Answered step by step

Verified Expert Solution

Question

1 Approved Answer

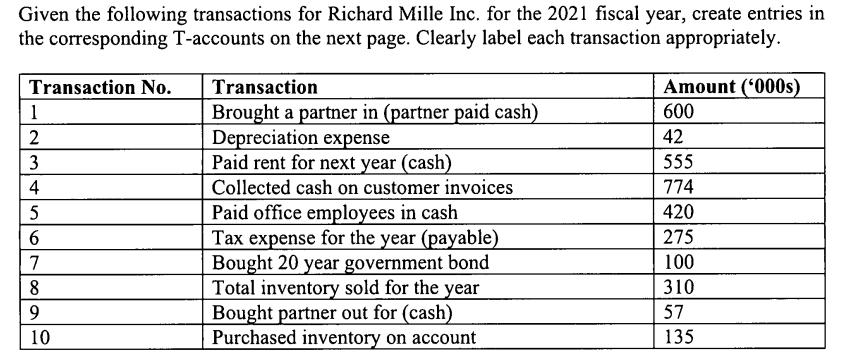

4 Paid rent for next year (cash) Collected cash on customer invoices Given the following transactions for Richard Mille Inc. for the 2021 fiscal

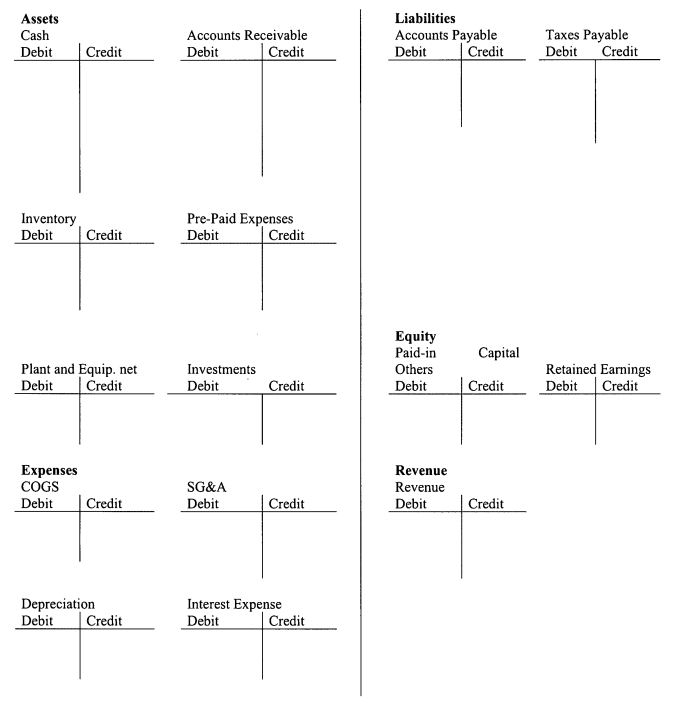

4 Paid rent for next year (cash) Collected cash on customer invoices Given the following transactions for Richard Mille Inc. for the 2021 fiscal year, create entries in the corresponding T-accounts on the next page. Clearly label each transaction appropriately. Transaction No. 1 2 3 Transaction Brought a partner in (partner paid cash) Depreciation expense Amount ('000s) 600 42 555 774 5 6 7 8 9 10 Paid office employees in cash Tax expense for the year (payable) Bought 20 year government bond Total inventory sold for the year Bought partner out for (cash) Purchased inventory on account 57 135 420 275 100 310 Assets Cash Accounts Receivable Liabilities Accounts Payable Debit Credit Debit Credit Debit Inventory Debit Credit Pre-Paid Expenses Debit Credit Credit Taxes Payable Debit Credit Equity Paid-in Capital Plant and Equip. net Debit Credit Investments Debit Others Credit Debit Credit Debit Retained Earnings Credit Expenses COGS Debit Credit SG&A Debit Credit Revenue Revenue Debit Credit Depreciation Interest Expense Debit Credit Debit Credit Taxes Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started