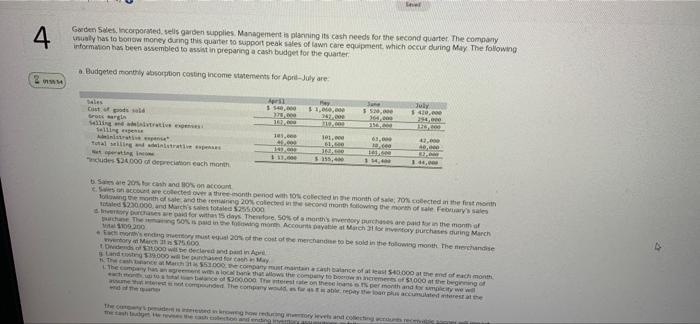

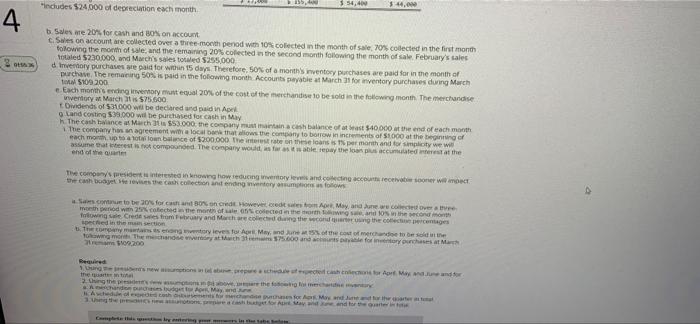

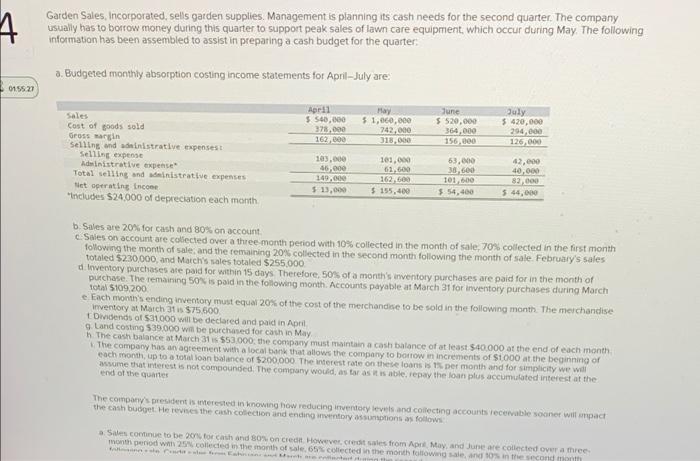

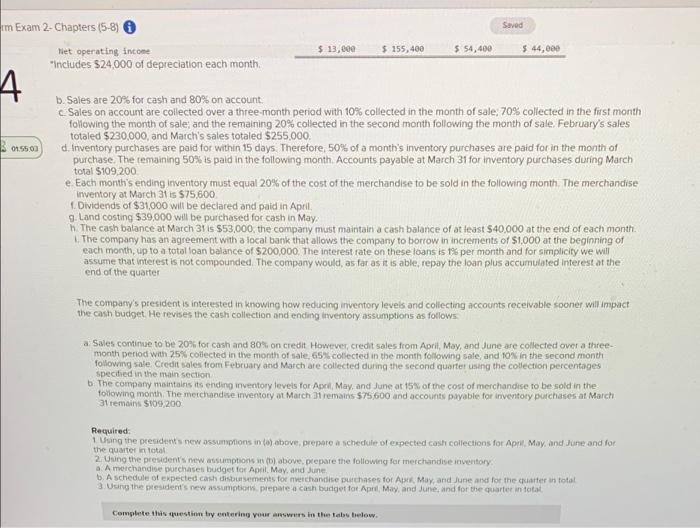

4 Garden Sales, incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usly has to bow money during this quarter to support peak sales of lawn Care equipment, which occur during May The following information has been assembled to assist in preparing a cash budget for the quarter a Budgeted many option costing income statements for April-July are 350,000 Sales Dispod rosa Si votive Talling 11., 0.00 . 55.00 164,00 July $410. 3500 101. 4. . 11.0 101. 1. 03.09 ta Total dudes 54000 oferece each month . 1. 1 are text and account can count we colected on the contented with to collected in the month of a 4.colected from Jokowange month of and the remaig 20% collected second montage morm of February od 230000 and March 25.000 case for dys. Therefore, son of a new hones are pandora theo This pagmam Account Manchurches in March 11000 o's get the cost of the merchand be sold in the following month the chance word March 15.600 ends on wieder Art Land will be for My the 53 commence of 40.000 domo thecary was the county to be of 1000 begge 00.000 tones per month and to med The com access the ecludes $24000 of depreciation each month 4. bese 20. for cash and BON on account c. Siis on account are collected over a three month period with 10% collected in the month of sale, 70% collected in the first month following the month of sale, and the remaining 20% collected as the second month following the month of sale. February's tales tad $230,000, and Mach's sales de $255.000 d Investory purchases are paid for within 15 days. Therefore, so of a month's nventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month Accounts payable at March 31 for inventory purchases during March 100200 e. Exch more inventory must equal 2016 of the cost of the merchandise to be sold in the following month. The merchandise wentory Match $75.600 Dividends of 531000 will be declared and paid in Apel in the cash balance March 53.000 the company maintain a cash balance of at least 540.000 at the end of each month and conting $39.000 will be purchased for cash in May The company has an agreement with local that allows the company to borrow in increments of 1000 at the beginning of each month pon balce of $200.000 The interests on these loans is per morth and for simplicity we will aset terest Comed. The company would be repay men plus accumulated at the end of the The company's president interested in knowing how reducing inventory and coding account recone w moc thecah bogel televises the cas colection and ending you follow to be forward Bord However stort May, and we were over the method with collected the month of collected in the month and other fotowe Credes from any and March are collected during the conteng the collecteercentages tin the mation The common wory levest for May, die of the cost of me to be in the Tow more Themen watch 7.600 and the former purchases at Mah 09.200 Red new motion where to Aryan the must 2.Ching them, the more du May Athos Mandows honor avendor A Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter a. Budgeted monthly absorption costing income statements for April-July are. 015521 April $ $40.000 378,000 162. 200 May $ 1,060,000 742,000 318.000 June $ 520,000 364,000 156.800 July 5.420,000 294,000 126,000 Sales Cost of goods sold Gross margin Selling and dinistrative expensest Selling expense Administrative expense Total selling and Ministrative expenses Net operating income ncludes $24.000 of depreciation each month 103.000 46.000 140.000 $ 13,000 103.000 62.500 162,600 $ 155,400 63.000 38.600 101.600 $ 54,400 42,000 40,000 82.000 544,000 b. Sales are 20% for cash and 80% on account Sales on account are collected over a three month period with 10% collected in the month of sale, 70% collected in the first month following the month of sale and the remaining 20% collected in the second month following the month of sale February's sales totaled $230,000, and March's sales totaled $255,000 dlowentory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March Total $109.200 e Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise Inventory at March 311 575,500 Dividends of $31000 will be declared and paid in April Land costing $39.000 will be purchased for cash in May The cash balance at March 31 $53000, the company must maintain a cash balance of at least $40.000 at the end of each month The company has an agreement with a local bank that allows the company to borrow in increments of $1000 at the beginning of each month, up to a total loan balance of $200.000 The interest rate on these loans is per month and for simplicity we will mume that interest is not compounded. The company would, as tu as it is able repay the loan plus accumulated interest at the end of the quarter The company's president is terested in knowing how reducing to devels and collecting accounts receivable sooner wit mpact the cash budget. Herves the cash collection and ending inventory assumptions as follows a Ses continue to be 2016 for cash and 80% on Credit. However creates from Apt May, and June are collected over a three month period with 25 collected in the month of sale 65% collected in the month follows and to the second me th Saved im Exam 2. Chapters (5-8) 6 Het operating income Includes $24.000 of depreciation each month. $ 13,000 $ 155,400 $ 54,400 $44,000 A 01.5503 b. Sales are 20% for cash and 80% on account Sales on account are collected over a three month period with 10% collected in the month of sale: 70% collected in the first month following the month of sale; and the remaining 20% collected in the second month following the month of sale February's sales totaled $230,000, and March's sales totaled $255.000 d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March total $109.200 e Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise Inventory at March 31 is $75,600 1. Dividends of $31000 will be declared and paid in April 9. Land costing $39,000 will be purchased for cash in May. nThe cash balance at March 31 is $53,000, the company must maintain a cash balance of at least $40,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $200,000 The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter The company's president is interested in knowing how reducing inventory levels and collecting accounts receivable sooner will impact the cash budget. He revises the cash collection and ending inventory assumptions as follows. a Sales continue to be 20% for cash and 80% on credit However, credit sales from Aprit, May, and June are collected over a three- month period with 25% collected in the month of sale, 65% collected in the month following sale, and 10% in the second month following sale Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section The company maintains its ending inventory levels for April May, and June at 15% of the cost of merchandise to be sold in the following month The merchandise inventory at March it remains $75 600 and accounts payable for inventory purchases at March 31 remains $109,200 Required: 1 Using the president's new assumptions in (a) above, prepare a schedule of expected cash collections for April May, and June and for the quarter total 2.Uung the president's new assumptions in (b) above, prepare the following for merchandise inventory a. A merchandise purchases budget for April May, and June b. A schedule of expected cash disbursements for merchandise purchases for Apr May, and June and for the quarter in total 3. Using the president's new assumptions prepare a cash budget for Apr May, and June, and for the quarter in total Complete this postin try entering your answers in the tabs below 4 Garden Sales, incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usly has to bow money during this quarter to support peak sales of lawn Care equipment, which occur during May The following information has been assembled to assist in preparing a cash budget for the quarter a Budgeted many option costing income statements for April-July are 350,000 Sales Dispod rosa Si votive Talling 11., 0.00 . 55.00 164,00 July $410. 3500 101. 4. . 11.0 101. 1. 03.09 ta Total dudes 54000 oferece each month . 1. 1 are text and account can count we colected on the contented with to collected in the month of a 4.colected from Jokowange month of and the remaig 20% collected second montage morm of February od 230000 and March 25.000 case for dys. Therefore, son of a new hones are pandora theo This pagmam Account Manchurches in March 11000 o's get the cost of the merchand be sold in the following month the chance word March 15.600 ends on wieder Art Land will be for My the 53 commence of 40.000 domo thecary was the county to be of 1000 begge 00.000 tones per month and to med The com access the ecludes $24000 of depreciation each month 4. bese 20. for cash and BON on account c. Siis on account are collected over a three month period with 10% collected in the month of sale, 70% collected in the first month following the month of sale, and the remaining 20% collected as the second month following the month of sale. February's tales tad $230,000, and Mach's sales de $255.000 d Investory purchases are paid for within 15 days. Therefore, so of a month's nventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month Accounts payable at March 31 for inventory purchases during March 100200 e. Exch more inventory must equal 2016 of the cost of the merchandise to be sold in the following month. The merchandise wentory Match $75.600 Dividends of 531000 will be declared and paid in Apel in the cash balance March 53.000 the company maintain a cash balance of at least 540.000 at the end of each month and conting $39.000 will be purchased for cash in May The company has an agreement with local that allows the company to borrow in increments of 1000 at the beginning of each month pon balce of $200.000 The interests on these loans is per morth and for simplicity we will aset terest Comed. The company would be repay men plus accumulated at the end of the The company's president interested in knowing how reducing inventory and coding account recone w moc thecah bogel televises the cas colection and ending you follow to be forward Bord However stort May, and we were over the method with collected the month of collected in the month and other fotowe Credes from any and March are collected during the conteng the collecteercentages tin the mation The common wory levest for May, die of the cost of me to be in the Tow more Themen watch 7.600 and the former purchases at Mah 09.200 Red new motion where to Aryan the must 2.Ching them, the more du May Athos Mandows honor avendor A Garden Sales, Incorporated, sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter a. Budgeted monthly absorption costing income statements for April-July are. 015521 April $ $40.000 378,000 162. 200 May $ 1,060,000 742,000 318.000 June $ 520,000 364,000 156.800 July 5.420,000 294,000 126,000 Sales Cost of goods sold Gross margin Selling and dinistrative expensest Selling expense Administrative expense Total selling and Ministrative expenses Net operating income ncludes $24.000 of depreciation each month 103.000 46.000 140.000 $ 13,000 103.000 62.500 162,600 $ 155,400 63.000 38.600 101.600 $ 54,400 42,000 40,000 82.000 544,000 b. Sales are 20% for cash and 80% on account Sales on account are collected over a three month period with 10% collected in the month of sale, 70% collected in the first month following the month of sale and the remaining 20% collected in the second month following the month of sale February's sales totaled $230,000, and March's sales totaled $255,000 dlowentory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March Total $109.200 e Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise Inventory at March 311 575,500 Dividends of $31000 will be declared and paid in April Land costing $39.000 will be purchased for cash in May The cash balance at March 31 $53000, the company must maintain a cash balance of at least $40.000 at the end of each month The company has an agreement with a local bank that allows the company to borrow in increments of $1000 at the beginning of each month, up to a total loan balance of $200.000 The interest rate on these loans is per month and for simplicity we will mume that interest is not compounded. The company would, as tu as it is able repay the loan plus accumulated interest at the end of the quarter The company's president is terested in knowing how reducing to devels and collecting accounts receivable sooner wit mpact the cash budget. Herves the cash collection and ending inventory assumptions as follows a Ses continue to be 2016 for cash and 80% on Credit. However creates from Apt May, and June are collected over a three month period with 25 collected in the month of sale 65% collected in the month follows and to the second me th Saved im Exam 2. Chapters (5-8) 6 Het operating income Includes $24.000 of depreciation each month. $ 13,000 $ 155,400 $ 54,400 $44,000 A 01.5503 b. Sales are 20% for cash and 80% on account Sales on account are collected over a three month period with 10% collected in the month of sale: 70% collected in the first month following the month of sale; and the remaining 20% collected in the second month following the month of sale February's sales totaled $230,000, and March's sales totaled $255.000 d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March total $109.200 e Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise Inventory at March 31 is $75,600 1. Dividends of $31000 will be declared and paid in April 9. Land costing $39,000 will be purchased for cash in May. nThe cash balance at March 31 is $53,000, the company must maintain a cash balance of at least $40,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $200,000 The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter The company's president is interested in knowing how reducing inventory levels and collecting accounts receivable sooner will impact the cash budget. He revises the cash collection and ending inventory assumptions as follows. a Sales continue to be 20% for cash and 80% on credit However, credit sales from Aprit, May, and June are collected over a three- month period with 25% collected in the month of sale, 65% collected in the month following sale, and 10% in the second month following sale Credit sales from February and March are collected during the second quarter using the collection percentages specified in the main section The company maintains its ending inventory levels for April May, and June at 15% of the cost of merchandise to be sold in the following month The merchandise inventory at March it remains $75 600 and accounts payable for inventory purchases at March 31 remains $109,200 Required: 1 Using the president's new assumptions in (a) above, prepare a schedule of expected cash collections for April May, and June and for the quarter total 2.Uung the president's new assumptions in (b) above, prepare the following for merchandise inventory a. A merchandise purchases budget for April May, and June b. A schedule of expected cash disbursements for merchandise purchases for Apr May, and June and for the quarter in total 3. Using the president's new assumptions prepare a cash budget for Apr May, and June, and for the quarter in total Complete this postin try entering your answers in the tabs below