Answered step by step

Verified Expert Solution

Question

1 Approved Answer

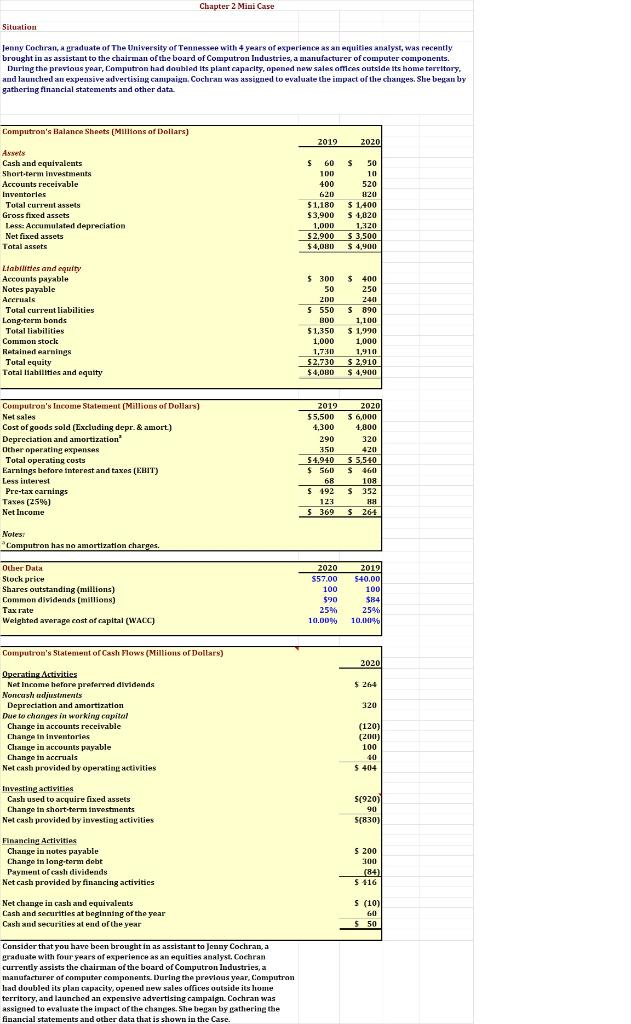

4.) Calculate Computrons net operating profit after taxes (NOPAT). Identify the opening current assets. Identify the operating current liabilities. Calculate how much net operating working

4.) Calculate Computrons net operating profit after taxes (NOPAT). Identify the opening current assets. Identify the operating current liabilities. Calculate how much net operating working capital and total net operating capital that Computron has.

Jenny Cochrait, s graduate of The Univarsity of Tennesses with 4 years of axperience as an equities analyst, was racently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the propious year, Computron had doubled lts plant capacity, opaned now sales ofmees outside fts home tervitory. and launched an expensive advertisizg campsign. Cochran was assigned to evaluate the impact of the changes. She began by gathering financial statements and other data. graduate with four years of exjerience as an eguities analyst, Cochran currently assists the chairman of the board of Computron lndustries, a manufacturar of computer components. During the previous year, Computron lat doubled its plan capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Cochran was assigned to evgluate the ingact of the changes. She hegan by gathering theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started