Answered step by step

Verified Expert Solution

Question

1 Approved Answer

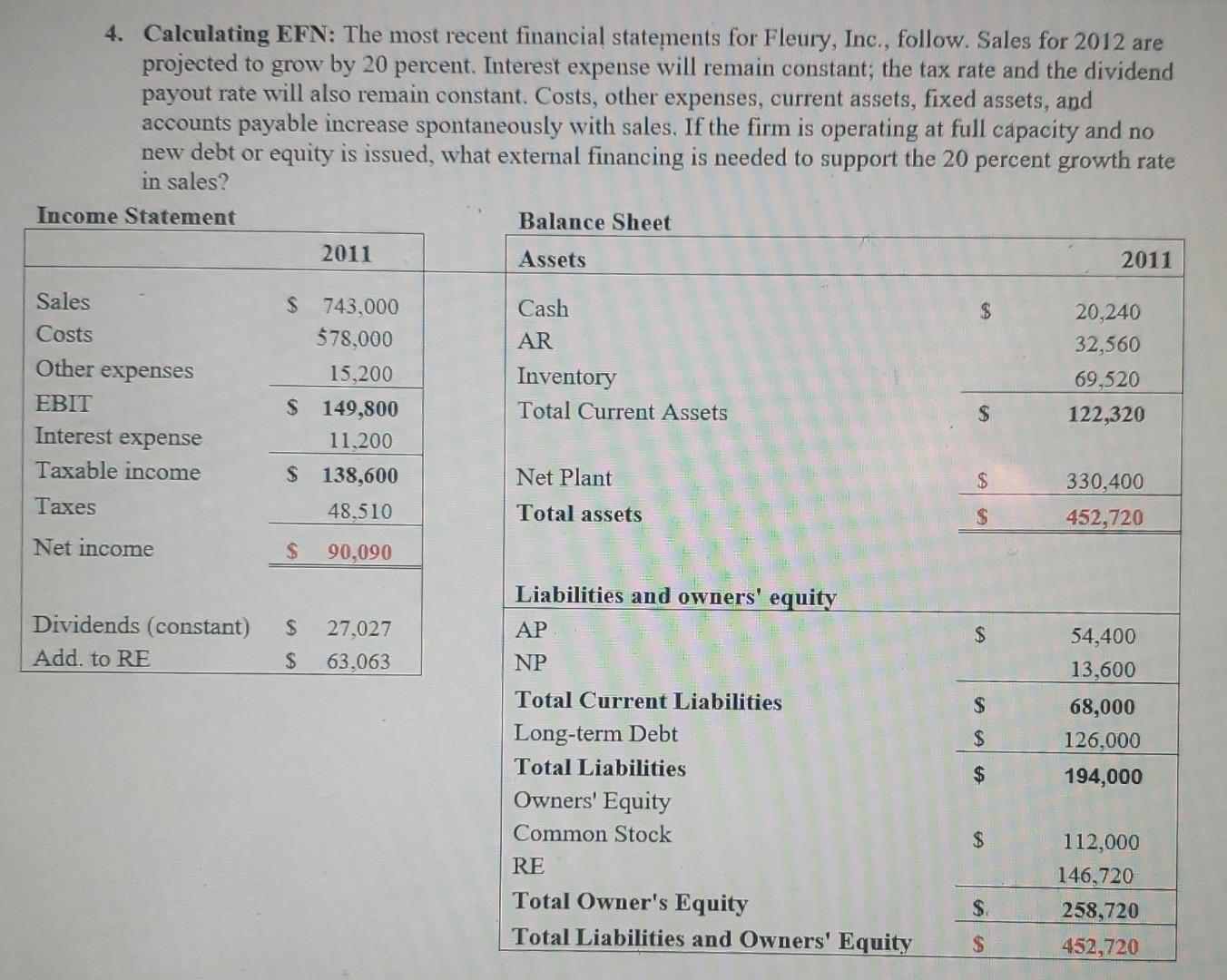

4. Calculating EFN: The most recent financial statements for Fleury, Inc., follow. Sales for 2012 are projected to grow by 20 percent. Interest expense will

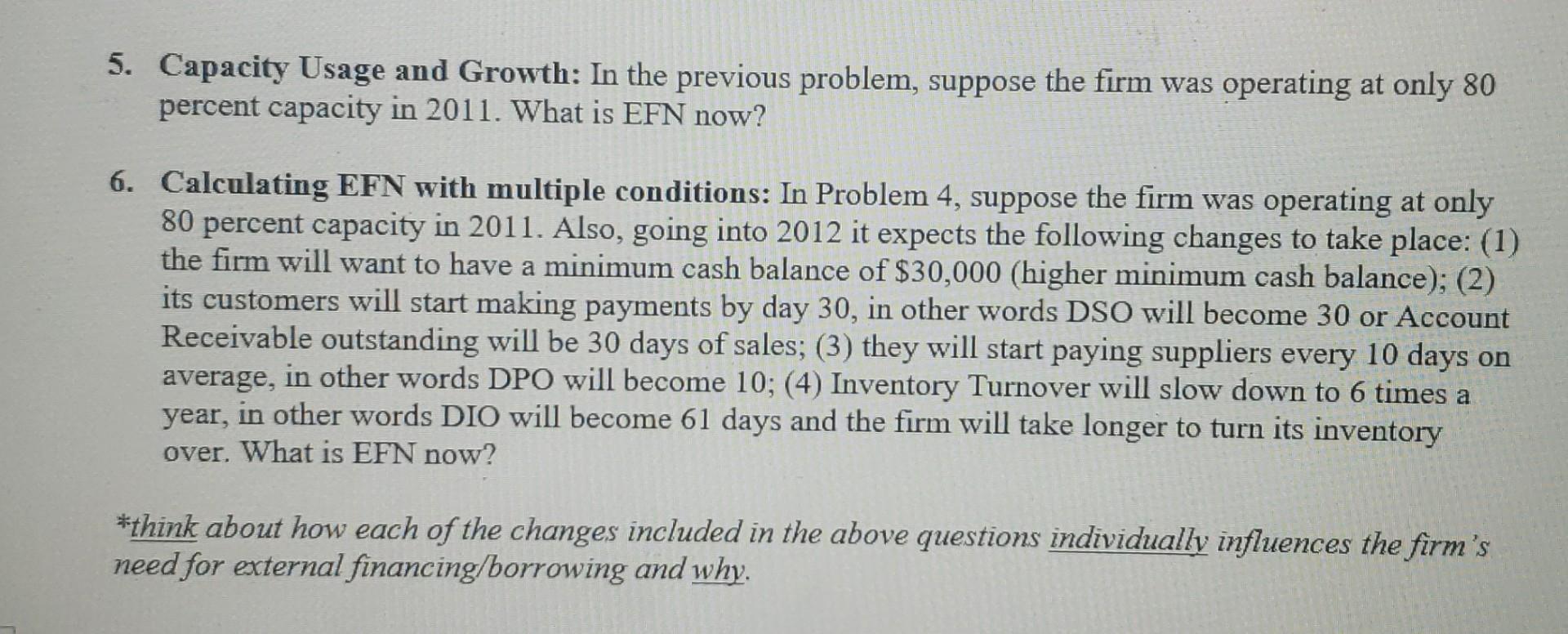

4. Calculating EFN: The most recent financial statements for Fleury, Inc., follow. Sales for 2012 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales? Income Statement Balance Sheet 2011 Assets 2011 $ Sales Costs Other expenses EBIT Interest expense Taxable income Taxes S 743,000 $78,000 15,200 $ 149,800 11.200 $ 138,600 48.510 Cash AR Inventory Total Current Assets 20,240 32,560 69,520 122,320 $ Net Plant $ 330,400 Total assets $ 452,720 Net income $ 90,090 $ Dividends (constant) Add. to RE Liabilities and owners' equity AP NP 27,027 63.063 $ $ $ 54,400 13,600 68,000 126,000 194,000 $ $ Total Current Liabilities Long-term Debt Total Liabilities Owners' Equity Common Stock RE Total Owner's Equity Total Liabilities and Owners' Equity $ 112,000 146,720 $ 258,720 $ 452,720 5. Capacity Usage and Growth: In the previous problem, suppose the firm was operating at only 80 percent capacity in 2011. What is EFN now? 6. Calculating EFN with multiple conditions: In Problem 4, suppose the firm was operating at only 80 percent capacity in 2011. Also, going into 2012 it expects the following changes to take place: (1) the firm will want to have a minimum cash balance of $30,000 (higher minimum cash balance); (2) its customers will start making payments by day 30, in other words DSO will become 30 or Account Receivable outstanding will be 30 days of sales; (3) they will start paying suppliers every 10 days on average, in other words DPO will become 10; (4) Inventory Turnover will slow down to 6 times a year, in other words DIO will become 61 days and the firm will take longer to turn its inventory over. What is EFN now? *think about how each of the changes included in the above questions individually influences the firm's need for external financing/borrowing and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started