Question

4.) ATT Company sold the rights to use one of their patented processes that will result in them receiving cash payments of $10,000 at the

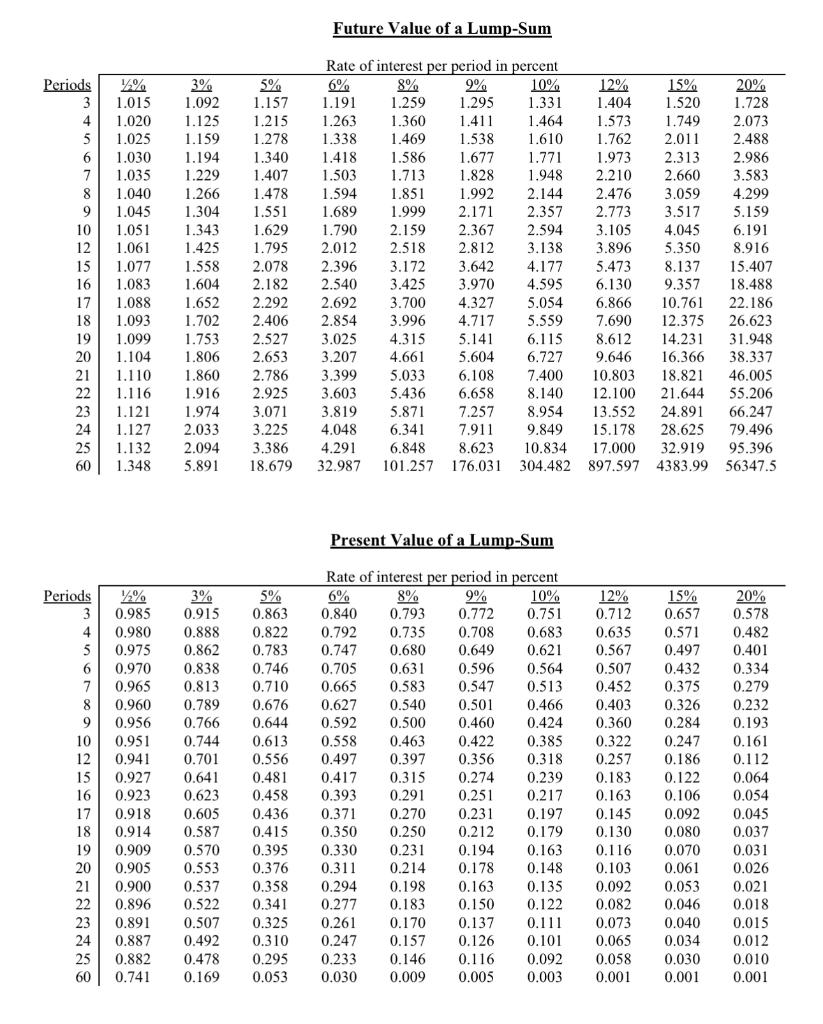

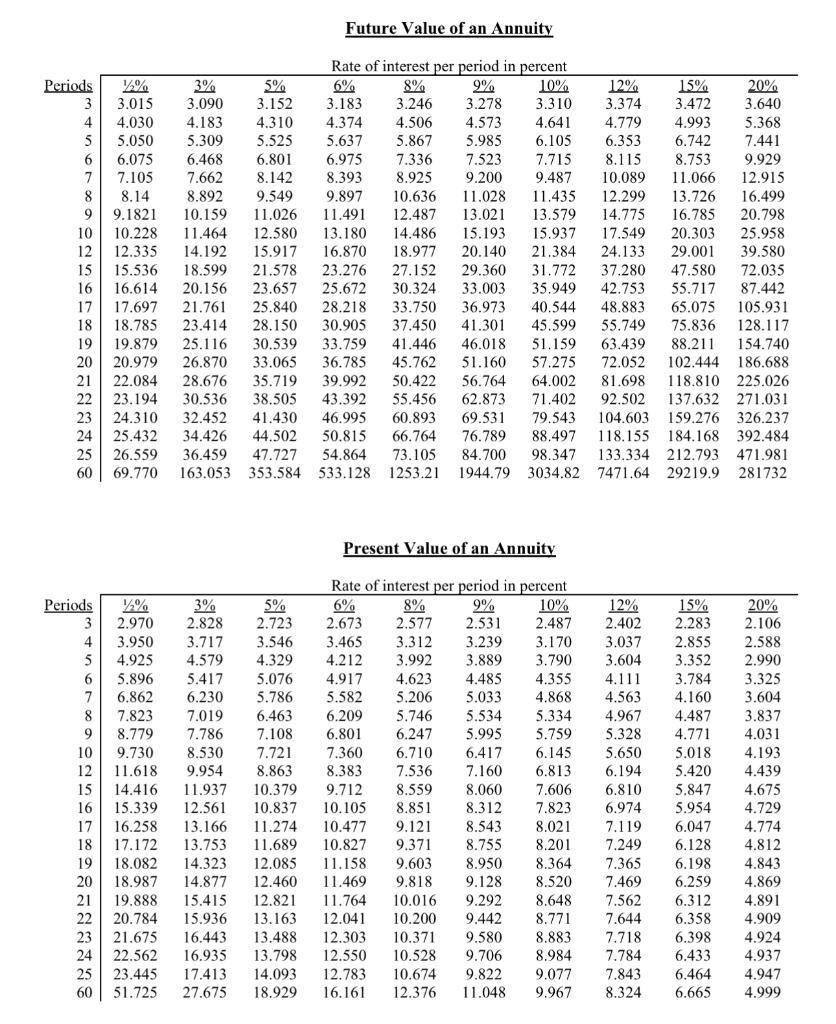

4.) ATT Company sold the rights to use one of their patented processes that will result in them receiving cash payments of $10,000 at the end of every six months for each of the next four years along with a lump sum payment of $20,000 at the end of the fifth year and a lump sum payment of $15,000 at the end of the sixth year. Assume an interest rate of 10% compounded semi-annually. Calculate the total present value of these payment

5.) Mason Company purchased a new machine on January 1, 2021 for $161,000. On this date, the machine was estimated to have a life of ten years and a residual value of $18,000. Assume Mason Company depreciates its assets using the sum- of-the-years'-digits method of depreciation. On December 31, 2024, the machine was sold for $93,000 cash. Calculate the amount of the gain recorded on the sale. Do not enter your answer with a minus sign in front of your number.

6.) Riley wants to have $198,594 in her savings account in 4 years. Riley opened her savings account with a deposit of $17,000. Riley intends to make equal deposits into the savings account at the end of every three months for the next four years. Riley will earn 12% interest compounded quarterly on all deposits with the bank. Calculate the amount of each equal quarterly deposit that Riley must make in order to have $198,594 in her account in four years.

Future Value of a Lump-Sum Present Value of a Lump-Sum Future Value of an Annuity Present Value of an AnnuityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started