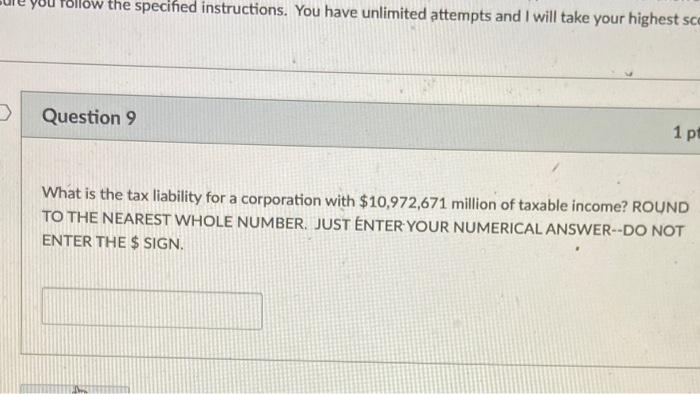

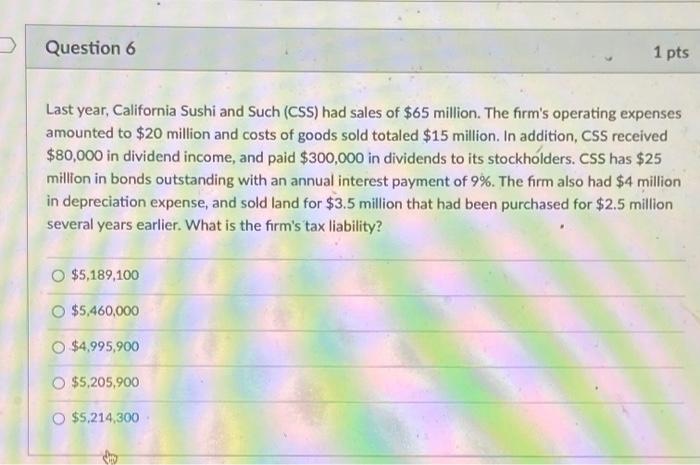

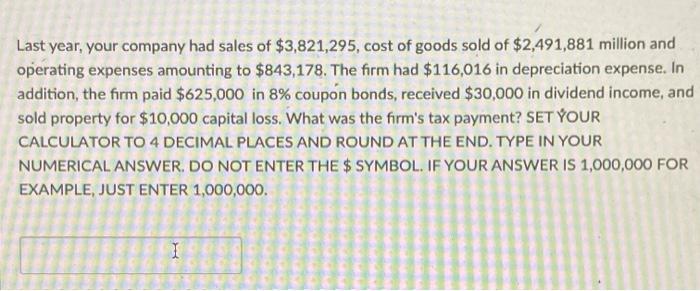

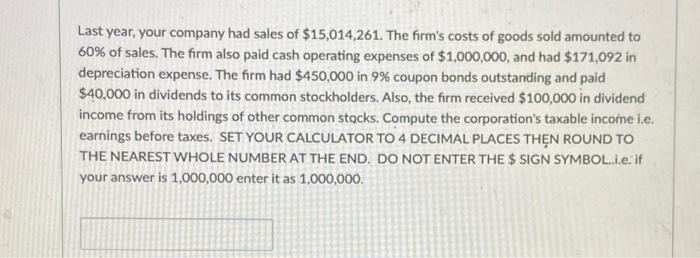

You follow the specified instructions. You have unlimited attempts and I will take your highest sce > Question 9 1 pt What is the tax liability for a corporation with $10,972,671 million of taxable income? ROUND TO THE NEAREST WHOLE NUMBER. JUST ENTER YOUR NUMERICAL ANSWER--DO NOT ENTER THE $ SIGN. Question 6 1 pts Last year, California Sushi and Such (CSS) had sales of $65 million. The firm's operating expenses amounted to $20 million and costs of goods sold totaled $15 million. In addition, CSS received $80,000 in dividend income, and paid $300,000 in dividends to its stockholders. CSS has $25 million in bonds outstanding with an annual interest payment of 9%. The firm also had $4 million in depreciation expense, and sold land for $3.5 million that had been purchased for $2.5 million several years earlier. What is the firm's tax liability? $5,189,100 O $5,460,000 O $4.995,900 O $5,205,900 O $5,214,300 Last year, your company had sales of $3,821,295, cost of goods sold of $2,491,881 million and operating expenses amounting to $843,178. The firm had $116,016 in depreciation expense. In addition, the firm paid $625,000 in 8% coupon bonds, received $30,000 in dividend income, and sold property for $10,000 capital loss. What was the firm's tax payment? SET YOUR CALCULATOR TO 4 DECIMAL PLACES AND ROUND AT THE END. TYPE IN YOUR NUMERICAL ANSWER. DO NOT ENTER THE $ SYMBOL. IF YOUR ANSWER IS 1,000,000 FOR EXAMPLE, JUST ENTER 1,000,000. 1 Last year, your company had sales of $15,014,261. The firm's costs of goods sold amounted to 60% of sales. The firm also paid cash operating expenses of $1,000,000, and had $171,092 in depreciation expense. The firm had $450,000 in 9% coupon bonds outstanding and paid $40,000 in dividends to its common stockholders. Also, the firm received $100,000 in dividend income from its holdings of other common stocks. Compute the corporation's taxable income i.e. earnings before taxes. SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN ROUND TO THE NEAREST WHOLE NUMBER AT THE END. DO NOT ENTER THE $ SIGN SYMBOL.I.eif your answer is 1,000,000 enter it as 1,000,000