Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Explain why the amount of Buildings and Improvements, net of Accumulated Depreciation differs from the total amount of Finance lease liabilities. C13-1 Target Corporation:

4. Explain why the amount of Buildings and Improvements, net of Accumulated Depreciation differs from the total amount of Finance lease liabilities.

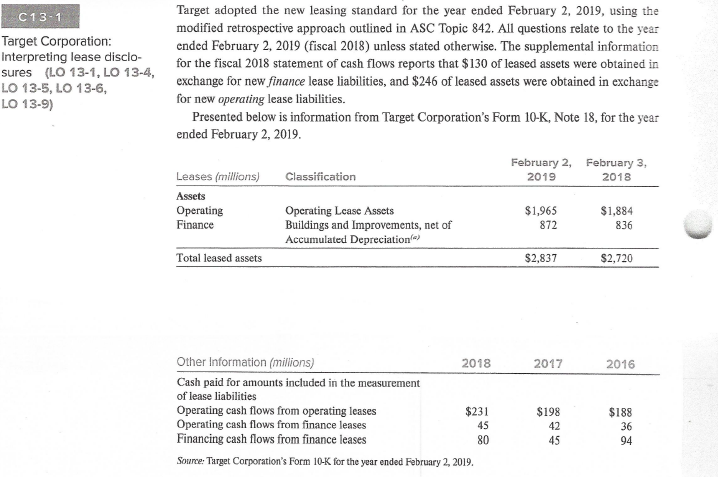

C13-1 Target Corporation: Interpreting lease disclo- sures (LO 13-1, LO 13-4, LO 13-5, LO 13-6, LO 13-9) Target adopted the new leasing standard for the year ended February 2, 2019, using the modified retrospective approach outlined in ASC Topic 842. All questions relate to the year ended February 2, 2019 (fiscal 2018) unless stated otherwise. The supplemental information for the fiscal 2018 statement of cash flows reports that $130 of leased assets were obtained in exchange for new finance lease liabilities, and $246 of leased assets were obtained in exchange for new operating lease liabilities. Presented below is information from Target Corporation's Form 10-K, Note 18, for the year ended February 2, 2019. Classification February 2, February 3, 2019 2018 Leases (millions) Assets Operating Finance Operating Lease Assets Buildings and Improvements, net of Accumulated Depreciation) $1,965 872 $1,884 836 Total leased assets $2,837 $2,720 2017 2016 Other Information (millions) 2018 Cash paid for amounts included in the measurement of lease liabilities Operating cash flows from operating leases $231 Operating cash flows from finance leases 45 Financing cash flows from finance leases 80 Source: Target Corporation's Form 10-K for the year ended February 2, 2019. $198 42 45 $188 36 94 C13-1 Target Corporation: Interpreting lease disclo- sures (LO 13-1, LO 13-4, LO 13-5, LO 13-6, LO 13-9) Target adopted the new leasing standard for the year ended February 2, 2019, using the modified retrospective approach outlined in ASC Topic 842. All questions relate to the year ended February 2, 2019 (fiscal 2018) unless stated otherwise. The supplemental information for the fiscal 2018 statement of cash flows reports that $130 of leased assets were obtained in exchange for new finance lease liabilities, and $246 of leased assets were obtained in exchange for new operating lease liabilities. Presented below is information from Target Corporation's Form 10-K, Note 18, for the year ended February 2, 2019. Classification February 2, February 3, 2019 2018 Leases (millions) Assets Operating Finance Operating Lease Assets Buildings and Improvements, net of Accumulated Depreciation) $1,965 872 $1,884 836 Total leased assets $2,837 $2,720 2017 2016 Other Information (millions) 2018 Cash paid for amounts included in the measurement of lease liabilities Operating cash flows from operating leases $231 Operating cash flows from finance leases 45 Financing cash flows from finance leases 80 Source: Target Corporation's Form 10-K for the year ended February 2, 2019. $198 42 45 $188 36 94

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started