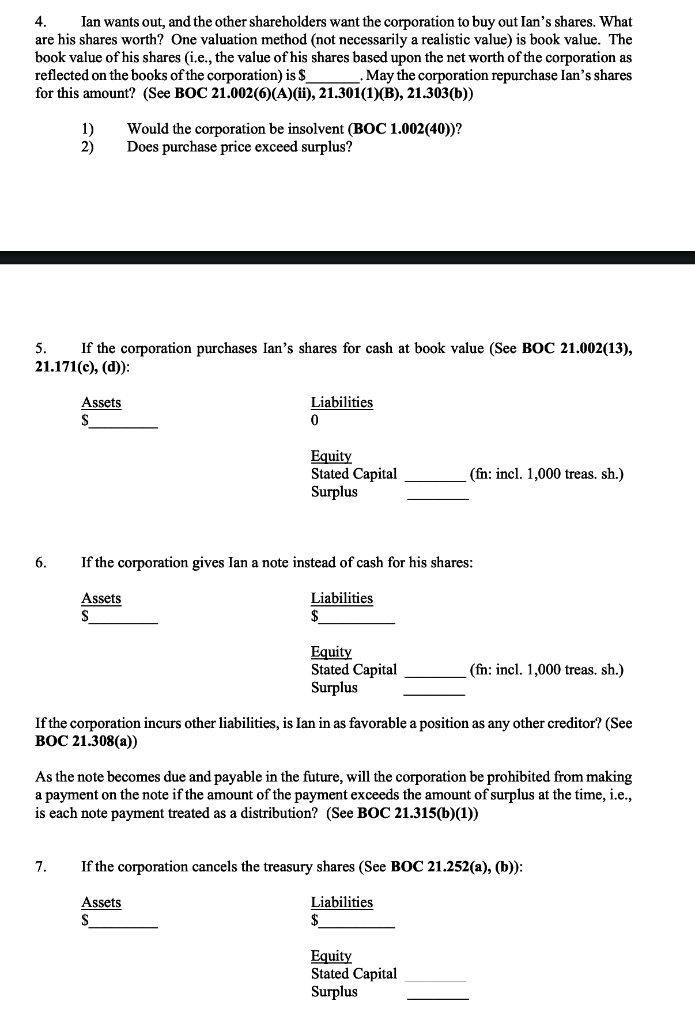

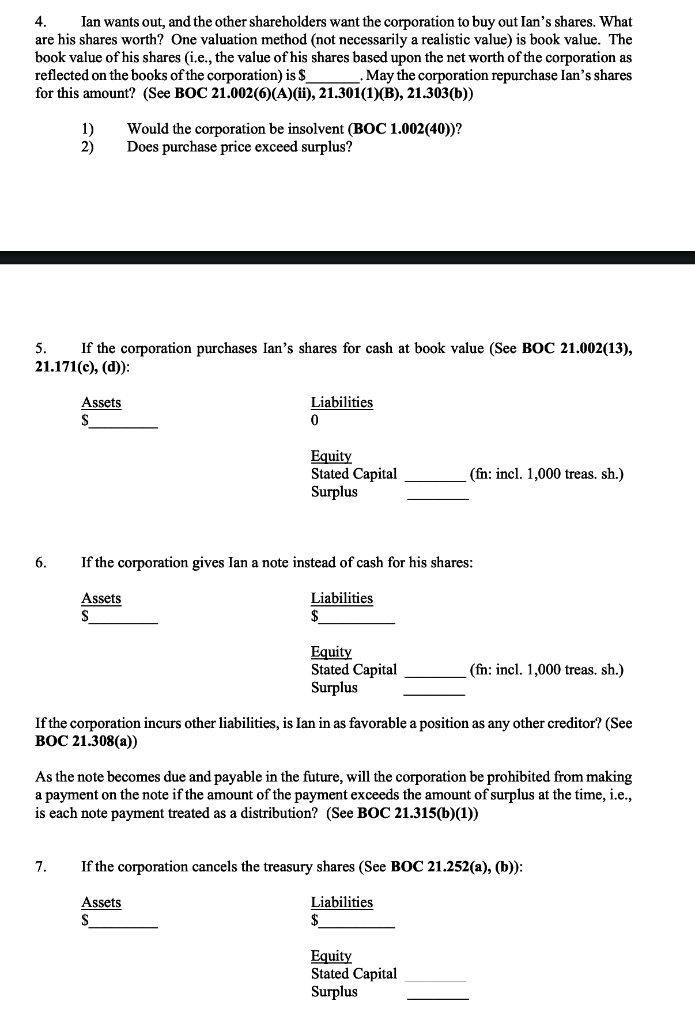

4. Ian wants out, and the other shareholders want the corporation to buy out Ian's shares. What are his shares worth? One valuation method (not necessarily a realistic value) is book value. The book value of his shares (i.e., the value of his shares based upon the net worth of the corporation as reflected on the books of the corporation) is $ May the corporation repurchase lan's shares for this amount? (See BOC 21.002()(A)(i), 21.301(1)(B), 21.303(b)) 1) 2) Would the corporation be insolvent (BOC 1.002(40))? Does purchase price exceed surplus? 5. If the corporation purchases Ian's shares for cash at book value (See BOC 21.002(13), 21.171(c), (d)): Assets S Liabilities 0 Equity Stated Capital Surplus (fn: incl. 1,000 treas. sh.) 6. If the corporation gives lan a note instead of cash for his shares: Assets S Liabilities $ Equity Stated Capital (fn: incl. 1,000 treas. sh.) Surplus If the corporation incurs other liabilities, is lan in as favorable a position as any other creditor? (See BOC 21.308(a)) As the note becomes due and payable in the future, will the corporation be prohibited from making a payment on the note if the amount of the payment exceeds the amount of surplus at the time, i.e., is each note payment treated as a distribution? (See BOC 21.315(b)(1)) 7. If the corporation cancels the treasury shares (See BOC 21.252(a), (b)): Assets S Liabilities $ Equity Stated Capital Surplus 4. Ian wants out, and the other shareholders want the corporation to buy out Ian's shares. What are his shares worth? One valuation method (not necessarily a realistic value) is book value. The book value of his shares (i.e., the value of his shares based upon the net worth of the corporation as reflected on the books of the corporation) is $ May the corporation repurchase lan's shares for this amount? (See BOC 21.002()(A)(i), 21.301(1)(B), 21.303(b)) 1) 2) Would the corporation be insolvent (BOC 1.002(40))? Does purchase price exceed surplus? 5. If the corporation purchases Ian's shares for cash at book value (See BOC 21.002(13), 21.171(c), (d)): Assets S Liabilities 0 Equity Stated Capital Surplus (fn: incl. 1,000 treas. sh.) 6. If the corporation gives lan a note instead of cash for his shares: Assets S Liabilities $ Equity Stated Capital (fn: incl. 1,000 treas. sh.) Surplus If the corporation incurs other liabilities, is lan in as favorable a position as any other creditor? (See BOC 21.308(a)) As the note becomes due and payable in the future, will the corporation be prohibited from making a payment on the note if the amount of the payment exceeds the amount of surplus at the time, i.e., is each note payment treated as a distribution? (See BOC 21.315(b)(1)) 7. If the corporation cancels the treasury shares (See BOC 21.252(a), (b)): Assets S Liabilities $ Equity Stated Capital Surplus