Answered step by step

Verified Expert Solution

Question

1 Approved Answer

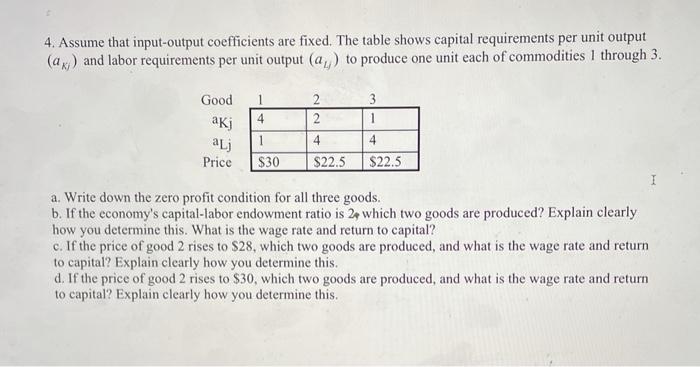

- 4. Assume that input-output coefficients are fixed. The table shows capital requirements per unit output (axi) and labor requirements per unit output (a,) to

-

4. Assume that input-output coefficients are fixed. The table shows capital requirements per unit output (axi) and labor requirements per unit output (a,) to produce one unit each of commodities through 3. Good ak; 2 2 3 1 4 aLj 4 4 Price $30 $22.5 $22.5 a. Write down the zero profit condition for all three goods. b. If the economy's capital-labor endowment ratio is 24 which two goods are produced? Explain clearly how you determine this. What is the wage rate and return to capital? c. If the price of good 2 rises to $28, which two goods are produced, and what is the wage rate and return to capital? Explain clearly how you determine this. d. If the price of good 2 rises to $30, which two goods are produced, and what is the wage rate and return to capital? Explain clearly how you determine this. 4. Assume that input-output coefficients are fixed. The table shows capital requirements per unit output (axi) and labor requirements per unit output (a,) to produce one unit each of commodities through 3. Good ak; 2 2 3 1 4 aLj 4 4 Price $30 $22.5 $22.5 a. Write down the zero profit condition for all three goods. b. If the economy's capital-labor endowment ratio is 24 which two goods are produced? Explain clearly how you determine this. What is the wage rate and return to capital? c. If the price of good 2 rises to $28, which two goods are produced, and what is the wage rate and return to capital? Explain clearly how you determine this. d. If the price of good 2 rises to $30, which two goods are produced, and what is the wage rate and return to capital? Explain clearly how you determine this Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started