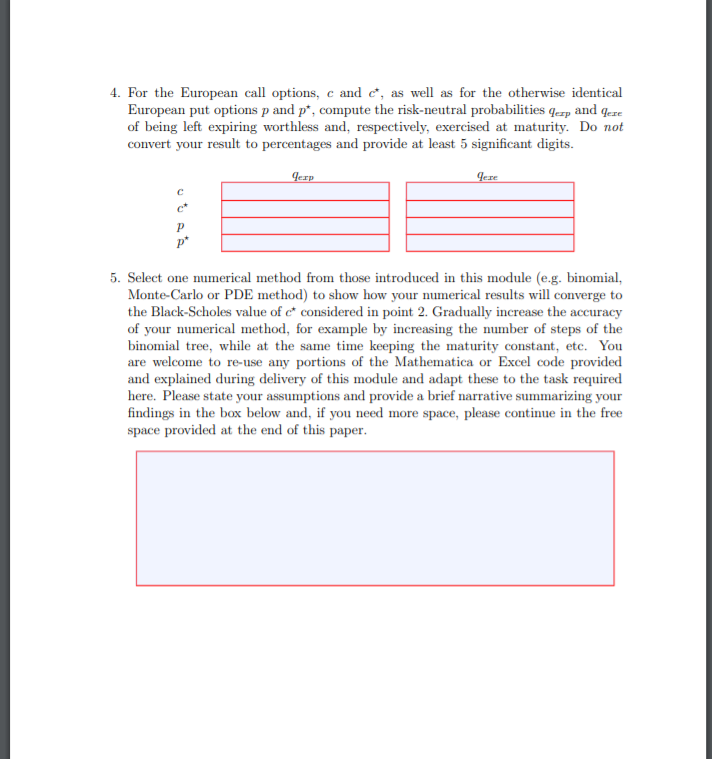

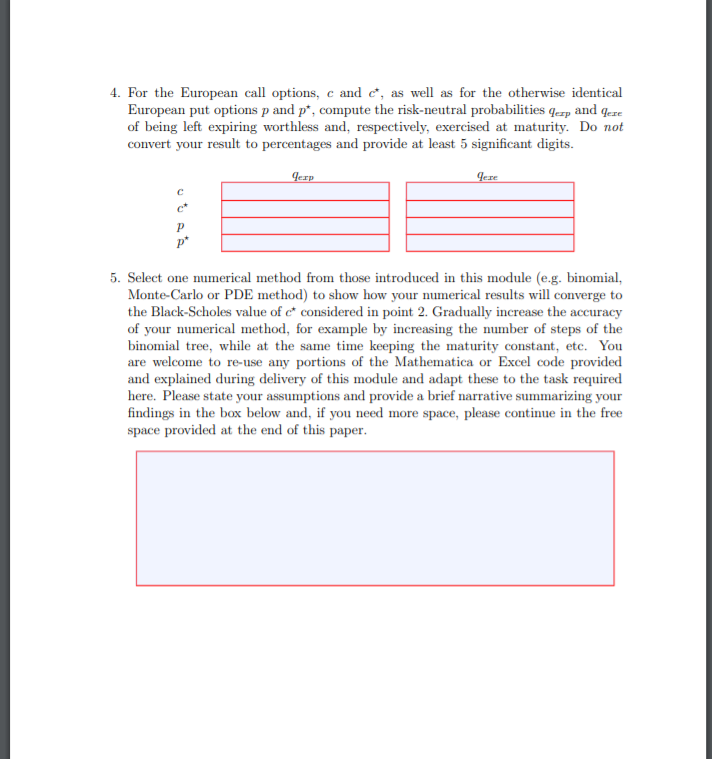

4. For the European call options, c and c, as well as for the otherwise identical European put options p and p*, compute the risk-neutral probabilities Gezp and qere of being left expiring worthless and, respectively, exercised at maturity. Do not convert your result to percentages and provide at least 5 significant digits. Gerp Jeze P p* 5. Select one numerical method from those introduced in this module (e.g. binomial, Monte-Carlo or PDE method) to show how your numerical results will converge to the Black-Scholes value of c* considered in point 2. Gradually increase the accuracy of your numerical method, for example by increasing the number of steps of the binomial tree, while at the same time keeping the maturity constant, etc. You are welcome to re-use any portions of the Mathematica or Excel code provided and explained during delivery of this module and adapt these to the task required here. Please state your assumptions and provide a brief narrative summarizing your findings in the box below and, if you need more space, please continue in the free space provided at the end of this paper. 4. For the European call options, c and c, as well as for the otherwise identical European put options p and p*, compute the risk-neutral probabilities Gezp and qere of being left expiring worthless and, respectively, exercised at maturity. Do not convert your result to percentages and provide at least 5 significant digits. Gerp Jeze P p* 5. Select one numerical method from those introduced in this module (e.g. binomial, Monte-Carlo or PDE method) to show how your numerical results will converge to the Black-Scholes value of c* considered in point 2. Gradually increase the accuracy of your numerical method, for example by increasing the number of steps of the binomial tree, while at the same time keeping the maturity constant, etc. You are welcome to re-use any portions of the Mathematica or Excel code provided and explained during delivery of this module and adapt these to the task required here. Please state your assumptions and provide a brief narrative summarizing your findings in the box below and, if you need more space, please continue in the free space provided at the end of this paper