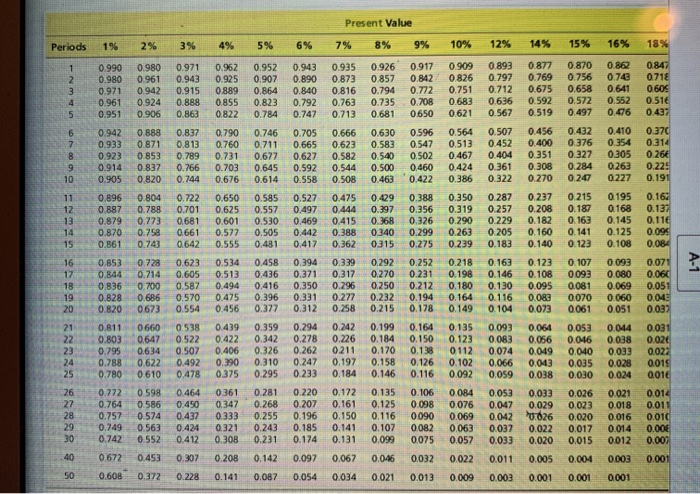

4. Personal Investment Analysis Find of the cost of a bachelor's degree at the university of your choice assume additional costs of $16,000 for an additional fifth year of education to get Master's degree. Assume that all tuition is paid at the beginning of the year. A student considering this investment must evaluate the present value of cash flows from possessing a graduate degree versus holding only the undergraduate degree. Assume that the average student with an undergraduate degree is expected to earn an annual salary of $55,000 per year (assumed to be paid at the end of the year) for 10 years. Assume that the average student with a graduate Masters degree is expected to earn an annual salary of $76,000 per year (assumed to be paid at the end of the year) for nine years after graduation. Assume a minimum rate of return of 10%. Determine the net present value of cash flows from an undergraduate degree. Use the present value table provided in this chapter 26. Determine the net present value of cash flows from a Masters degree, assuming that no salary is earned during the graduate year of schooling. What is the net advantage or disadvantage of pursuing a graduate degree under these assumption? cost for bachelor's degree Ilk a year X 4 years $44,000 Present Value Periods 1 2 3 % 5% 6 7 K 9 10^ 12x 14K 15 16 18K 0A = 2 0718 3 4 5 0990 098 097 0.961 1.951 0980 096 0942 0924 090 02 095 0 889 0,855 1 822 0952 0,907 0.8fA 0.823 0.784 097 0,890 0.840 0.792 0.77 0935 0873 0.816 0.765 0.3 090% 0 26 07 083 061 0 893 0.797 07. 0636 07 08 07 075 0 592 0519 ,870 07 0,658 0. 0.497 0 8 07 041 0.2 0, 46 bDK 051 0 31 0971 0 93 0.915 0.888 0.863 0.837 0.8 13 , 789 0.766 .74 0926 087 0.70M 0.735 01. 0.630 0.583 0 $40 0.50 0.463 0917 0.2 0.71 0 KAB 065 059 0547 0502 0,46 0,422 6 7 E 0 94 0.933 092 0.94 0.905 0 888 0.871 0 853 083 0 820 07 0.7 07 0.703 0.676 076 07 0677 0.645 0.64 0.705 0 665 0.627 0.592 0.558 0 666 0.623 0.82 044 008 05A 053 0.46 0424 0.3M 0.57 042 0 404 0 361, 0 322 046 0,40) 031 0.30 0270 0,432 076 0 327 02A 03 D ) 3 0.896 0 E67 0.879 0.870 1.B 0.585 0.557 0.53 0.55 0,48) 0.527 0,497 0,469 0.42 0,417 09 0.7 038 0340 035 27 0,208 0.12 010 0,140 011 0.18 0. 163 0 141 0123 15 0,475 04 0.415 0.388 0,362 0.33 017 0.20 0.27/ 0.8 0.388 0356 0 326 0.299 0.275 0.252 0.21 012 0.194 0,178, 0.30 0.319 0.290 0263 0239 0218 0,198 0.180 0.14 049 0 65 0, to 017 03 04 0305 02 0263 02 0227 0.191 0195 0.16 08_0.13 0 145 0,116 0 25 0.0 0.108 0,084 007 006 0.069 0051 0 00 0M 0 051 003) 0M 007 0 038 02 003 02. 0028 001 00A 001 7 2 6 17 18 9 20 0.8 1.8 36 0.828 0.820 0.458 0,43 ,416 9,396 0.37) 0.30A 0 31 0,35 0.3 0.312 0.292 0,270 0.25 0.22 02 0123 0.108 005 003 0073 0.804 2,22 0,650 078-B. 0.701 0.625 0.77 681 0.6, 0.7 066 07 074/ 02 0.555 078 0.62 0534 0.74 0.605 0.53 o Po 0 587 ,944 066 570 0.475 007 0,55 0.456 060 03B 04] 07 022 0.2) 0,634 017 0, 404 0 622 0492 o, 0 60 0 A78 O.375 0 598 0 4 ( 36 158 0.4 07 074 0.45 0 333 0563 0.4M 0 32 0552 0.12 0 3B 0 107 095 0081 0070 001 0.287 027 0.229 0 205 0.183 0.163 046 0.13 0.116 0 1M 0 ) 0 MB] 0074 0.0 0059 0,053 | 0,047 0.0M2 007 00) 22 0 811 0.803 0.735 0.7BB 0789 0.39 0,342 0.326 031o 0.204 0178 0.2 0.247 0.233 0M2 0,26 02 o, 197 0, 1A 0.1M 0.15 0.1 0126 0.16 00 00 0A9 0,M3 0.038 24 25 029$ 0.10 0.18 07 9,15 0,146 0,35 0,125 0,116 0.107 0,0 0, 13s 012 012 0 102 0 092 0MM 0 076 0 069 0.063 0,057 26 0.77 0.764 0757 049 0,742 0.28] 0.268 0.25 0.23 Z8 29 30 0 120 0 07 0.19 0.185 074 072 0 161 015 0.14) 031 0 10% 08 009 0.082 0,075 0032 0,053 0.0M 0.00 0.015 0,030 016 00) 00 0.017 0.015 00M 0.0] 0.029 026 0.022 0.020 0.005 0021 008 006 004 0012 0003 001 00) 001 00 0.00 40 7.673 0453 0.07 2008 0,12 0.067 0.0M 0 022 0 011 0.001 0,097 0.054 0 0 608 0.37 6.228 0.141 0,087 0.034 0.021 0.013 0.009 0 0 0.001 0 00 0001