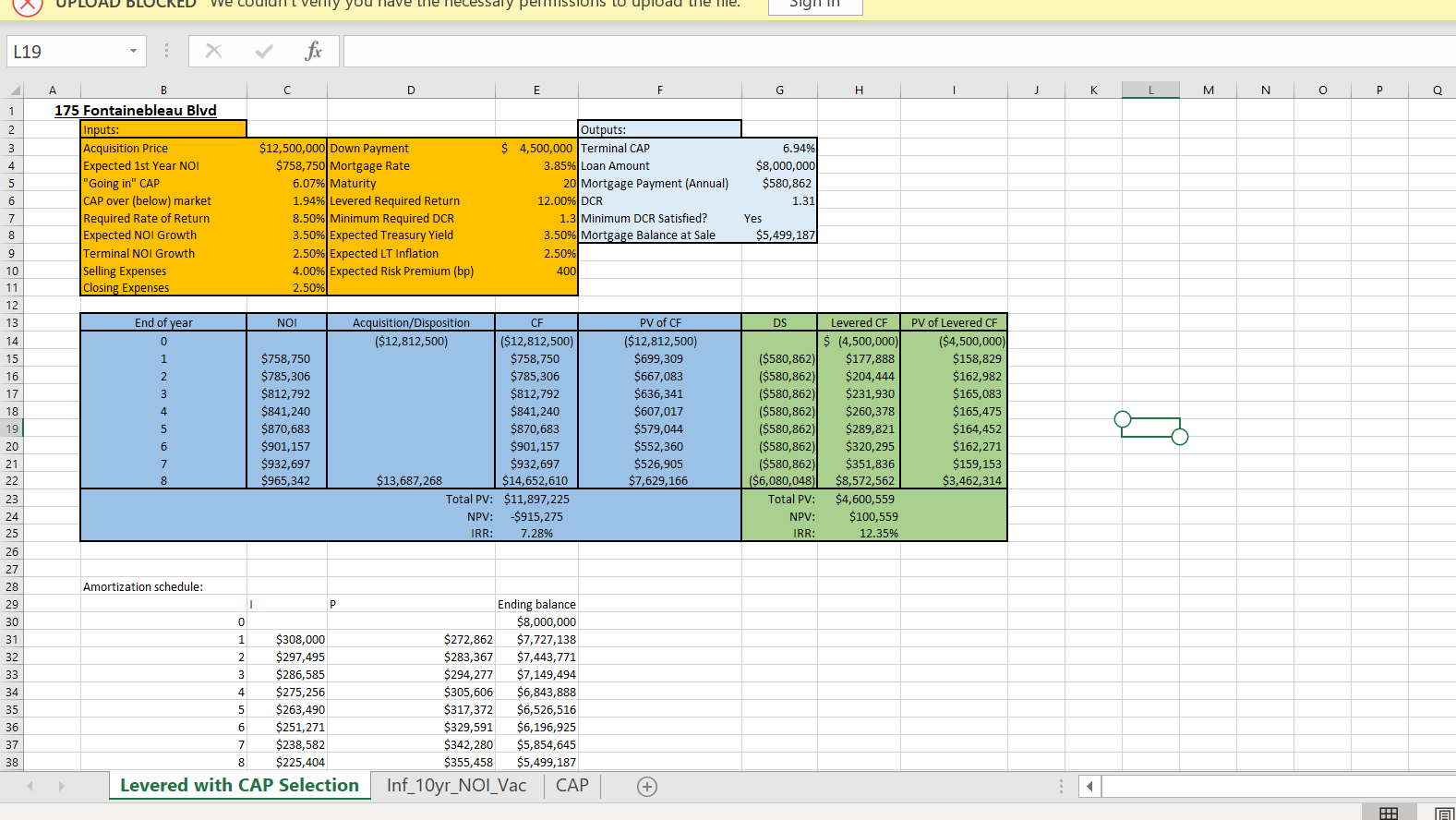

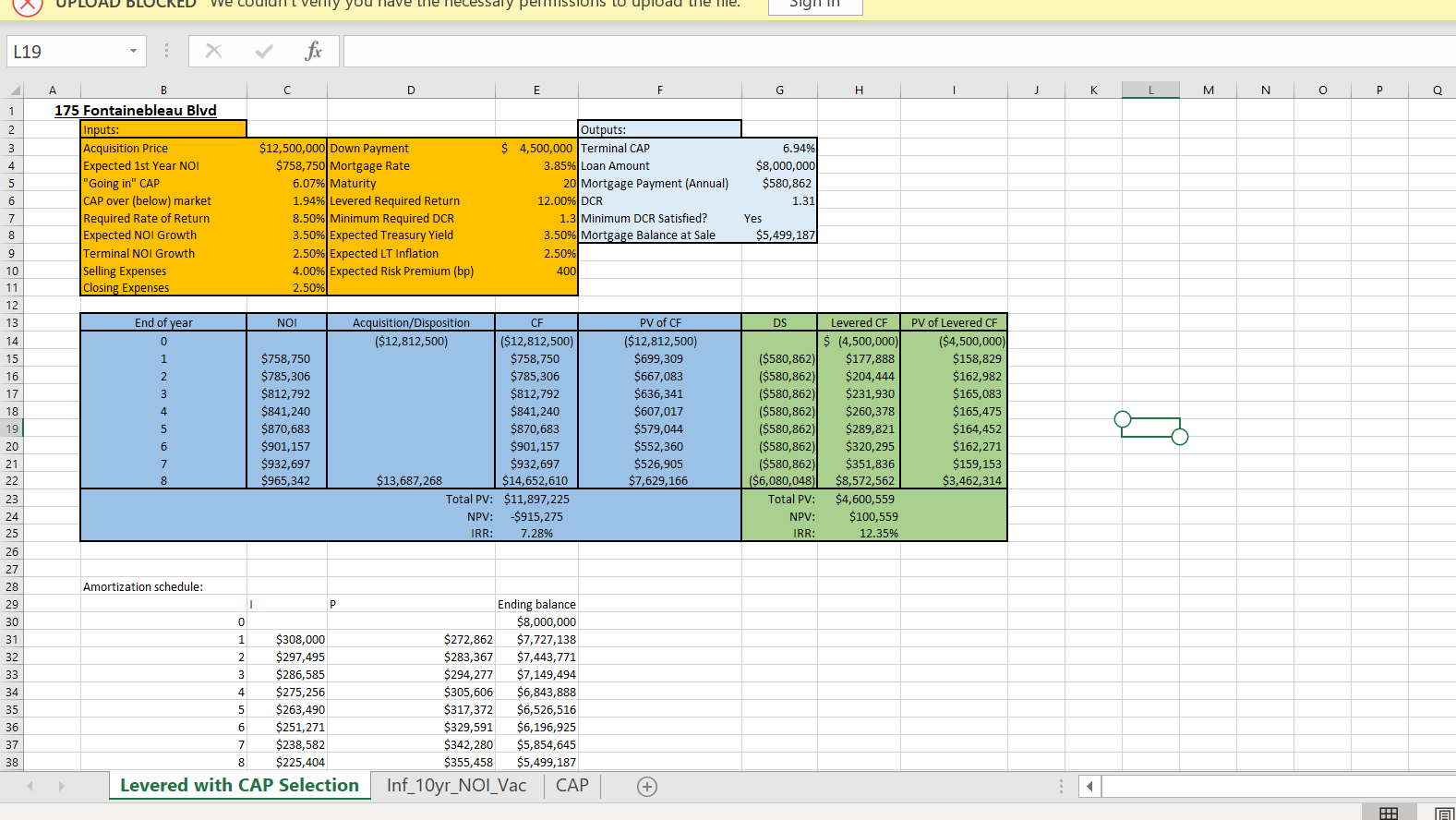

4. Before-tax expected return Using an Excel spreadsheet, determine the expected levered-before-tax-annual rate of return on your capital. Also, you need to determine the portion of the return that is expected from the annual cashflows and the portion that is expected as a result of property price appreciation.

UPLOAD DLUCKED we couiunt very you live the necessary periSSIUMIS LU upludu liene. Siy L19 L M N O P Q 175 Fontainebleau Blvd Inputs: Acquisition Price Expected 1st Year NOI "Going in" CAP CAP Over (below) market Required Rate of Return Expected NOI Growth Terminal NOI Growth Selling Expenses Closing Expenses $12,500,000 Down Payment $758,750 Mortgage Rate 6.07% Maturity 1.94% Levered Required Return 8.50% Minimum Required DCR 3.50% Expected Treasury Yield 2.50% Expected LT Inflation 4.00% Expected Risk Premium (bp) 2.50% Outputs: $ 4,500,000 Terminal CAP 3.85% Loan Amount 20 Mortgage Payment Annual) 12.00% DCR 1.3 Minimum DCR Satisfied? 3.50% Mortgage Balance at Sale 2.50% 400 6.94% $8,000,000 $580,862 1.31 Yes $5,499,187 | End of year NOI L m $758,750 $785,306 $812,792 $841,240 $870,683 $901,157 $932,697 $965,342 + Acquisition/Disposition CF ($12,812,500) ($12,812,500) $758,750 $785,306 $812,792 $841,240 $870,683 $901,157 $932,697 $13,687,268 $14,652,610 Total PV: $11,897,225 NPV: $915,275 IRR: 7.28% P V of CF ($12,812,500) $699,309 $667,083 $636,341 $607,017 $579,044 $552,360 $526,905 $7,629,166 DS Levered CFPV of Levered CF $ (4,500,000) ($4,500,000) ($580,862) $177,888 $158,829 ($580,862) $204,444 $162,982 ($580,862) $231,930 $165,083 ($580,862) $260,378 $165,475 ($580,862) $289,821 $164,452 ($580,862) $320,295 $162,271 ($580,862) $351,836 $159,153 ($6,080,048) $8,572,562 $3,462,314 Total PV: $4,600,559 NPV: $100,559 IRR: 12.35% 00 Amortization schedule: $308,000 $297,495 $286,585 $275,256 $263,490 $251,271 $238,582 $225,404 Levered with CAP Selection Ending balance $8,000,000 $272,862 $7,727,138 $283,367 $7,443,771 $294,277 $7,149,494 $305,606 $6,843,888 $317,372 $6,526,516 $329,591 $6,196,925 $342,280 $5,854,645 $355,458 $5,499,187 Inf_10yr_NOI_Vac CAP + UPLOAD DLUCKED we couiunt very you live the necessary periSSIUMIS LU upludu liene. Siy L19 L M N O P Q 175 Fontainebleau Blvd Inputs: Acquisition Price Expected 1st Year NOI "Going in" CAP CAP Over (below) market Required Rate of Return Expected NOI Growth Terminal NOI Growth Selling Expenses Closing Expenses $12,500,000 Down Payment $758,750 Mortgage Rate 6.07% Maturity 1.94% Levered Required Return 8.50% Minimum Required DCR 3.50% Expected Treasury Yield 2.50% Expected LT Inflation 4.00% Expected Risk Premium (bp) 2.50% Outputs: $ 4,500,000 Terminal CAP 3.85% Loan Amount 20 Mortgage Payment Annual) 12.00% DCR 1.3 Minimum DCR Satisfied? 3.50% Mortgage Balance at Sale 2.50% 400 6.94% $8,000,000 $580,862 1.31 Yes $5,499,187 | End of year NOI L m $758,750 $785,306 $812,792 $841,240 $870,683 $901,157 $932,697 $965,342 + Acquisition/Disposition CF ($12,812,500) ($12,812,500) $758,750 $785,306 $812,792 $841,240 $870,683 $901,157 $932,697 $13,687,268 $14,652,610 Total PV: $11,897,225 NPV: $915,275 IRR: 7.28% P V of CF ($12,812,500) $699,309 $667,083 $636,341 $607,017 $579,044 $552,360 $526,905 $7,629,166 DS Levered CFPV of Levered CF $ (4,500,000) ($4,500,000) ($580,862) $177,888 $158,829 ($580,862) $204,444 $162,982 ($580,862) $231,930 $165,083 ($580,862) $260,378 $165,475 ($580,862) $289,821 $164,452 ($580,862) $320,295 $162,271 ($580,862) $351,836 $159,153 ($6,080,048) $8,572,562 $3,462,314 Total PV: $4,600,559 NPV: $100,559 IRR: 12.35% 00 Amortization schedule: $308,000 $297,495 $286,585 $275,256 $263,490 $251,271 $238,582 $225,404 Levered with CAP Selection Ending balance $8,000,000 $272,862 $7,727,138 $283,367 $7,443,771 $294,277 $7,149,494 $305,606 $6,843,888 $317,372 $6,526,516 $329,591 $6,196,925 $342,280 $5,854,645 $355,458 $5,499,187 Inf_10yr_NOI_Vac CAP +