Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 part question Required information Problem 7.8B Record the disposal of equipment (LO7.6) [The following information applies to the questions displayed befow] New Deli is

4 part question

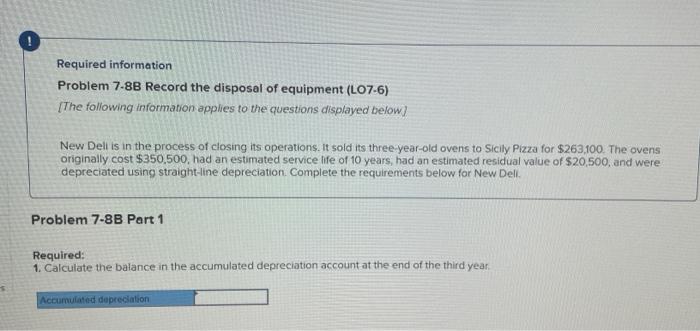

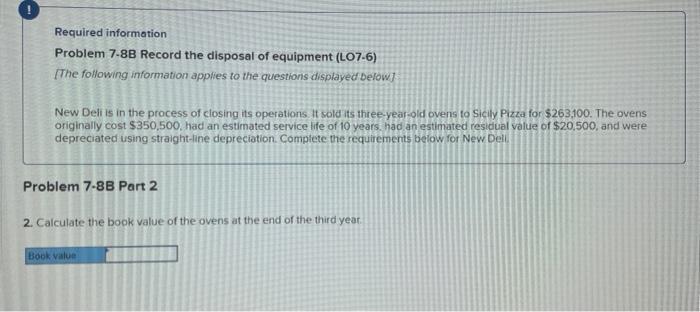

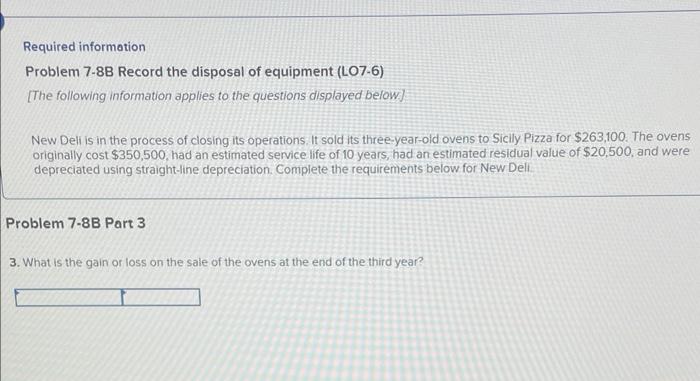

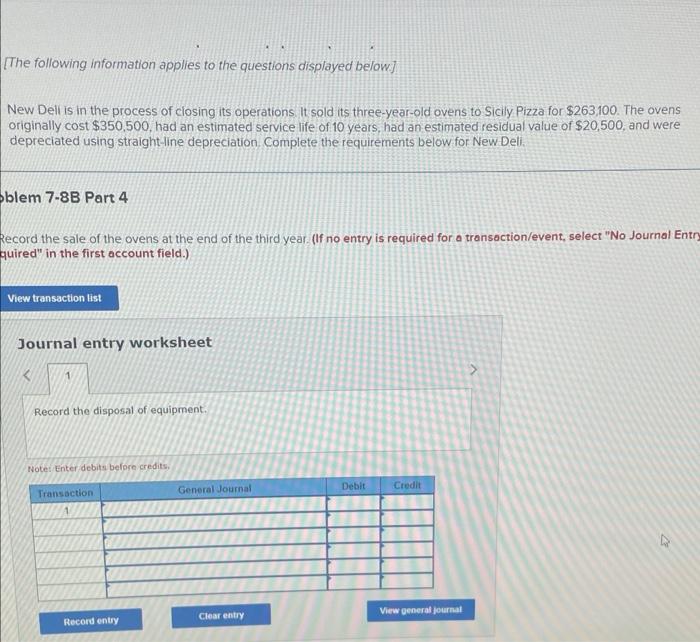

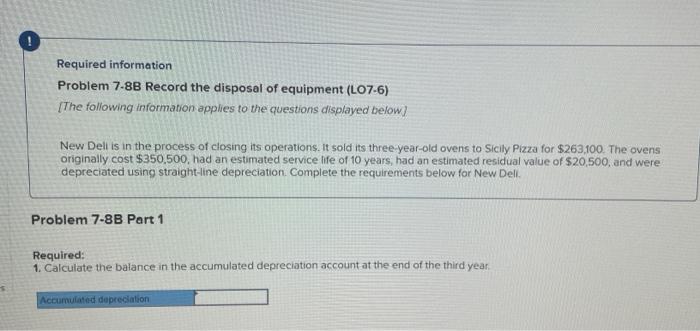

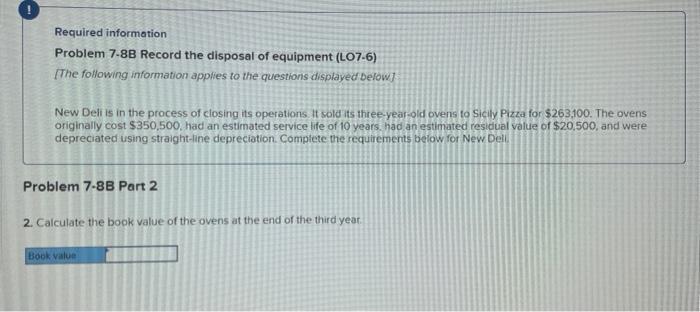

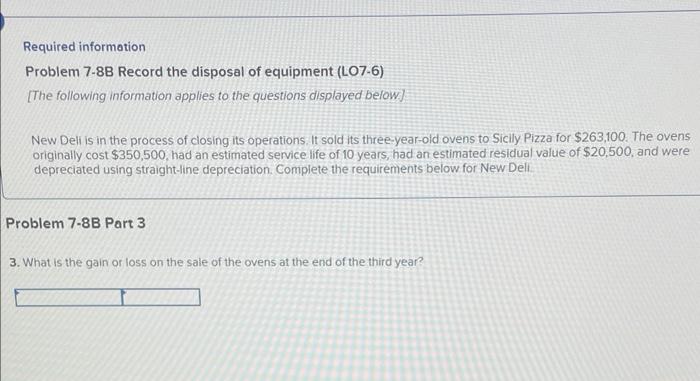

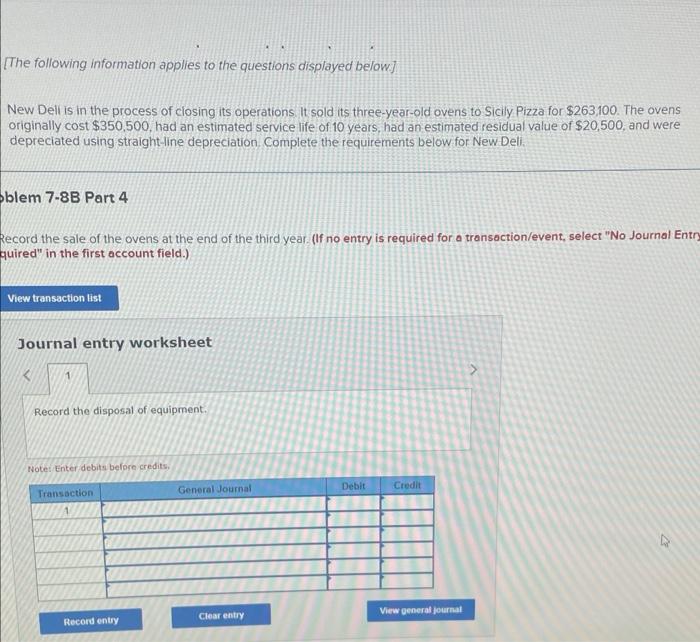

Required information Problem 7.8B Record the disposal of equipment (LO7.6) [The following information applies to the questions displayed befow] New Deli is in the process of ciosing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B Part 1 Required: 1. Calculate the balance in the accumulated depreciation account at the end of the third year. Required information Problem 7-8B Record the disposal of equipment (LO7.6) The following information applies to the questions displayed below 1 . New Deli is in the process of closing its operations it sold its three-year-old ovens to Sicily Pizza for $263100. The ovens originally cost $350,500. had an estimated service life of 10 years. had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. Problem 7-8B Part 2 2. Caiculate the book value of the ovens at the end of the third yeat: Required information Problem 7-8B Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below]: New Dell is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350,500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Dell Problem 7-8B Part 3 3. What is the gain or loss on the sale of the ovens at the end of the third year? The following information applies to the questions displayed below] New Deli is in the process of ciosing its operations, it sold its three-year-old ovens to Sicily Pizza for $263,100. The ovens originally cost $350.500, had an estimated service life of 10 years, had an estimated residual value of $20,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. blem 7-8B Part 4 tecord the sale of the ovens at the end of the third year. (If no entry is required for a transaction/event, select "No Journal Entru quired" in the first account field.) Journal entry worksheet Record the disposal of equipment. Wotes Enter debitn before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started