in relation to its risk exposures? If not, how should Chuck take advantage of the portfolio abnormal return? = =