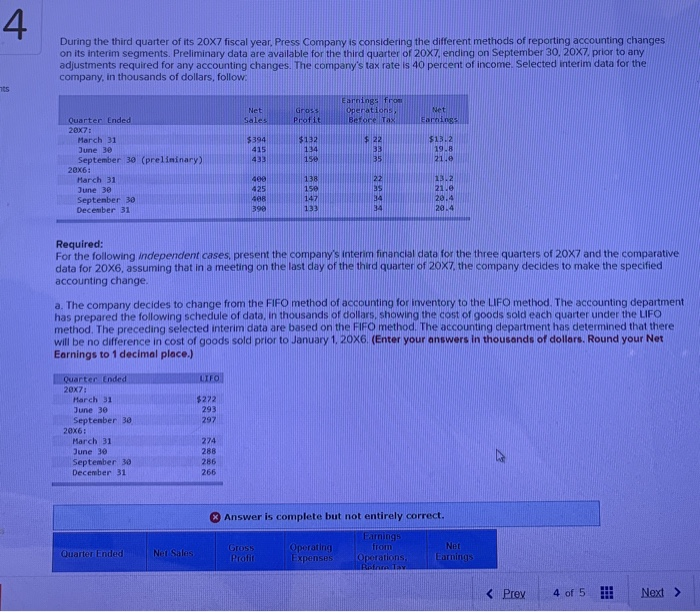

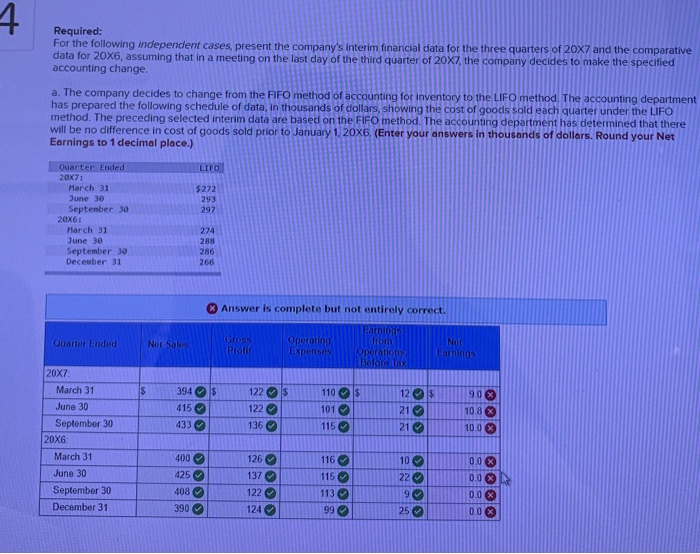

4 During the third quarter of its 20x7 fiscal year, Press Company is considering the different methods of reporting accounting changes on its interim segments. Preliminary data are available for the third quarter of 20x7. ending on September 30, 20X7. prior to any adjustments required for any accounting changes. The company's tax rate is 40 percent of income. Selected interim data for the company, in thousands of dollars, follow, ts Net Sales Gross Profit Earnings from Operations, Before Tax Net Earnings $394 415 433 $132 134 150 $ 22 33 35 $13.2 19.8 21.0 Quarter Ended 2BX: March 31 June 30 September 30 (preliminary) 20x6: March 31 June 30 September 30 December 31 400 425 408 390 138 150 147 133 22 35 34 34 13.2 21.0 20.4 20.4 Required: For the following independent cases, present the company's interim financial data for the three quarters of 20x7 and the comparative data for 20X6, assuming that in a meeting on the last day of the third quarter of 20X7, the company decides to make the specified accounting change. a. The company decides to change from the FIFO method of accounting for inventory to the LIFO method. The accounting department has prepared the following schedule of data, in thousands of dollars, showing the cost of goods sold each quarter under the LIFO method. The preceding selected interim data are based on the FIFO method. The accounting department has determined that there will be no difference in cost of goods sold prior to January 1, 20X6 (Enter your answers in thousands of dollars. Round your Net Earnings to 1 decimal place.) LIFO $272 293 297 Quarter Ended 20x7: March 31 June 30 September 30 20x6: March 31 June 30 September 30 December 31 274 288 286 266 Answer is complete but not entirely correct. Quarter Ended Net Sales Cross Prati Operating Expenses Earnings from Operations, Ronal Net Earnings st Required: For the following independent cases, present the company's interim financial data for the three quarters of 20X7 and the comparative data for 20X6, assuming that in a meeting on the last day of the third quarter of 20X7, the company decides to make the specified accounting change. a. The company decides to change from the FIFO method of accounting for inventory to the LIFO method. The accounting department has prepared the following schedule of data, in thousands of dollars, showing the cost of goods sold each quarter under the LIFO method. The preceding selected interim data are based on the FIFO method. The accounting department has determined that there will be no difference in cost of goods sold prior to January 1, 20X6. (Enter your answers in thousands of dollars. Round your Net Earnings to 1 decimal place.) LIFO $272 293 297 Quarter Ended 20X7: March 31 June 30 September 30 20x6: March 31 June 30 September 30 December 31 274 288 286 266 Answer is complete but not entirely correct. Quarter Ended Net Sales Gross Proti Operating Expenses Earnings from Operations Before Tax Net Earrings $ 3945 110S 12 $ 90 x 415 122S 122 136 101 115 21 21 433 10.8 % 10.0 X 20x7 March 31 June 30 September 30 20X6 March 31 June 30 September 30 December 31 10 400 425 408 390 22 126 137 122 124 116 115 113 99 0.0 X 0.0 % 0.0 % 0.0 X 9 25