pls help!!

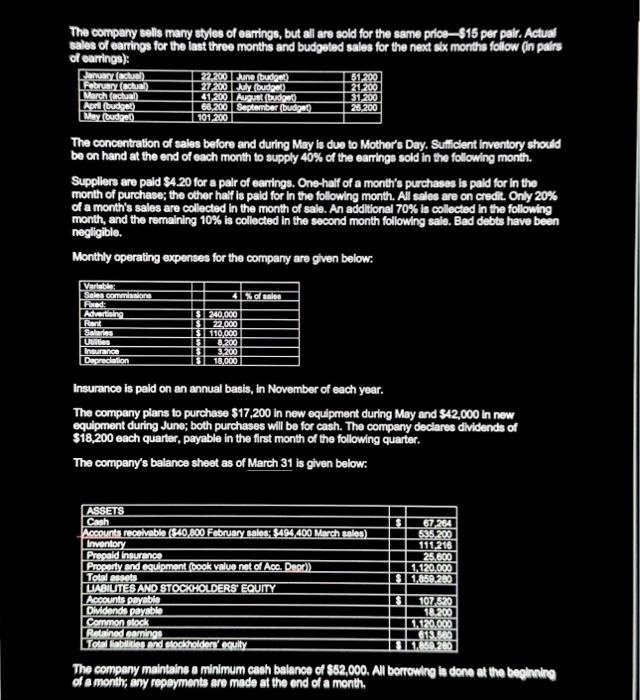

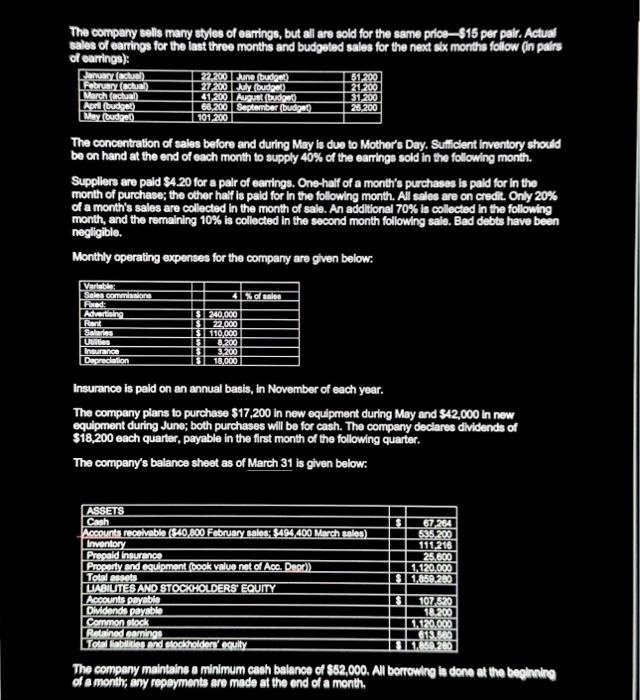

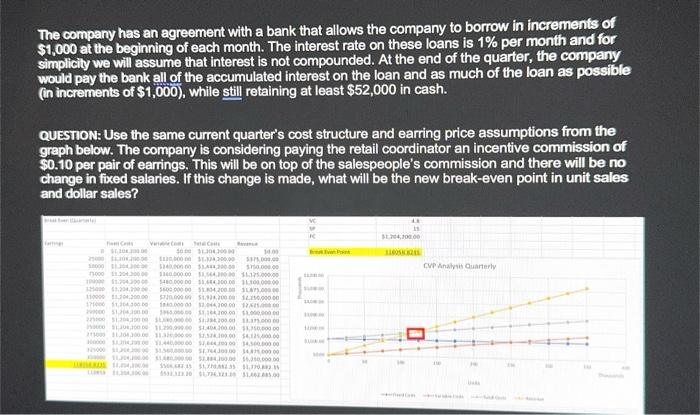

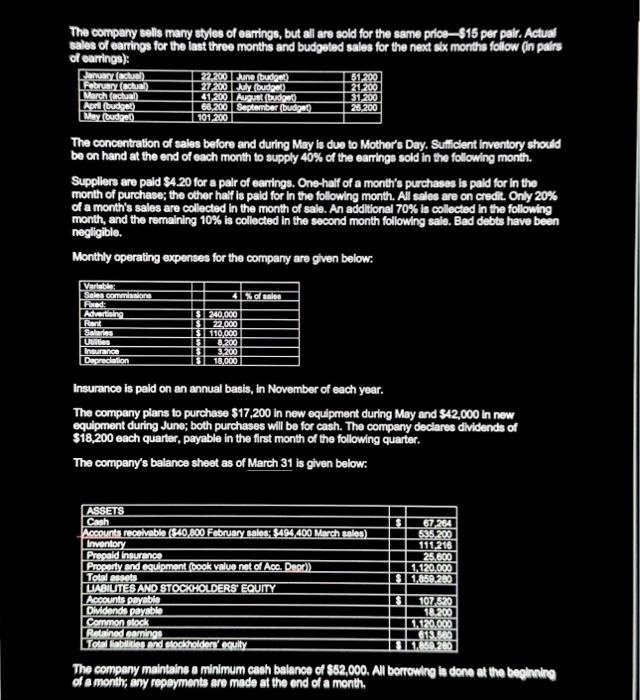

cales of carings for the last three months and budpated sales for the next elx months follow (in pairs of earings: \begin{tabular}{|c|c|c|c|} \hline Fing x(c) & & sin(0x) & [51F0] \\ \hline Fon 10con) & & & \\ \hline log(C5) & 41,70 & T(0)=0 & 1200 \\ \hline & & & 20200 \\ \hline 11700000 & & & \\ \hline \end{tabular} The concentration of sales before and during May is due to Mother's Day. Suilicient inventory should be on hand at the end of each month to supply 40% of the earringes soid in the following month. Suppliers are pald 54,20 for a palr of earrings. One-half of a month's purchases is paid for in the month of purchase; the other half is paid for in the following month. All eales are on credit. Only 20% of a month's sales are collected in the month of sale. An additional 70% is collected in the following month, and the remaining 10% is collocted in the second month following sale. Bad dabts have been negligiblo. Monthly operating expenses for the company are given below: Insuranco is pald on an annual basis, in November of each year. The company plans to purchase $17,200 in new equipment during May and $42,000 in new equipment during June; both purchases will be for cash. The compeny declares dividends of $18,200 each quarter, payable in the first month of the following quarter. The company's balance sheet as of March 31 is given below: The compeny malntains a minimum eash balanes of 852,000 . All berrowlog be dene et the becinning of e month; eny repeyments are made at the end of a month. The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicily we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000 ), while still retaining at least $52,000 in cash. QUESIION: Use the same current quarter's cost structure and earring price assumptions from the graph below. The company is considering paying the retail coordinator an incentive commission of $0.10 per pair of earrings. This will be on top of the salespeople's commission and there will be no change in fixed salaries. If this change is made, what will be the new break-even point in unit sales and dollar sales