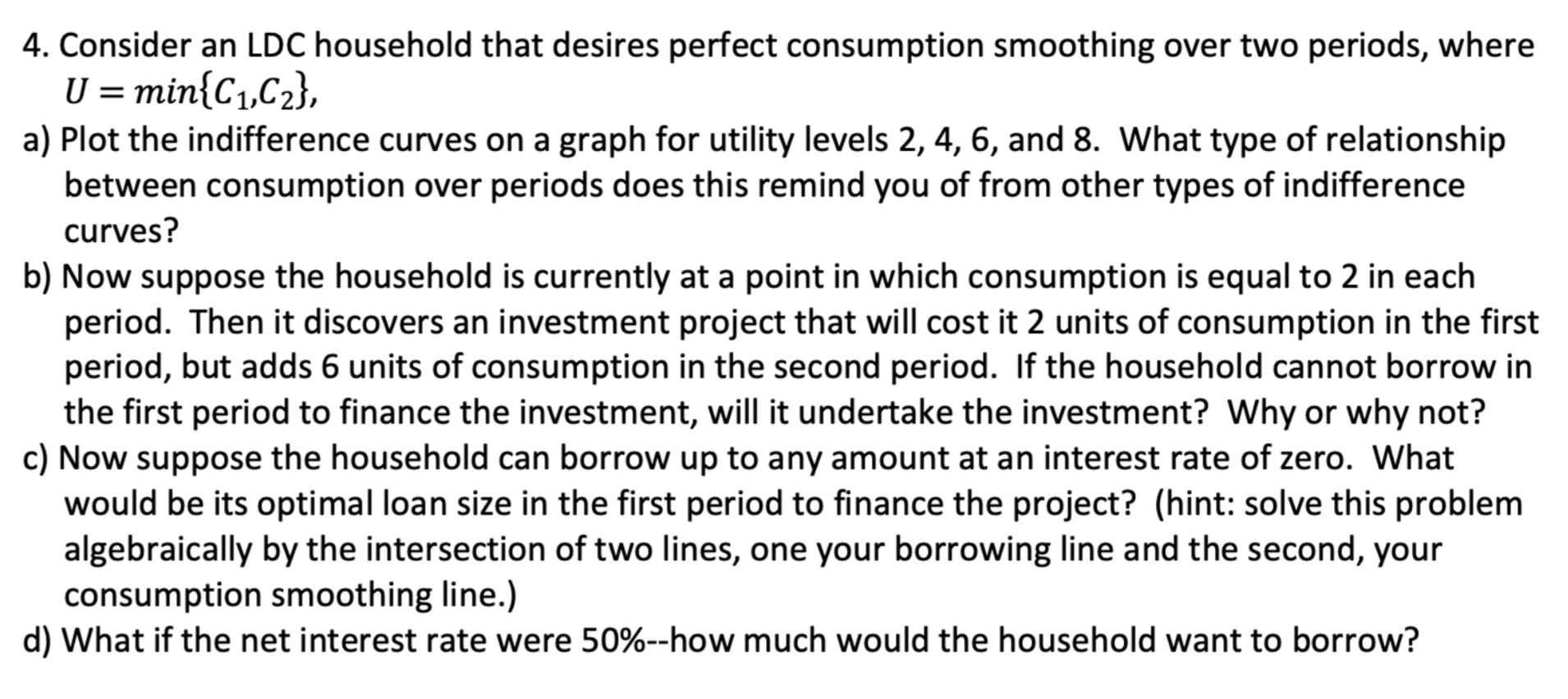

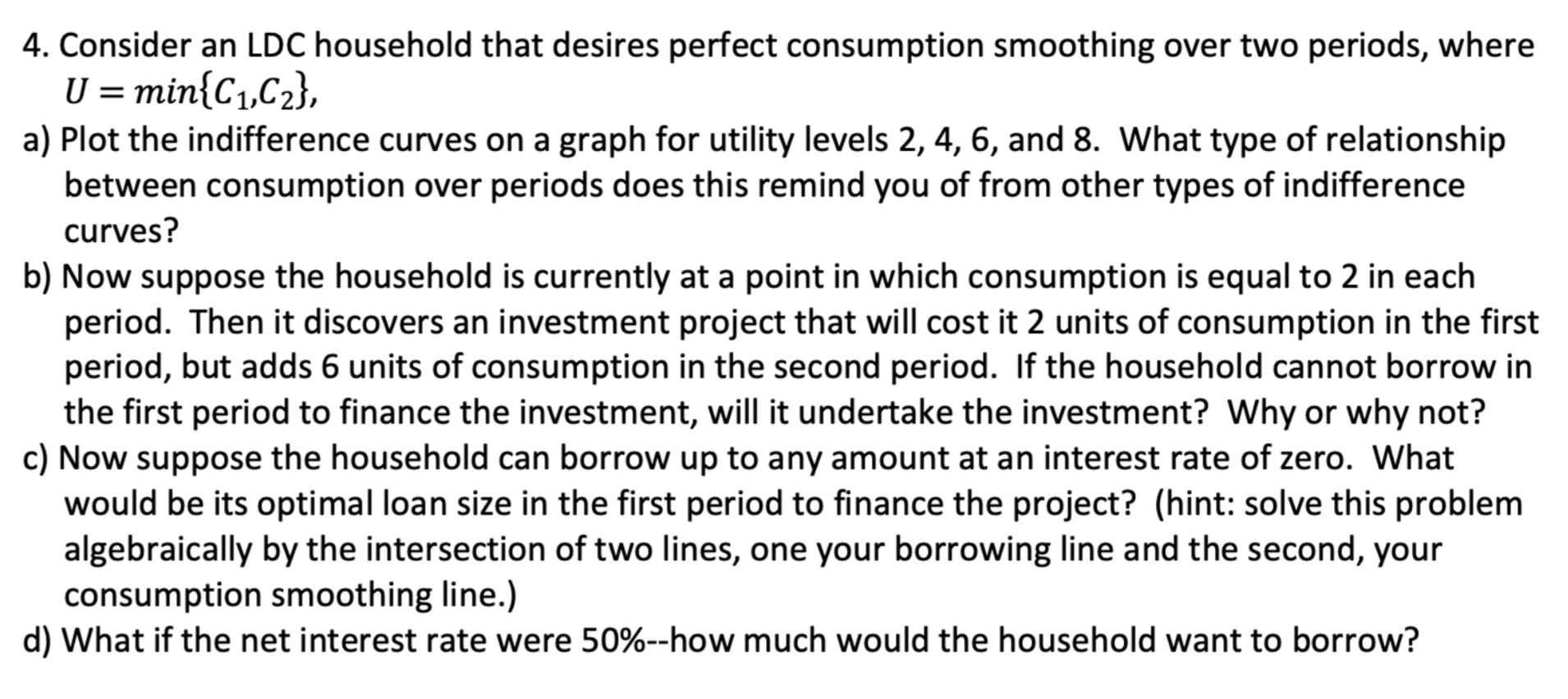

4. Consider an LDC household that desires perfect consumption smoothing over two periods, where U = min{C1,C2}, a) Plot the indifference curves on a graph for utility levels 2, 4, 6, and 8. What type of relationship between consumption over periods does this remind you of from other types of indifference curves? b) Now suppose the household is currently at a point in which consumption is equal to 2 in each period. Then it discovers an investment project that will cost it 2 units of consumption in the first period, but adds 6 units of consumption in the second period. If the household cannot borrow in the first period to finance the investment, will it undertake the investment? Why or why not? c) Now suppose the household can borrow up to any amount at an interest rate of zero. What would be its optimal loan size in the first period to finance the project? (hint: solve this problem algebraically by the intersection of two lines, one your borrowing line and the second, your consumption smoothing line.) d) What if the net interest rate were 50%--how much would the household want to borrow? 4. Consider an LDC household that desires perfect consumption smoothing over two periods, where U = min{C1,C2}, a) Plot the indifference curves on a graph for utility levels 2, 4, 6, and 8. What type of relationship between consumption over periods does this remind you of from other types of indifference curves? b) Now suppose the household is currently at a point in which consumption is equal to 2 in each period. Then it discovers an investment project that will cost it 2 units of consumption in the first period, but adds 6 units of consumption in the second period. If the household cannot borrow in the first period to finance the investment, will it undertake the investment? Why or why not? c) Now suppose the household can borrow up to any amount at an interest rate of zero. What would be its optimal loan size in the first period to finance the project? (hint: solve this problem algebraically by the intersection of two lines, one your borrowing line and the second, your consumption smoothing line.) d) What if the net interest rate were 50%--how much would the household want to borrow