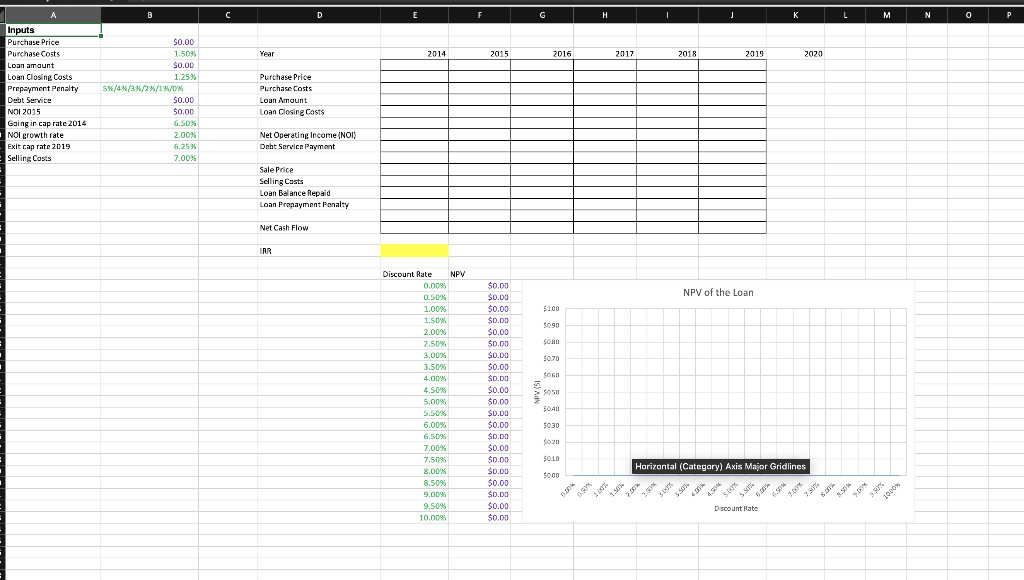

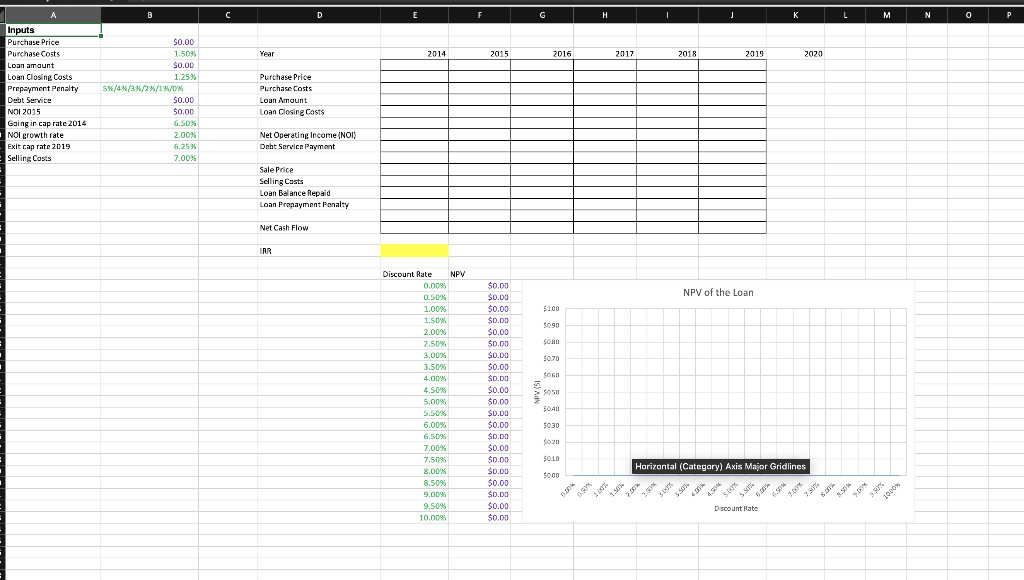

(4) Fill in the sheet titled "Loan Analysis" but ONLY include cash-flow related to Ann's loan in the sheet "NPV-IRR. Leave cells unrelated to the loan cash flow blank. (4.a) What is the annualized IRR for Ann's loan? (4.b) is the IRR for Ann's loan higher or lower than the advertised loan contract rate? (4.c) Why? (4.d) Plot Ann's NPV for Ann's loan, for discount rates 0%-10%. Copy and paste the chart below. A B C D E F H J L M M N N 0 Year 2014 2015 2016 2017 2018 2019 2020 Inputs Purchase Price Purchase Costs Loan amount Loan Closing Costs Prepayment Penalty Debt Service NOI 2015 Going in cap rate 2014 NOI Growth rate Exit cap rate 2019 Selling Costs $0.00 1.50% $0.00 1.25% 5X/4X/3x/2x/14/0% $0.00 $0.00 G.SDX 2.00% 6.25% 7.00% Purchase Price Purchase Costs Loan Amount Loan Closing Costs Net Operating Income (NOI) Debt Service Payment Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty Net Cash Flow IRR NPV NPV of the Loan $100 cogn SON $0.70 Discount Rate 0.00% 0.50 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% S.50% 6.00% 6.50% 7.00% con $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $ $040 $030 $0.20 7.50% $0.10 Horizontal (Category) Axis Major Gridlines $0.00 8.00% 8.50% 9.00% 9.50% 10.00% SO 5.30 1000 Discount Hate (4) Fill in the sheet titled "Loan Analysis" but ONLY include cash-flow related to Ann's loan in the sheet "NPV-IRR. Leave cells unrelated to the loan cash flow blank. (4.a) What is the annualized IRR for Ann's loan? (4.b) is the IRR for Ann's loan higher or lower than the advertised loan contract rate? (4.c) Why? (4.d) Plot Ann's NPV for Ann's loan, for discount rates 0%-10%. Copy and paste the chart below. A B C D E F H J L M M N N 0 Year 2014 2015 2016 2017 2018 2019 2020 Inputs Purchase Price Purchase Costs Loan amount Loan Closing Costs Prepayment Penalty Debt Service NOI 2015 Going in cap rate 2014 NOI Growth rate Exit cap rate 2019 Selling Costs $0.00 1.50% $0.00 1.25% 5X/4X/3x/2x/14/0% $0.00 $0.00 G.SDX 2.00% 6.25% 7.00% Purchase Price Purchase Costs Loan Amount Loan Closing Costs Net Operating Income (NOI) Debt Service Payment Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty Net Cash Flow IRR NPV NPV of the Loan $100 cogn SON $0.70 Discount Rate 0.00% 0.50 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% S.50% 6.00% 6.50% 7.00% con $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $ $040 $030 $0.20 7.50% $0.10 Horizontal (Category) Axis Major Gridlines $0.00 8.00% 8.50% 9.00% 9.50% 10.00% SO 5.30 1000 Discount Hate