Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 hours left for deadline. and i am asking thia question second time. pls be sure that your answer is correct plss solve it immediatelyyy

4 hours left for deadline. and i am asking thia question second time. pls be sure that your answer is correct

plss solve it immediatelyyy

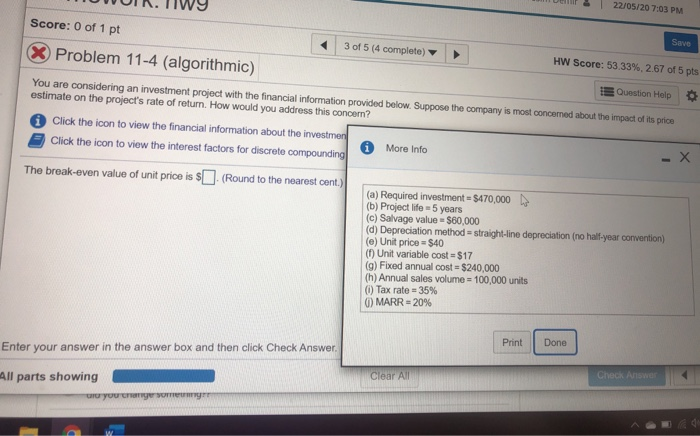

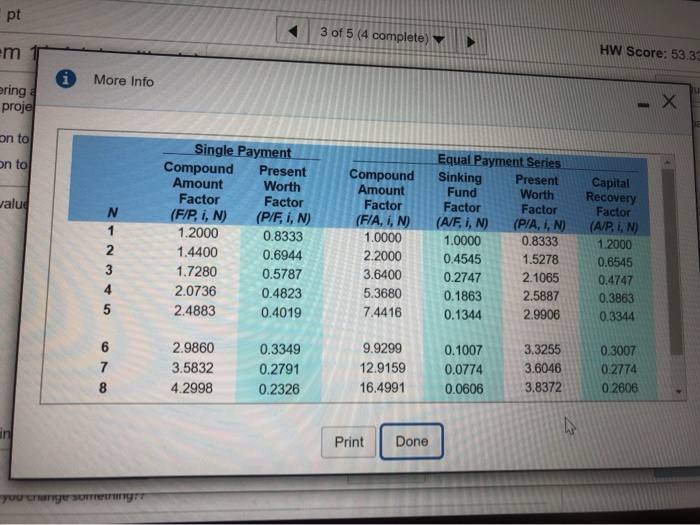

22/05/20 7:03 PM Save Score: 0 of 1 pt 3 of 5 (4 complete) HW Score: 53.33%, 2.67 of 5 pts Problem 11-4 (algorithmic) Question Help You are considering an investment project with the financial information provided below. Suppose the company is most concerned about the impact of its price estimate on the project's rate of retum. How would you address this concern? Click the icon to view the financial information about the investmen More Info Click the icon to view the interest factors for discrete compounding The break-even value of unit price is $. (Round to the nearest cent.) (a) Required investment $470.000 (b) Project life = 5 years (c) Salvage value $60,000 (d) Depreciation method - straight-line depreciation (no half-year convention) (e) Unit price = $40 (f) Unit variable cost-$17 (9) Fixed annual cost = $240,000 (h) Annual sales volume = 100,000 units (1) Tax rate = 35% MARR = 20% Print Done Enter your answer in the answer box and then click Check Answer Clear All Check Answer All parts showing u you can pt 3 of 5 (4 complete) HW Score: 53.39 E More Info ering projel - on to on to walu N 1 2 3 4 5 Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (P/F, I, N) 1.2000 0.8333 1.4400 0.6944 1.7280 0.5787 2.0736 0.4823 2.4883 0.4019 Compound Amount Factor (F/A, 1, N) 1.0000 2.2000 3.6400 5.3680 7.4416 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) (P/A, i, N) 1.0000 0.8333 0.4545 1.5278 0.2747 2.1065 0.1863 2.5887 0.1344 2.9906 Capital Recovery Factor (A/P, 1, N) 1.2000 0.6545 0.4747 0.3863 0.3344 6 7 2.9860 3.5832 4.2998 0.3349 0.2791 0.2326 9.9299 12.9159 16.4991 0.1007 0.0774 0.0606 3.3255 3.6046 3.8372 0.3007 0.2774 0.2606 8 ws Print Done you criarge SU TUTTGTT 22/05/20 7:03 PM Save Score: 0 of 1 pt 3 of 5 (4 complete) HW Score: 53.33%, 2.67 of 5 pts Problem 11-4 (algorithmic) Question Help You are considering an investment project with the financial information provided below. Suppose the company is most concerned about the impact of its price estimate on the project's rate of retum. How would you address this concern? Click the icon to view the financial information about the investmen More Info Click the icon to view the interest factors for discrete compounding The break-even value of unit price is $. (Round to the nearest cent.) (a) Required investment $470.000 (b) Project life = 5 years (c) Salvage value $60,000 (d) Depreciation method - straight-line depreciation (no half-year convention) (e) Unit price = $40 (f) Unit variable cost-$17 (9) Fixed annual cost = $240,000 (h) Annual sales volume = 100,000 units (1) Tax rate = 35% MARR = 20% Print Done Enter your answer in the answer box and then click Check Answer Clear All Check Answer All parts showing u you can pt 3 of 5 (4 complete) HW Score: 53.39 E More Info ering projel - on to on to walu N 1 2 3 4 5 Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (P/F, I, N) 1.2000 0.8333 1.4400 0.6944 1.7280 0.5787 2.0736 0.4823 2.4883 0.4019 Compound Amount Factor (F/A, 1, N) 1.0000 2.2000 3.6400 5.3680 7.4416 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) (P/A, i, N) 1.0000 0.8333 0.4545 1.5278 0.2747 2.1065 0.1863 2.5887 0.1344 2.9906 Capital Recovery Factor (A/P, 1, N) 1.2000 0.6545 0.4747 0.3863 0.3344 6 7 2.9860 3.5832 4.2998 0.3349 0.2791 0.2326 9.9299 12.9159 16.4991 0.1007 0.0774 0.0606 3.3255 3.6046 3.8372 0.3007 0.2774 0.2606 8 ws Print Done you criarge SU TUTTGTTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started