Answered step by step

Verified Expert Solution

Question

1 Approved Answer

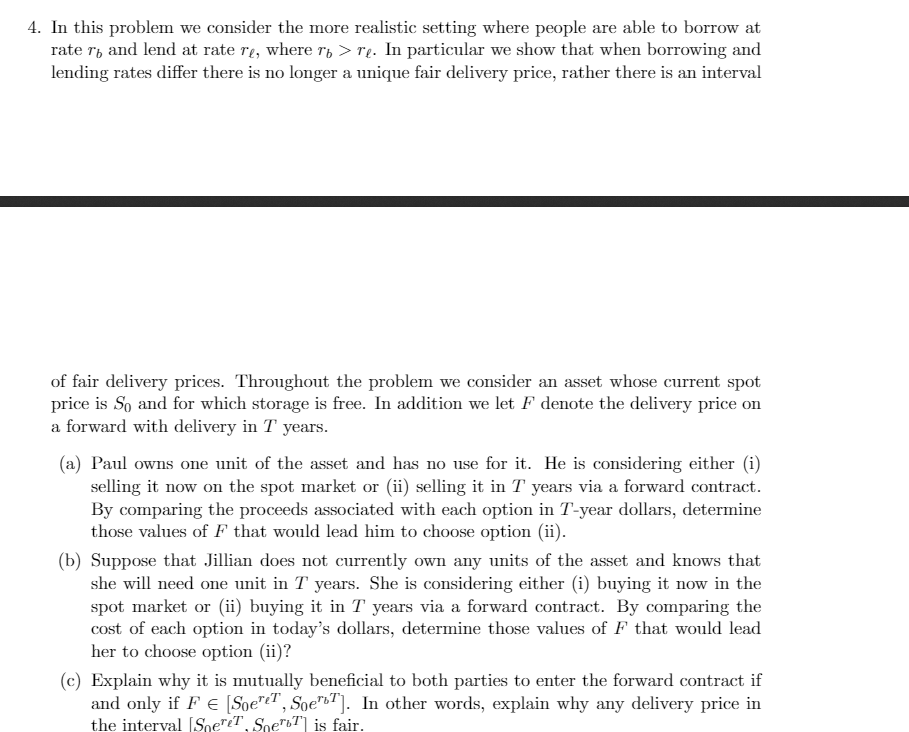

4. In this problem we consider the more realistic setting where people are able to borrow at rater, and lend at rate re, where

4. In this problem we consider the more realistic setting where people are able to borrow at rater, and lend at rate re, where r>re. In particular we show that when borrowing and lending rates differ there is no longer a unique fair delivery price, rather there is an interval of fair delivery prices. Throughout the problem we consider an asset whose current spot price is So and for which storage is free. In addition we let F denote the delivery price on a forward with delivery in T years. (a) Paul owns one unit of the asset and has no use for it. He is considering either (i) selling it now on the spot market or (ii) selling it in T years via a forward contract. By comparing the proceeds associated with each option in T-year dollars, determine those values of F that would lead him to choose option (ii). (b) Suppose that Jillian does not currently own any units of the asset and knows that she will need one unit in T years. She is considering either (i) buying it now in the spot market or (ii) buying it in T years via a forward contract. By comparing the cost of each option in today's dollars, determine those values of F that would lead her to choose option (ii)? (c) Explain why it is mutually beneficial to both parties to enter the forward contract if and only if FE [Soe, Soe]. In other words, explain why any delivery price in the interval [SoereT, Soe is fair.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the values of F that would lead Paul to choose option ii selling via a forward contract we compare the proceeds associated with each op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started