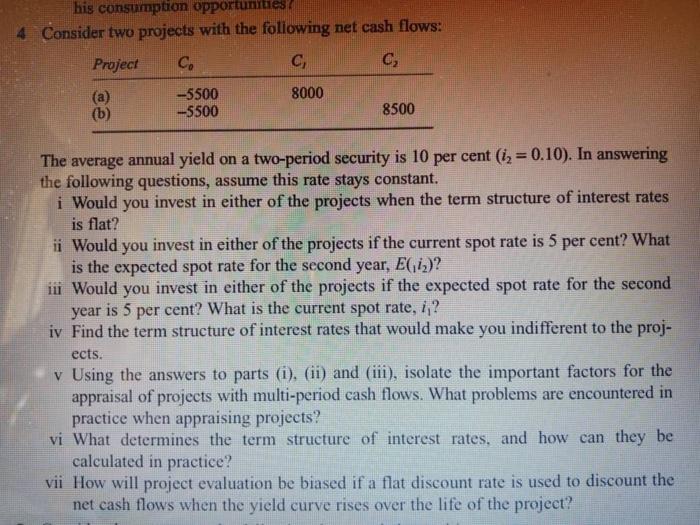

4 Consider two projects with the foliowing net cash flows: The average annual yield on a two-period security is 10 per cent (i2=0.10). In answering the following questions, assume this rate stays constant. i Would you invest in either of the projects when the term structure of interest rates is flat? ii Would you invest in either of the projects if the current spot rate is 5 per cent? What is the expected spot rate for the second year, E(i1i2) ? iii Would you invest in either of the projects if the expected spot rate for the second year is 5 per cent? What is the current spot rate, i1 ? iv Find the term structure of interest rates that would make you indifferent to the projects. v Using the answers to parts (i), (ii) and (iii), isolate the important factors for the appraisal of projects with multi-period cash flows. What problems are encountered in practice when appraising projects? vi What determines the term structure of interest rates, and how can they be calculated in practice? vii How will project evaluation be biased if a flat discount rate is used to discount the net cash flows when the yield curve rises over the life of the project? 4 Consider two projects with the foliowing net cash flows: The average annual yield on a two-period security is 10 per cent (i2=0.10). In answering the following questions, assume this rate stays constant. i Would you invest in either of the projects when the term structure of interest rates is flat? ii Would you invest in either of the projects if the current spot rate is 5 per cent? What is the expected spot rate for the second year, E(i1i2) ? iii Would you invest in either of the projects if the expected spot rate for the second year is 5 per cent? What is the current spot rate, i1 ? iv Find the term structure of interest rates that would make you indifferent to the projects. v Using the answers to parts (i), (ii) and (iii), isolate the important factors for the appraisal of projects with multi-period cash flows. What problems are encountered in practice when appraising projects? vi What determines the term structure of interest rates, and how can they be calculated in practice? vii How will project evaluation be biased if a flat discount rate is used to discount the net cash flows when the yield curve rises over the life of the project