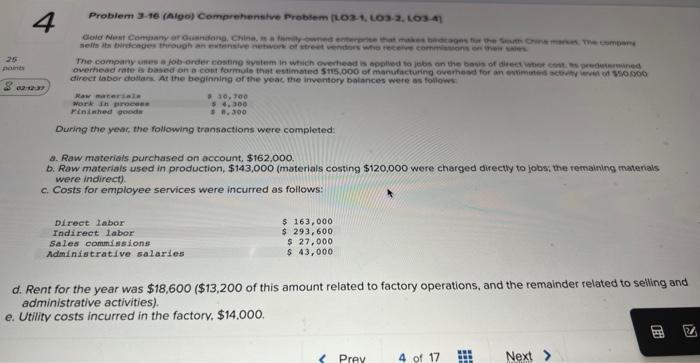

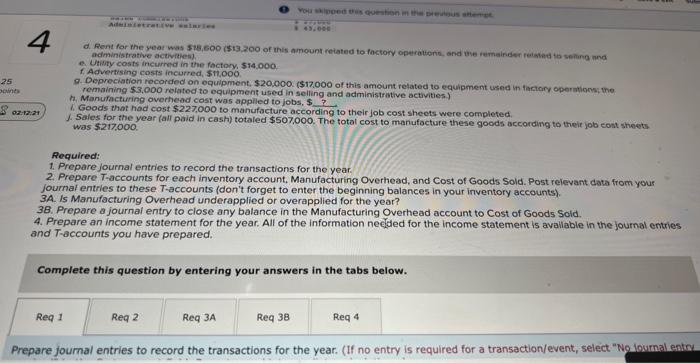

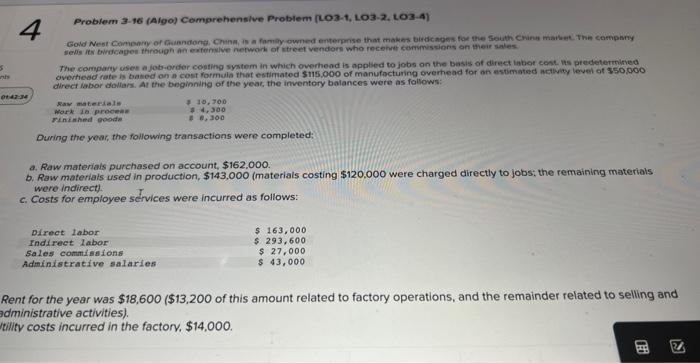

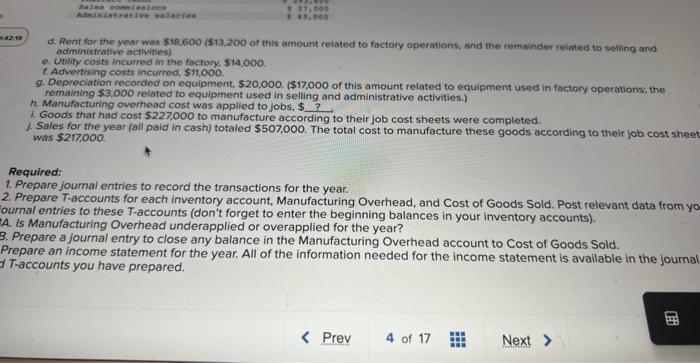

4 Probiem 3.16 (Algo) Comprehenstve Probiem (LO3.4, L03.2, 103.47 ctirect dabor dodtars. Ar the beginning of the yeac, the imventory batances were as folloins. Durirtg the year, the following transiactions were completed: a. Raw materiats purchased an account, $162,000. Were inclirect. c. Costs for employee services were incurred as follovs: d. Rent for the year was $18,600($13,200 of this amount related to factory operations, and the remainder related to selling and administrative activities). Utility costs incurred in the factory. $14,000. d. Rent for the vear was 518,600 (513,200 of this amount reiated to factory operattonn, and use remainien feisted to seing nnd administrative activithes). a. Utility costs incurned in the factory, 514,000 f. Advertising costs incurred, 511000 g. Depreciation recorded on equipment, $20.000 (\$17.000 of this amount retated to equipment used in factory operations; me remaining $3,000 related to equipment used in selling and administritive activities) h. Manufacturing overheod cost was appilled to jobs, $ ? 1. Goods that had cost $227,000 to manufocture according to their job cost sheots were completed. 1. Saies for the year (all paid in cash) totaled $507,000. The total cost to manufacture these goods according to theit job cont shevts was 5217000 . Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journaf entries to these. T-accounts (don't forget to enter the beginning balances in your inventory accounts). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the information necjded for the income statement is avaliable in the journal entries and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. 4 Problem 3-16 (Algo ) Comprehensive Problem (LO3-1, L03-2, L03-4) The comparty osees a job-ovicor costing systom in which overhead is applied to jobs on the basis of direct linbot cest. uts peedeternifved direct iebor doliars. At the beginndng of the yeat, the imventery balances were as follows: During the your, tho following transactions were completed: a. Raw materiais purchased on account, $162,000. b. Raw materials used in production, $143,000 (materials costing $120,000 were charged directly to jobs; the remaining materials were indirect). c. Costs for employee sctrvices were incurred as follows: tent for the year was $18,600($13,200 of this amount related to factory operations, and the remainder related to selling and Iministrative activities). Wty costs incurred in the factory. $14,000. d. Rent for the year was $18.600 (\$\$13,200 of this amount related to factory operations, anid the remninder relsted to selling and administrative activities). e. Utility costs incurred in the factory, $14,000. 6 Advertising costs incurred, $11,000. 9. Deprociation recorded on equipment, $20,000. $17,000 of this amount related to equipment used in factory operations; the remaining $3,000 related to equipment used in selling and administrative activities.) h. Manufacturing overhead cost was applied to jobs. $ ? i. Goods that had cost $227,000 to manufacture according to their job cost sheets were completed. 1. Sales for the year (all paid in cash) totaled $507,000. The total cost to manufacture these goods according to their job cost shee was $217000 Required: Prepare joumal entries to record the transactions for the year. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from yc urnal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. repare an income statement for the year. All of the information needed for the income statement is avallable in the journa T-accounts you have prepared. 4 Probiem 3.16 (Algo) Comprehenstve Probiem (LO3.4, L03.2, 103.47 ctirect dabor dodtars. Ar the beginning of the yeac, the imventory batances were as folloins. Durirtg the year, the following transiactions were completed: a. Raw materiats purchased an account, $162,000. Were inclirect. c. Costs for employee services were incurred as follovs: d. Rent for the year was $18,600($13,200 of this amount related to factory operations, and the remainder related to selling and administrative activities). Utility costs incurred in the factory. $14,000. d. Rent for the vear was 518,600 (513,200 of this amount reiated to factory operattonn, and use remainien feisted to seing nnd administrative activithes). a. Utility costs incurned in the factory, 514,000 f. Advertising costs incurred, 511000 g. Depreciation recorded on equipment, $20.000 (\$17.000 of this amount retated to equipment used in factory operations; me remaining $3,000 related to equipment used in selling and administritive activities) h. Manufacturing overheod cost was appilled to jobs, $ ? 1. Goods that had cost $227,000 to manufocture according to their job cost sheots were completed. 1. Saies for the year (all paid in cash) totaled $507,000. The total cost to manufacture these goods according to theit job cont shevts was 5217000 . Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journaf entries to these. T-accounts (don't forget to enter the beginning balances in your inventory accounts). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the information necjded for the income statement is avaliable in the journal entries and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. 4 Problem 3-16 (Algo ) Comprehensive Problem (LO3-1, L03-2, L03-4) The comparty osees a job-ovicor costing systom in which overhead is applied to jobs on the basis of direct linbot cest. uts peedeternifved direct iebor doliars. At the beginndng of the yeat, the imventery balances were as follows: During the your, tho following transactions were completed: a. Raw materiais purchased on account, $162,000. b. Raw materials used in production, $143,000 (materials costing $120,000 were charged directly to jobs; the remaining materials were indirect). c. Costs for employee sctrvices were incurred as follows: tent for the year was $18,600($13,200 of this amount related to factory operations, and the remainder related to selling and Iministrative activities). Wty costs incurred in the factory. $14,000. d. Rent for the year was $18.600 (\$\$13,200 of this amount related to factory operations, anid the remninder relsted to selling and administrative activities). e. Utility costs incurred in the factory, $14,000. 6 Advertising costs incurred, $11,000. 9. Deprociation recorded on equipment, $20,000. $17,000 of this amount related to equipment used in factory operations; the remaining $3,000 related to equipment used in selling and administrative activities.) h. Manufacturing overhead cost was applied to jobs. $ ? i. Goods that had cost $227,000 to manufacture according to their job cost sheets were completed. 1. Sales for the year (all paid in cash) totaled $507,000. The total cost to manufacture these goods according to their job cost shee was $217000 Required: Prepare joumal entries to record the transactions for the year. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from yc urnal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. repare an income statement for the year. All of the information needed for the income statement is avallable in the journa T-accounts you have prepared