Question: 4) Provide the balance sheet and income statement presentations for the lessee related to the lease as of 12/31/18. The lease term is 4

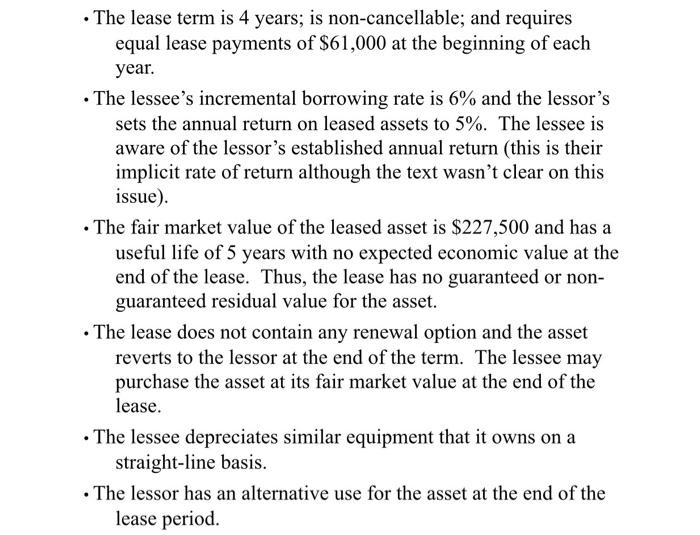

4) Provide the balance sheet and income statement presentations for the lessee related to the lease as of 12/31/18. The lease term is 4 years; is non-cancellable; and requires equal lease payments of $61,000 at the beginning of each year. The lessee's incremental borrowing rate is 6% and the lessor's sets the annual return on leased assets to 5%. The lessee is aware of the lessor's established annual return (this is their implicit rate of return although the text wasn't clear on this issue). The fair market value of the leased asset is $227,500 and has a useful life of 5 years with no expected economic value at the end of the lease. Thus, the lease has no guaranteed or non- guaranteed residual value for the asset. The lease does not contain any renewal option and the asset reverts to the lessor at the end of the term. The lessee may purchase the asset at its fair market value at the end of the lease. The lessee depreciates similar equipment that it owns on a straight-line basis. The lessor has an alternative use for the asset at the end of the lease period.

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

As per the given information in the question we can classify this lease as a finance lease on the fo... View full answer

Get step-by-step solutions from verified subject matter experts