Answered step by step

Verified Expert Solution

Question

1 Approved Answer

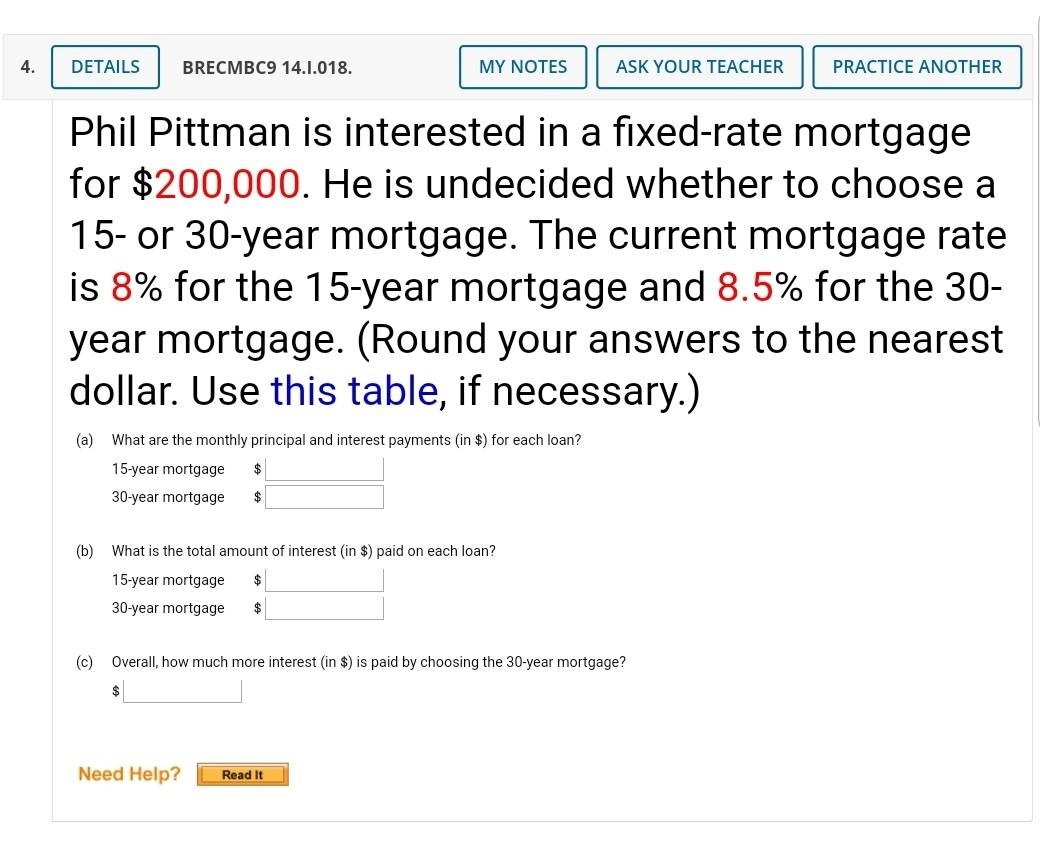

4. DETAILS BRECMBC9 14.1.018. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Phil Pittman is interested in a fixed-rate mortgage for $200,000. He is undecided whether

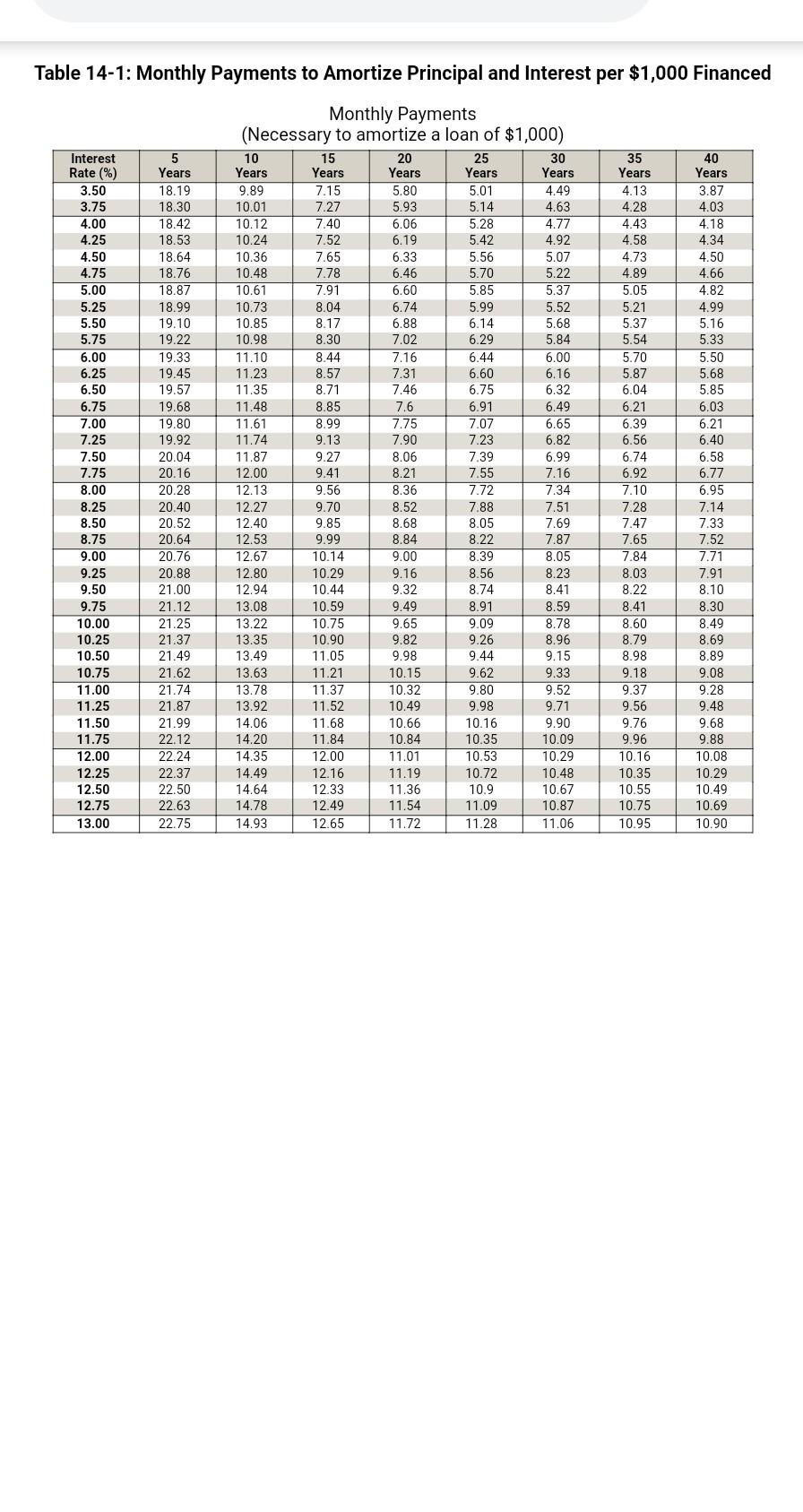

4. DETAILS BRECMBC9 14.1.018. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Phil Pittman is interested in a fixed-rate mortgage for $200,000. He is undecided whether to choose a 15- or 30-year mortgage. The current mortgage rate is 8% for the 15-year mortgage and 8.5% for the 30- year mortgage. (Round your answers to the nearest dollar. Use this table, if necessary.) (a) What are the monthly principal and interest payments (in $) for each loan? 15-year mortgage 30-year mortgage (b) What is the total amount of interest in $) paid on each loan? 15-year mortgage 30-year mortgage (c) Overall, how much more interest (in $) is paid by choosing the 30-year mortgage? Need Help? Read It Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed 5 Years 18.19 18.30 18.42 18.53 18.64 18.76 18.87 18.99 19.10 19.22 19.33 6.88 5.68 Interest Rate(%) 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 9.50 9.75 10.00 10.25 10.50 10.75 11.00 11.25 11.50 11.75 12.00 12.25 12.50 12.75 13.00 19.45 35 Years 4.13 4.28 4.43 4.58 4.73 4.89 5.05 5.21 5.37 5.54 5.70 5.87 6.04 6.21 6.39 6.56 6.74 6.92 7.10 7.28 7.47 7.65 Monthly Payments (Necessary to amortize a loan of $1,000) 10 15 20 25 30 Years Years Years Years Years 9.89 7.15 5.80 5.01 4.49 10.01 7.27 5.93 5.14 4.63 10.12 7.40 6.06 5.28 4.77 10.24 7.52 6.19 5.42 4.92 10.36 7.65 6.33 5.56 5.07 10.48 7.78 6.46 5.70 5.22 10.61 7.91 6.60 5.85 5.37 10.73 8.04 6.74 5.99 5.52 10.85 8.17 6.14 10.98 8.30 7.02 6.29 5.84 11.10 8.44 7.16 6.44 6.00 11.23 8.57 7.31 6.60 6.16 11.35 8.71 7.46 6.75 6.32 11.48 8.85 7.6 6.91 6.49 11.61 8.99 7.75 7.07 6.65 11.74 9.13 7.90 7.23 6.82 11.87 9.27 8.06 7.39 6.99 12.00 9.41 8.21 7.55 7.16 12.13 9.56 8.36 7.72 7.34 12.27 9.70 8.52 7.88 7.51 12.40 9.85 8.68 8.05 7.69 12.53 9.99 8.84 8.22 7.87 12.67 10.14 9.00 8.39 8.05 12.80 10.29 9.16 8.56 8.23 12.94 10.44 9.32 8.74 8.41 13.08 10.59 9.49 8.91 8.59 13.22 10.75 9.65 9.09 8.78 13.35 10.90 9.82 9.26 8.96 13.49 11.05 9.98 9.44 9.15 13.63 11.21 10.15 9.62 9.33 13.78 11.37 10.32 9.80 9.52 13.92 11.52 10.49 9.98 9.71 14.06 11.68 10.66 10.16 9.90 14.20 11.84 10.84 10.35 10.09 14.35 12.00 11.01 10.53 10.29 14.49 12.16 11.19 10.72 10.48 14.64 12.33 11.36 10.67 14.78 12.49 11.54 11.09 10.87 14.93 12.65 11.72 11.28 11.06 19.57 19.68 19.80 19.92 20.04 20.16 20.28 20.40 20.52 20.64 20.76 20.88 21.00 21.12 21.25 21.37 21.49 21.62 21.74 21.87 21.99 22.12 22.24 22.37 22.50 22.63 22.75 40 Years 3.87 4.03 4.18 4.34 4.50 4.66 4.82 4.99 5.16 5.33 5.50 5.68 5.85 6.03 6.21 6.40 6.58 6.77 6.95 7.14 7.33 7.52 7.71 7.91 8.10 8.30 8.49 8.69 8.89 9.08 9.28 9.48 9.68 9.88 10.08 10.29 10.49 10.69 10.90 7.84 8.03 8.22 8.41 8.60 8.79 8.98 9.18 9.37 9.56 9.76 9.96 10.16 10.35 10.55 10.75 10.95 10.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started