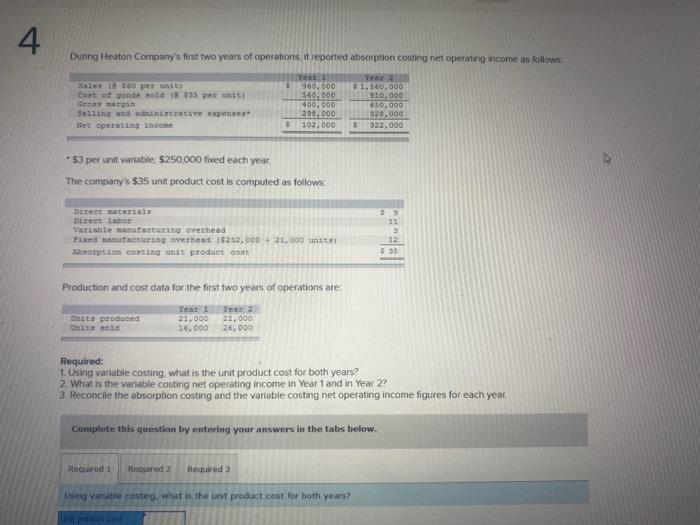

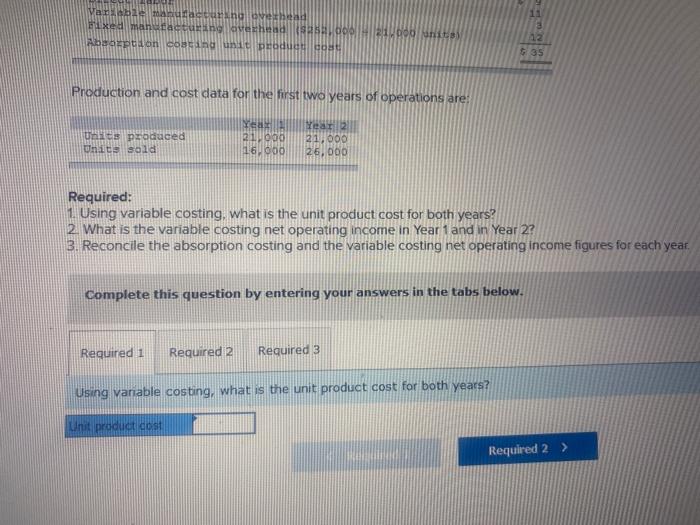

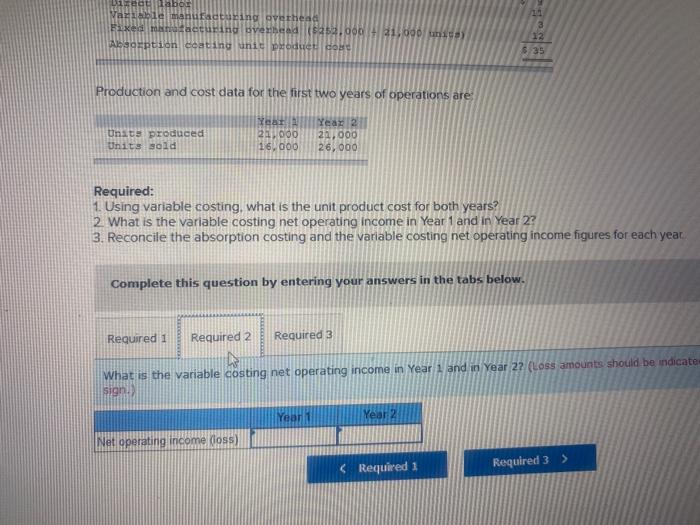

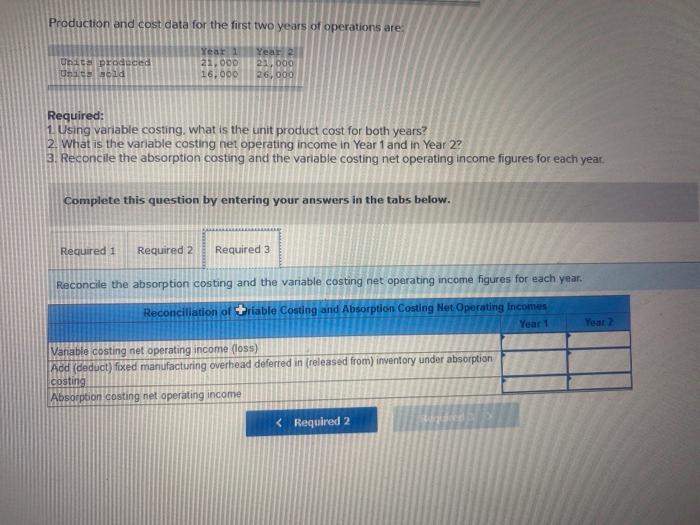

4 During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows Si te lo permit CON Obode od 1935 per unit Grossargi Selling and die expenses Bet operating theme Test: 1 960.000 560.000 400000 290,000 102,000 Y 1,560,000 910.000 650,000 220,000 322,000 5 53 per unit variable: $250,000 fived each year The company's $35 unit product cost is computed as follows DE Steals Direct labor Variable manufacturing overhead Fixed tacturing overhead 15252.000 - 21.000 units Aboption coating unit product cost 13 3 22 $ 35 Production and cost data for the first two years of operations are Units produced that said Year 1 21,000 16.000 Year 2 22.000 25,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2 What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Uang vanatie costing, what is the unit product cost for both years? Variable manufacturing och mixed manufacturing overhead 28.000 2100 anos Absorption conduit Deoducho 12 $ 35 Production and cost data for the first two years of operations are: Units produced Units sold Yea 2100 16000 Year 2 21,000 26.000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using vanable costing, what is the unit product cost for both years? Unit product cost Required 2 > 10 Badabog Vazibe manufacturing overhead Faxe maturing verhead (22.000 31000 Aption coating unit odiet do 12 $ 35 Production and cost data for the first two years of operations are Unats produced Units sold Yaat 21.000 16.000 Year 2 22,000 26,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the variable costing net operating income in Year 1 and in Year 2? (Loss amounts should be indicate sign. Year Year 2 Net operating income (oss) Production and cost data for the first two years of operations are Unite produced Unisoid Year 1 21,000 16.000 Year 2,000 26,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of triable Costing and Absorption Costing Net Operating Incomes Year1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income