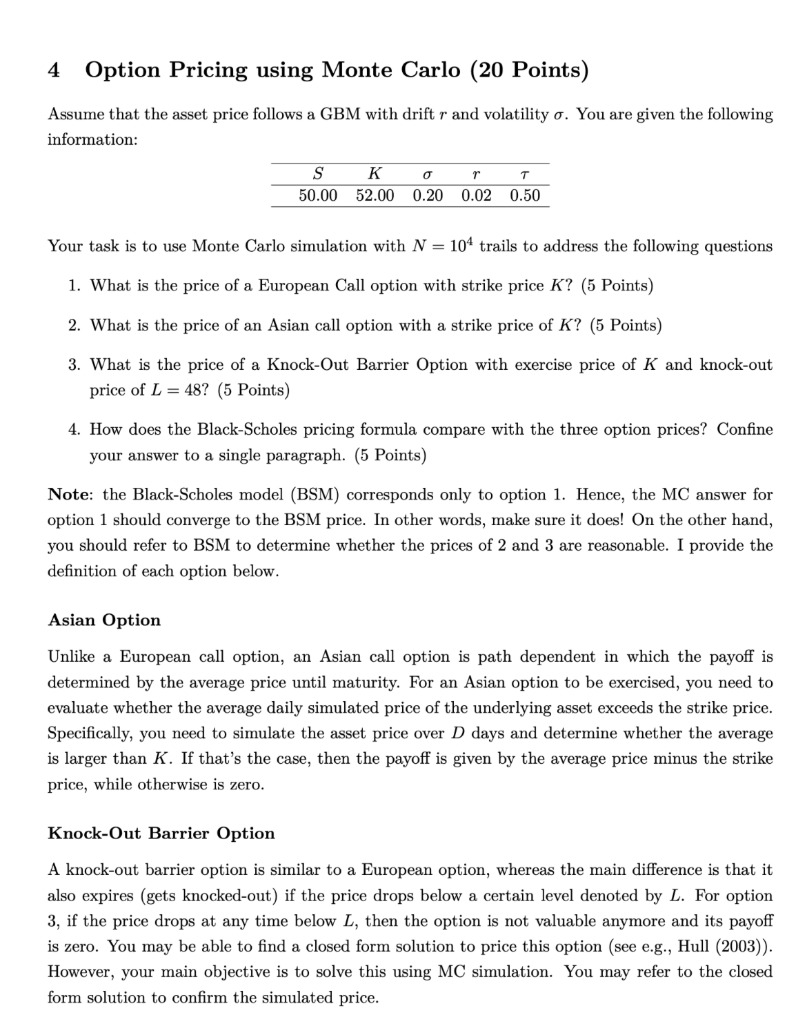

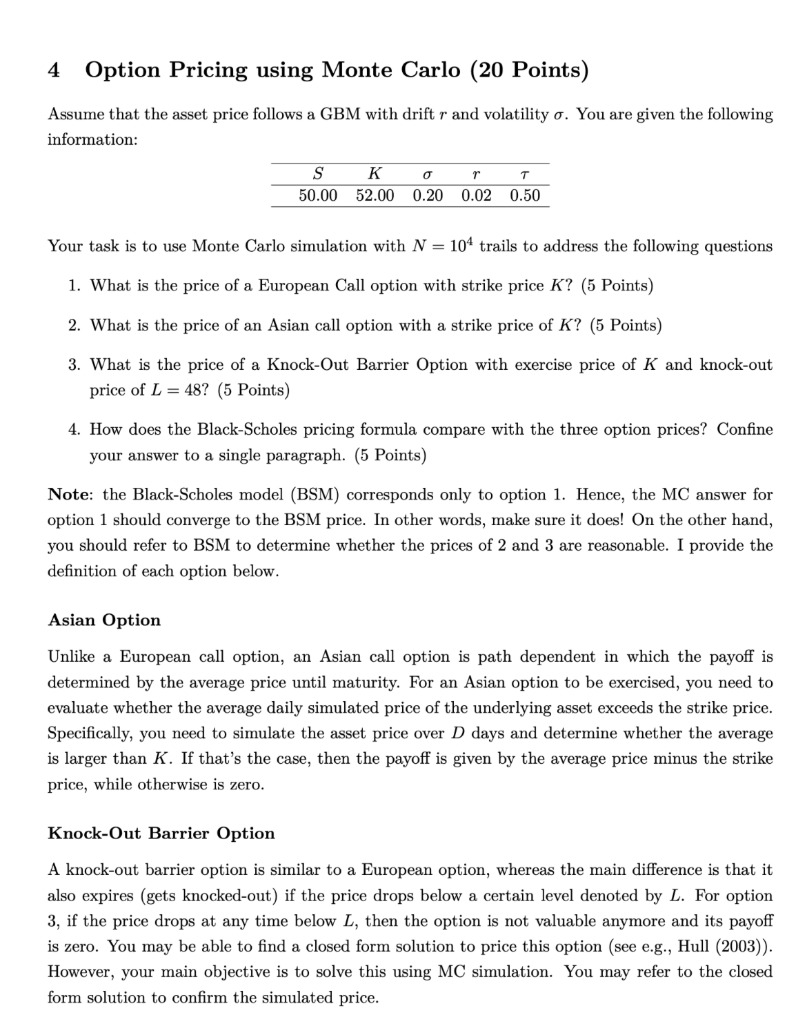

4 Option Pricing using Monte Carlo (20 Points) Assume that the asset price follows a GBM with drift r and volatility o. You are given the following information: S K o r 50.00 52.00 0.20 0.02 0.50 Your task is to use Monte Carlo simulation with N = 104 trails to address the following questions 1. What is the price of a European Call option with strike price K? (5 Points) 2. What is the price of an Asian call option with a strike price of K? (5 Points) 3. What is the price of a Knock-Out Barrier Option with exercise price of K and knock-out price of L = 48? (5 Points) 4. How does the Black-Scholes pricing formula compare with the three option prices? Confine your answer to a single paragraph. (5 Points) Note: the Black-Scholes model (BSM) corresponds only to option 1. Hence, the MC answer for option 1 should converge to the BSM price. In other words, make sure it does! On the other hand, you should refer to BSM to determine whether the prices of 2 and 3 are reasonable. I provide the definition of each option below. Asian Option Unlike a European call option, an Asian call option is path dependent in which the payoff is determined by the average price until maturity. For an Asian option to be exercised, you need to evaluate whether the average daily simulated price of the underlying asset exceeds the strike price. Specifically, you need to simulate the asset price over D days and determine whether the average is larger than K. If that's the case, then the payoff is given by the average price minus the strike price, while otherwise is zero. Knock-Out Barrier Option A knock-out barrier option is similar to a European option, whereas the main difference is that it also expires (gets knocked-out) if the price drops below a certain level denoted by L. For option 3, if the price drops at any time below L, then the option is not valuable anymore and its payoff is zero. You may be able to find a closed form solution to price this option (see e.g., Hull (2003)). However, your main objective is to solve this using MC simulation. You may refer to the closed form solution to confirm the simulated price. 4 Option Pricing using Monte Carlo (20 Points) Assume that the asset price follows a GBM with drift r and volatility o. You are given the following information: S K o r 50.00 52.00 0.20 0.02 0.50 Your task is to use Monte Carlo simulation with N = 104 trails to address the following questions 1. What is the price of a European Call option with strike price K? (5 Points) 2. What is the price of an Asian call option with a strike price of K? (5 Points) 3. What is the price of a Knock-Out Barrier Option with exercise price of K and knock-out price of L = 48? (5 Points) 4. How does the Black-Scholes pricing formula compare with the three option prices? Confine your answer to a single paragraph. (5 Points) Note: the Black-Scholes model (BSM) corresponds only to option 1. Hence, the MC answer for option 1 should converge to the BSM price. In other words, make sure it does! On the other hand, you should refer to BSM to determine whether the prices of 2 and 3 are reasonable. I provide the definition of each option below. Asian Option Unlike a European call option, an Asian call option is path dependent in which the payoff is determined by the average price until maturity. For an Asian option to be exercised, you need to evaluate whether the average daily simulated price of the underlying asset exceeds the strike price. Specifically, you need to simulate the asset price over D days and determine whether the average is larger than K. If that's the case, then the payoff is given by the average price minus the strike price, while otherwise is zero. Knock-Out Barrier Option A knock-out barrier option is similar to a European option, whereas the main difference is that it also expires (gets knocked-out) if the price drops below a certain level denoted by L. For option 3, if the price drops at any time below L, then the option is not valuable anymore and its payoff is zero. You may be able to find a closed form solution to price this option (see e.g., Hull (2003)). However, your main objective is to solve this using MC simulation. You may refer to the closed form solution to confirm the simulated price