Answered step by step

Verified Expert Solution

Question

1 Approved Answer

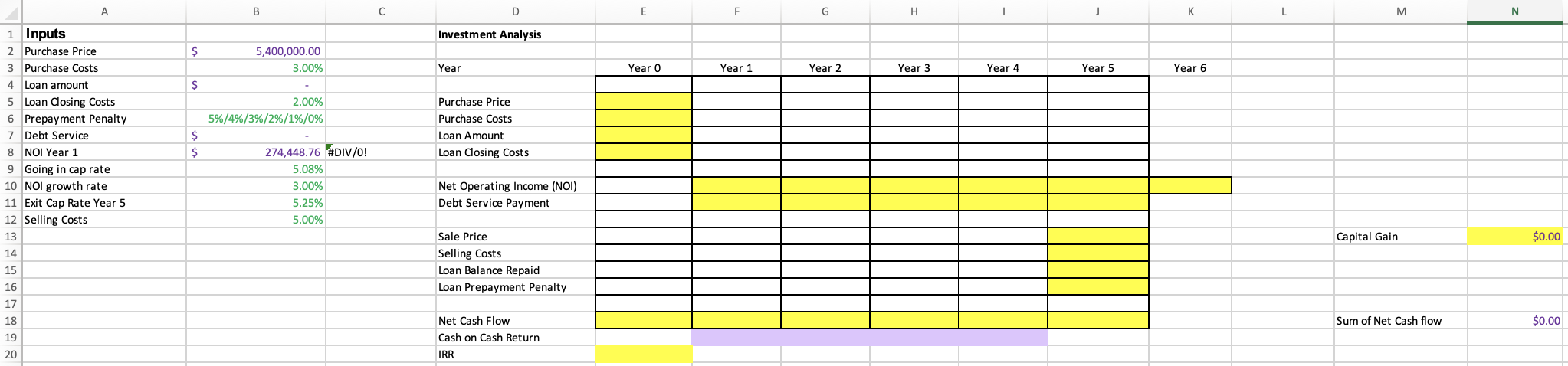

(4) Fill in the sheet titled NPV-IRR Unlevered Assume you purchase this property without any financing. (4.a) What is your unleveraged IRR (using the base

(4) Fill in the sheet titled NPV-IRR Unlevered

Assume you purchase this property without any financing.

(4.a) What is your unleveraged IRR (using the base case of 3% NOI growth and 5.25% Exit Cap Rate).

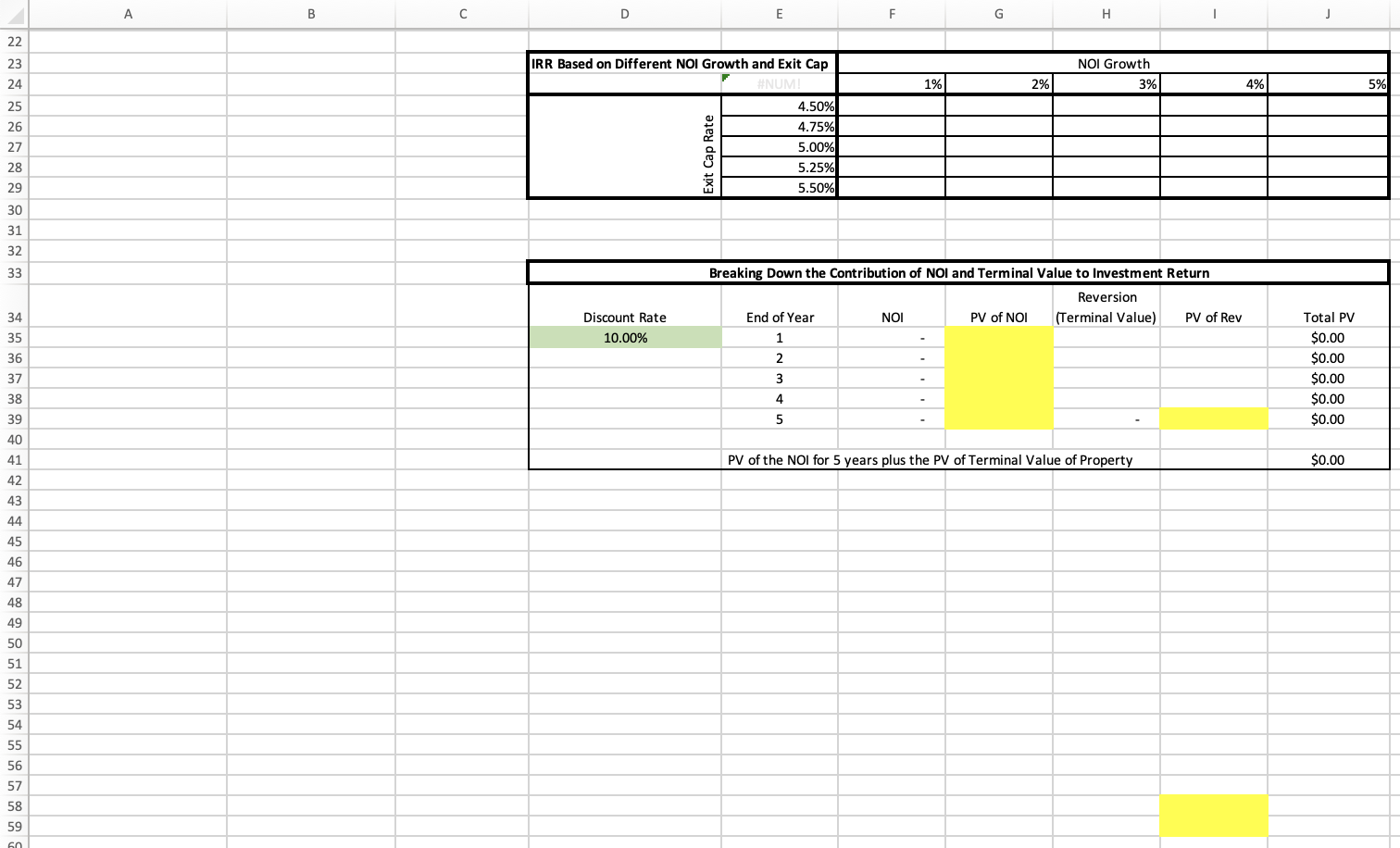

Fill in the chart Breaking down the contribution of NOI and Terminal Value to Investment Return. Use the numbers from the Net Cash Flow line.

(4.b) Using the NCF from years 1 through 5 as presented, what would you be willing to pay if you wanted to earn a 10% IRR on this investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started