Answered step by step

Verified Expert Solution

Question

1 Approved Answer

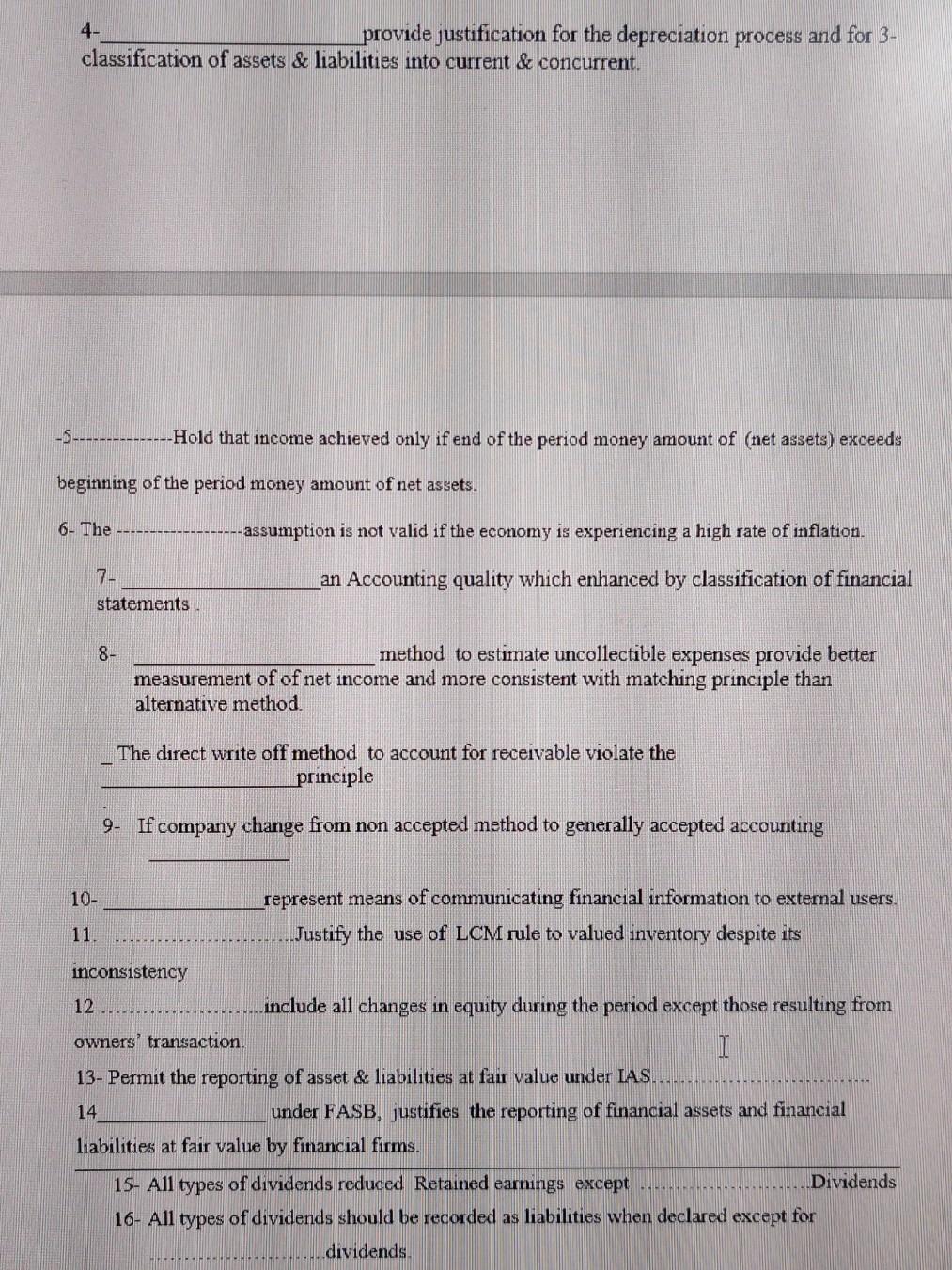

4- provide justification for the depreciation process and for 3- classification of assets & liabilities into current & concurrent. -5-.-.-.-.- -Hold that income achieved only

4- provide justification for the depreciation process and for 3- classification of assets & liabilities into current & concurrent. -5-.-.-.-.- -Hold that income achieved only if end of the period money amount of (net assets) exceeds beginning of the period money amount of net assets. 6- The assumption is not valid if the economy is experiencing a high rate of inflation. 7- statements an Accounting quality which enhanced by classification of financial 8- method to estimate uncollectible expenses provide better measurement of of net income and more consistent with matching principle than alternative method. The direct write off method to account for receivable violate the principle 9- If company change from non accepted method to generally accepted accounting 10- represent means of communicating financial information to external users. ...Justify the use of LCM rule to valued inventory despite its inconsistency 12 include all changes in equity during the period except those resulting from owners transaction. I 13- Permit the reporting of asset & liabilities at fair value under IAS. 14 under FASB, justifies the reporting of financial assets and financial liabilities at fair value by financial firms. 15- All types of dividends reduced Retained earnings except Dividends 16- All types of dividends should be recorded as liabilities when declared except for dividends 4- provide justification for the depreciation process and for 3- classification of assets & liabilities into current & concurrent. -5-.-.-.-.- -Hold that income achieved only if end of the period money amount of (net assets) exceeds beginning of the period money amount of net assets. 6- The assumption is not valid if the economy is experiencing a high rate of inflation. 7- statements an Accounting quality which enhanced by classification of financial 8- method to estimate uncollectible expenses provide better measurement of of net income and more consistent with matching principle than alternative method. The direct write off method to account for receivable violate the principle 9- If company change from non accepted method to generally accepted accounting 10- represent means of communicating financial information to external users. ...Justify the use of LCM rule to valued inventory despite its inconsistency 12 include all changes in equity during the period except those resulting from owners transaction. I 13- Permit the reporting of asset & liabilities at fair value under IAS. 14 under FASB, justifies the reporting of financial assets and financial liabilities at fair value by financial firms. 15- All types of dividends reduced Retained earnings except Dividends 16- All types of dividends should be recorded as liabilities when declared except for dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started