Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Future value of annuities II There are three categories of cash flows: single cash flows, also referred to as lump sums, a stream of

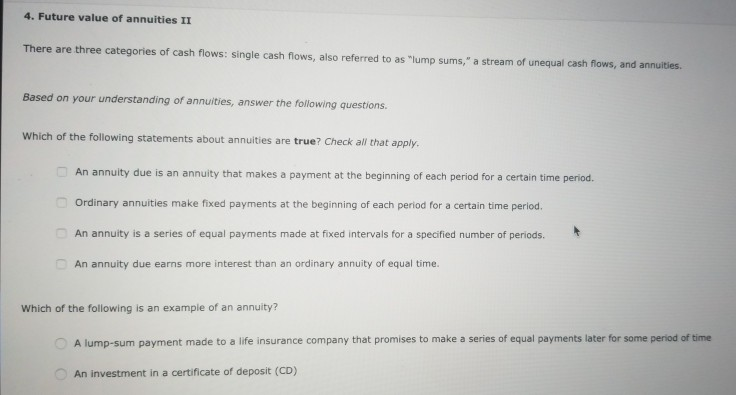

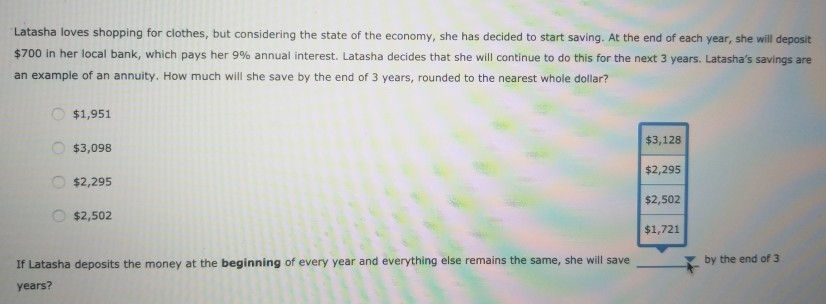

4. Future value of annuities II There are three categories of cash flows: single cash flows, also referred to as "lump sums," a stream of unequal cash flows, and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. An annuity due is an annuity that makes a payment at the beginning of each period for a certain time period. Ordinary annuities make fixed payments at the beginning of each period for a certain time period. An annuity is a series of equal payments made at fixed intervals for a specified number of periods. An annuity due earns more interest than an ordinary annuity of equal time. Which of the following is an example of an annuity? A lump-sum payment made to a life insurance company that promises to make a series of equal payments later for some period of time An investment in a certificate of deposit (CD) Latasha loves shopping for clothes, but considering the state of the economy, she has decided to start saving. At the end of each year, she will deposit $700 in her local bank, which pays her 9% annual interest. Latasha decides that she will continue to do this for the next 3 years. Latasha's savings are an example of an annuity. How much will she save by the end of 3 years, rounded to the nearest whole dollar? $1,951 $3,128 $3,098 $2,295 $2,295 $2,502 $2,502 $1,721 by the end of 3 If Latasha deposits the money at the beginning of every year and everything else remains the same, she will save years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started